Check Out What Whales Are Doing With URI

Check Out What Whales Are Doing With URI

Deep-pocketed investors have adopted a bearish approach towards United Rentals (NYSE:URI), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in URI usually suggests something big is about to happen.

资金雄厚的投资者对联合租赁(纽交所:URI)采取了看淡的策略,市场参与者不应忽视这一点。我们在彭博社的公开期权记录中发现了这一重大举措。尽管这些投资者的身份仍然未知,但URI的这一大幅波动通常意味着即将发生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 11 extraordinary options activities for United Rentals. This level of activity is out of the ordinary.

我们从今天彭博社的期权扫描器中的11个非同寻常的期权交易活动中获取了这些信息。这种活动水平是非同寻常的。

The general mood among these heavyweight investors is divided, with 18% leaning bullish and 72% bearish. Among these notable options, 2 are puts, totaling $143,681, and 9 are calls, amounting to $910,872.

这些重量级投资者之间的普遍情绪有所分化,其中18%倾向于看涨,72%倾向于看淡。在这些引人注目的期权中,有2个看跌期权,总计$143,681,还有9个看涨期权,总计$910,872。

Projected Price Targets

预计价格目标

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $360.0 to $850.0 for United Rentals over the last 3 months.

根据这些合约的成交量和持仓量,过去3个月,大户们一直将联合租赁的目标价区间设定在$360.0至$850.0之间。

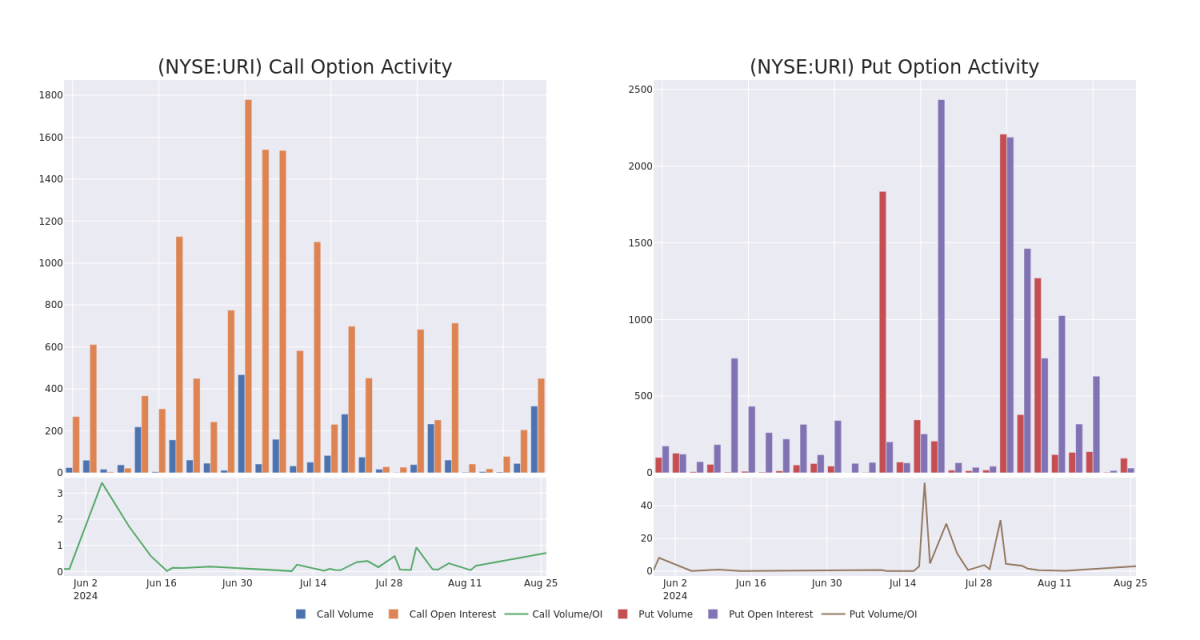

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for United Rentals's options for a given strike price.

这些数据可以帮助您跟踪特定行权价的联合租赁期权的流动性和兴趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of United Rentals's whale activity within a strike price range from $360.0 to $850.0 in the last 30 days.

下面我们可以观察到过去30天内,United Rentals的看涨期权和看跌期权的成交量和持仓量的变化。它们的行使价格范围从$360.0到$850.0。

United Rentals Call and Put Volume: 30-Day Overview

United Rentals看涨期权和看跌期权的成交量:30天的概览

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| URI | CALL | TRADE | BEARISH | 09/20/24 | $32.5 | $30.6 | $30.1 | $740.00 | $451.5K | 195 | 154 |

| URI | CALL | TRADE | BEARISH | 10/18/24 | $403.0 | $395.8 | $397.5 | $360.00 | $119.2K | 0 | 5 |

| URI | PUT | SWEEP | BEARISH | 09/20/24 | $21.6 | $20.0 | $21.44 | $740.00 | $100.4K | 31 | 75 |

| URI | CALL | TRADE | BULLISH | 03/21/25 | $48.3 | $44.7 | $48.3 | $850.00 | $86.9K | 4 | 0 |

| URI | CALL | TRADE | BEARISH | 10/18/24 | $402.0 | $397.5 | $397.5 | $360.00 | $79.5K | 0 | 2 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 联合租赁 | 看涨 | 交易 | 看淡 | 09/20/24 | $32.5 | $30.6 | 30.1美元 | $740.00 | CALL | 195 | 154 |

| 联合租赁 | 看涨 | 交易 | 看淡 | 10/18/24 | $79.5K | $395.8 | 2 | $360.00 | $119.2K | 0 | 5 |

| 联合租赁 | 看跌 | SWEEP | 看淡 | 09/20/24 | $21.6 | $20.0 | $21.44 | $740.00 | $100.4K | 31 | 75 |

| 联合租赁 | 看涨 | 交易 | 看好 | 03/21/25 | $48.3 | $44.7 | $48.3 | $850.00 | $86.9K | 4 | 0 |

| 联合租赁 | 看涨 | 交易 | 看淡 | 10/18/24 | $402.0 | 2 | 2 | $360.00 | $79.5K | 0 | 2 |

About United Rentals

关于联合租赁

United Rentals is the world's largest equipment rental company. It principally operates in the United States and Canada, where it commands approximately 15% share in a highly fragmented market. It serves three end markets: general industrial, commercial construction, and residential construction. Like its peers, United Rentals historically has provided its customers with equipment that was intermittently used, such as aerial equipment and portable generators. As the company has grown organically and through hundreds of acquisitions since it went public in 1997, its catalog (fleet size of $21 billion) now includes a range of specialty equipment and other items that can be rented for indefinite periods.

After a thorough review of the options trading surrounding United Rentals, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

United Rentals's Current Market Status

- Trading volume stands at 123,382, with URI's price down by -0.46%, positioned at $741.58.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 58 days.

- RSI指标显示该股票可能接近超买。

What The Experts Say On United Rentals

In the last month, 1 experts released ratings on this stock with an average target price of $795.0.

- Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for United Rentals, targeting a price of $795.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。