Market Mover | Shares of Temu Parent PDD Slump 26% After Q2 Financial Results

Market Mover | Shares of Temu Parent PDD Slump 26% After Q2 Financial Results

August 26, 2024 - Shares of the Temu parent company $PDD Holdings (PDD.US)$ slumped 26.10% to $103.37 in early trading on Monday.

2024 年 8 月 26 日-Temu 母公司的股份 $拼多多 (PDD.US)$ 周一早盘,下跌26.10%,至103.37美元。

Today, the company reported its Q2 unaudited financial results that fell short of expectations. The China-based online retailer reported revenue below analysts' estimates, and management indicated that revenue growth pressures are expected to continue due to heightened competition and other challenges.

今天,该公司公布的第二季度未经审计的财务业绩低于预期。这家总部位于中国的在线零售商报告的收入低于分析师的预期,管理层表示,由于竞争加剧和其他挑战,预计收入增长压力将持续下去。

Highlights for Q2 earnings

第二季度收益亮点

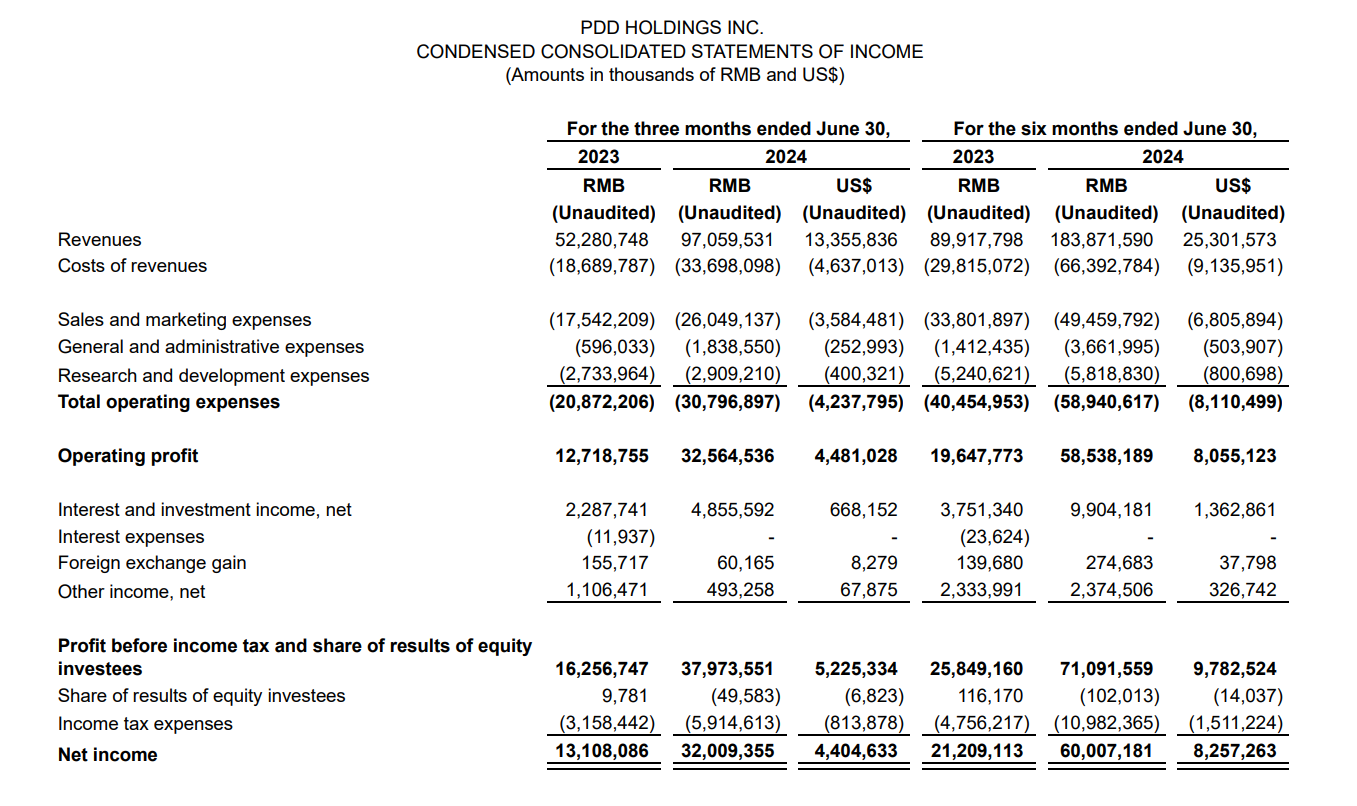

Q2 total revenue of RMB97,059.5 million (US$13,355.8 million), an increase of 86% from RMB52,280.7 million in the same period last year, but falling short of the market expectation of RMB99,985 million.

Q2 net income attributable to ordinary shareholders of RMB32,009.4 million (US$4,404.6 million), an increase of 144% from RMB13,108.1 million in the same period last year.

Q2 non-GAAP net income attributable to ordinary shareholders of RMB34,432.1 million (US$4,738.0 million), an increase of 125% from RMB15,269.4 million in the same quarter of 2023.

In this quarter, revenues from online marketing services and others of RMB49,115.9 million (US$6,758.6 million); and revenues from transaction services of RMB47,943.7 million (US$6,597.3 million).

Non-GAAP diluted earnings per ADS were RMB23.24 (US$3.20).

Additionally, cash, cash equivalents and short-term investments were RMB284.9 billion (US$39.2 billion) as of June 30, 2024, compared with RMB217.2 billion as of December 31, 2023.

第二季度总收入为人民币9705950万元(合133.558亿美元),较去年同期的人民币5228070万元增长了86%,但未达到市场预期的人民币9998500万元。

第二季度归属于普通股股东的净收益为人民币3200940万元(合44.046亿美元),较去年同期的人民币131081.0万元增长了144%。

第二季度归属于普通股股东的非公认会计准则净收益为人民币3443210万元(合47.38亿美元),较2023年同期的人民币1526940万元增长了125%。

在本季度,来自在线营销服务和其他服务的收入为人民币4911590万元(合67.586亿美元);交易服务收入为人民币4794370万元(合65.973亿美元)。

每股ADS的非公认会计准则摊薄收益为人民币23.24元(合3.20美元)。

此外,截至2024年6月30日,现金、现金等价物和短期投资为人民币2849元(合392亿美元),而截至2023年12月31日为人民币2172元。

Chairman and Co-Chief Executive Officer of PDD Holdings, Mr. Lei Chen said:

PDD Holdings董事长兼联席首席执行官陈雷先生表示:

“While encouraged by the solid progress we made in the past few quarters, we see many challenges ahead, We are committed to transitioning toward high-quality development and fostering sustainable ecosystem. We will invest heavily in the platform’s trust and safety, support high-quality merchants, and relentlessly improve the merchant ecosystem. We are prepared to accept short-term sacrifices and potential decline in profitability.”

“尽管我们对过去几个季度取得的稳步进展感到鼓舞,但我们看到了许多挑战,但我们致力于向高质量发展过渡并培育可持续的生态系统。我们将大力投资于平台的信任和安全,支持高质量的商家,并不断改善商户生态系统。我们准备接受短期的牺牲和潜在的盈利能力下降。”

Q2 net income attributable to ordinary shareholders of RMB32,009.4 million (US$4,404.6 million), an increase of 144% from RMB13,108.1 million in the same period last year.

Q2 net income attributable to ordinary shareholders of RMB32,009.4 million (US$4,404.6 million), an increase of 144% from RMB13,108.1 million in the same period last year.