Spotlight on Redfin: Analyzing the Surge in Options Activity

Spotlight on Redfin: Analyzing the Surge in Options Activity

Financial giants have made a conspicuous bearish move on Redfin. Our analysis of options history for Redfin (NASDAQ:RDFN) revealed 11 unusual trades.

金融巨头对Redfin采取了明显看淡的举动。我们对Redfin(纳斯达克:RDFN)期权历史进行了分析,发现了11笔异常交易。

Delving into the details, we found 36% of traders were bullish, while 45% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $460,000, and 9 were calls, valued at $461,500.

深入了解细节,我们发现36%的交易员看涨,而45%的交易员表现出看淡的倾向。在我们发现的所有交易中,有2个看跌期权,价值46万美元,有9个看涨期权,价值46.15万美元。

Projected Price Targets

预计价格目标

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $8.0 to $20.0 for Redfin over the recent three months.

根据交易活动,看起来重要的投资者正在以8.0到20.0的价格区间来投资Redfin,这个情况在最近三个月内一直持续。

Volume & Open Interest Trends

成交量和未平仓量趋势

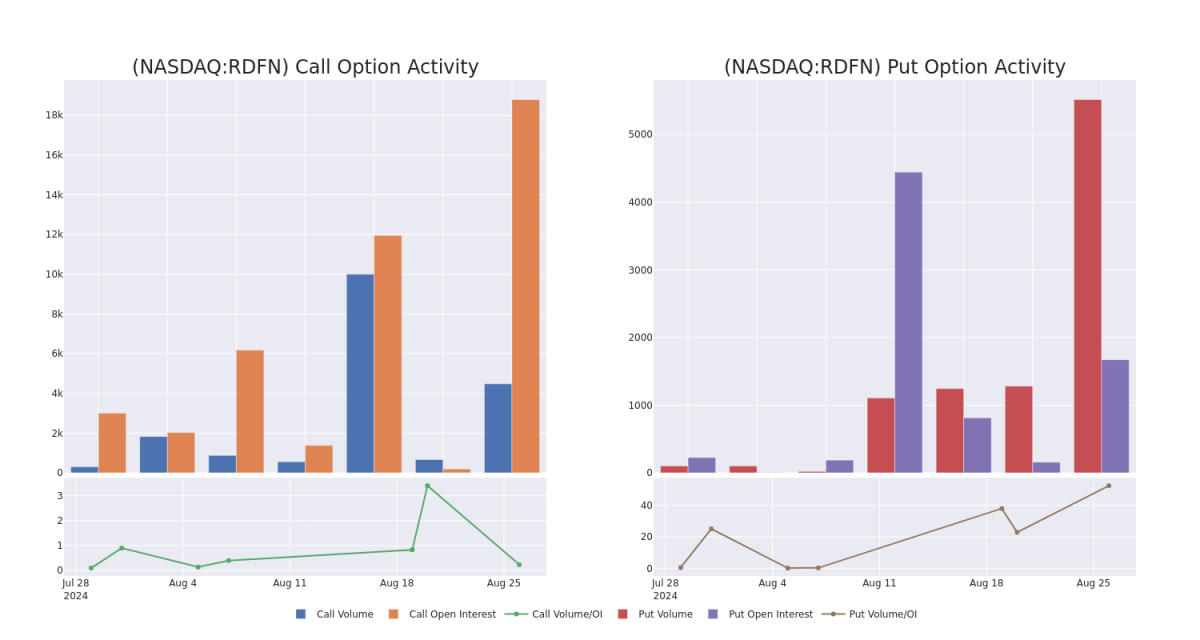

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Redfin's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Redfin's substantial trades, within a strike price spectrum from $8.0 to $20.0 over the preceding 30 days.

评估成交量和空仓量是期权交易的战略步骤。这些指标揭示了Redfin指定行权价格期权的流动性和投资者的兴趣。即将发布的数据可视化了过去30天内Redfin的成交量和空仓量的波动情况,涵盖了8.0到20.0的行权价范围内与Redfin的大量交易相关的看涨期权和看跌期权。

Redfin 30-Day Option Volume & Interest Snapshot

Redfin 30天期权成交量和持仓量快照

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RDFN | PUT | SWEEP | BEARISH | 10/18/24 | $0.9 | $0.8 | $0.9 | $10.00 | $435.0K | 96 | 5.0K |

| RDFN | CALL | SWEEP | BEARISH | 01/17/25 | $4.2 | $4.0 | $4.0 | $8.00 | $80.0K | 1.3K | 823 |

| RDFN | CALL | SWEEP | BEARISH | 01/17/25 | $4.1 | $3.9 | $3.92 | $8.00 | $78.1K | 1.3K | 623 |

| RDFN | CALL | SWEEP | BEARISH | 01/17/25 | $4.1 | $3.9 | $3.9 | $8.00 | $78.0K | 1.3K | 423 |

| RDFN | CALL | SWEEP | BEARISH | 01/16/26 | $2.3 | $2.25 | $2.25 | $20.00 | $68.4K | 5.8K | 319 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 01/17/25 | 看跌 | SWEEP | 看淡 | 10/18/24 | $0.9 | $0.8 | $0.9 | $10.00 | $435.0K | 96 | 5.0K |

| 看涨 | SWEEP | 看淡 | 01/17/25 | $4.2 | $4.0 | $4.0 | 8.00美元 | $80.0K | 1.3K | 823 | |

| 看涨 | SWEEP | 看淡 | 01/17/25 | $4.1 | $3.9 | $3.92 | 8.00美元 | $78.1K | 1.3K | 623 | |

| 看涨 | SWEEP | 看淡 | 01/17/25 | $4.1 | $3.9 | $3.9 | 8.00美元 | $78.0K | 1.3K | 423 | |

| 看涨 | SWEEP | 看淡 | 01/16/26 | $2.3 | 每千立方英尺2.25美元 | 每千立方英尺2.25美元 | $20.00 | 68,400美元 | 5.8K | 319 |

About Redfin

关于redfin

Redfin Corp is a residential real estate broker. It pairs its agents with the technology to create a service that is faster and costs less. The company meets customers through a listings-search website and mobile application. The company uses the same combination of technology and local service to originate mortgage loans and offer title and settlement services. It has five operating segments and three reportable segments, real estate services, rentals, and mortgage. The company generates the majority of its revenue from Real estate services.

After a thorough review of the options trading surrounding Redfin, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Redfin's Current Market Status

- With a trading volume of 5,757,376, the price of RDFN is up by 0.95%, reaching $11.19.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 66 days from now.

- 当前RSI值表明该股票可能接近超买状态。

- 下一个季度收益报告将在66天后公布。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Redfin options trades with real-time alerts from Benzinga Pro.