Merck & Co's Options: A Look at What the Big Money Is Thinking

Merck & Co's Options: A Look at What the Big Money Is Thinking

Financial giants have made a conspicuous bullish move on Merck & Co. Our analysis of options history for Merck & Co (NYSE:MRK) revealed 11 unusual trades.

金融巨头对默沙东采取了明显的看好举动。我们对默沙东的期权历史进行分析后发现,有11笔不寻常的交易。

Delving into the details, we found 63% of traders were bullish, while 36% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $345,354, and 5 were calls, valued at $202,967.

深入研究细节,我们发现63%的交易员看好,而有36%的交易员表现出看淡的倾向。我们发现了所有交易中的6笔看跌期权交易,价值345,354美元,以及5笔看涨期权交易,价值202,967美元。

Predicted Price Range

预测价格区间

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $85.0 to $130.0 for Merck & Co during the past quarter.

分析这些合约的成交量和持仓量,似乎大户在过去一个季度里一直关注默沙东的股价区间为85.0美元到130.0美元。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

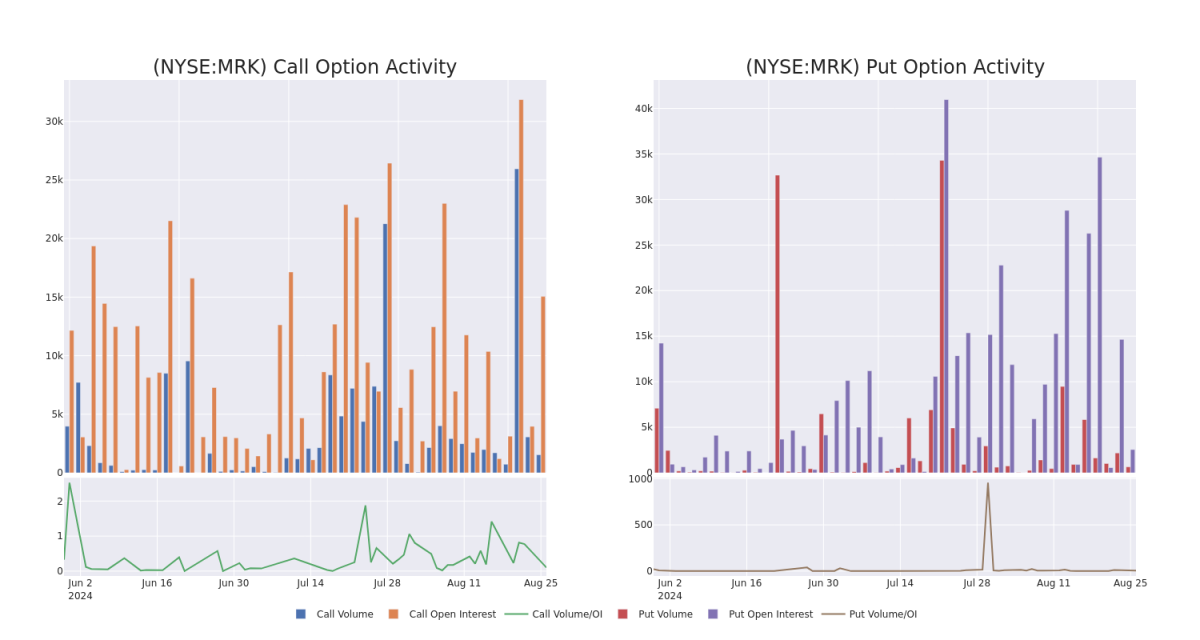

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for Merck & Co's options for a given strike price.

这些数据可以帮助你追踪默沙东的期权在给定行权价格上的流动性和兴趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Merck & Co's whale activity within a strike price range from $85.0 to $130.0 in the last 30 days.

下面,我们可以观察到近30天内,默沙东所有的鲸鱼活动中,看涨和看跌期权的成交量和持仓量的变化,的行使价格区间为85.0美元到130.0美元。

Merck & Co 30-Day Option Volume & Interest Snapshot

默沙东30天期权成交量及持仓量快照

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRK | PUT | TRADE | BULLISH | 01/16/26 | $18.75 | $18.1 | $18.25 | $130.00 | $182.5K | 332 | 100 |

| MRK | CALL | SWEEP | BULLISH | 09/06/24 | $1.99 | $1.98 | $1.99 | $116.00 | $49.9K | 180 | 327 |

| MRK | CALL | SWEEP | BULLISH | 01/17/25 | $8.15 | $8.05 | $8.15 | $115.00 | $40.7K | 2.1K | 50 |

| MRK | CALL | SWEEP | BEARISH | 10/18/24 | $1.86 | $1.8 | $1.81 | $120.00 | $39.8K | 12.6K | 635 |

| MRK | CALL | SWEEP | BULLISH | 09/06/24 | $1.97 | $1.96 | $1.97 | $116.00 | $37.8K | 180 | 520 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRK | 看跌 | 交易 | 看好 | 01/16/26 | 18.75美元 | $18.1 | $18.25 | $130.00 | Current RSI values indicate that the stock is may be approaching overbought. | 332 | 100 |

| MRK | 看涨 | SWEEP | 看好 | 09/06/24 | $1.99 | $1.98 | $1.99 | $116.00 | 49.9千美元 | 180 | 327 |

| MRK | 看涨 | SWEEP | 看好 | 01/17/25 | $8.15 | $8.05 | $8.15 | $115.00 | $40.7K | 2.1K | 50 |

| MRK | 看涨 | SWEEP | 看淡 | 10/18/24 | $1.86 | $1.8 | $1.81 | $120.00 | $39.8K | 12.6K | 635 |

| MRK | 看涨 | SWEEP | 看好 | 09/06/24 | $1.97 | 1.96美元 | $1.97 | $116.00 | $37.8K | 180 | 520 |

About Merck & Co

关于默沙东

Merck makes pharmaceutical products to treat several conditions in a number of therapeutic areas, including cardiometabolic disease, cancer, and infections. Within cancer, the firm's immuno-oncology platform is growing as a major contributor to overall sales. The company also has a substantial vaccine business, with treatments to prevent pediatric diseases as well as human papillomavirus, or HPV. Additionally, Merck sells animal health-related drugs. From a geographical perspective, just under half of the company's sales are generated in the United States.

默沙东生产多种药品,治疗多种领域的疾病,包括心代谢症、癌症和感染。在癌症领域,该公司的免疫肿瘤学平台正在成为总销售额的主要贡献者。该公司还具有实质性的疫苗业务,包括预防儿童疾病以及人类乳头瘤病毒(HPV)治疗。此外,默沙东出售与动物健康相关的药品。从地理角度来看,公司销售额的近一半来自于美国境内。

In light of the recent options history for Merck & Co, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Merck & Co

默沙东的现市场地位

- With a trading volume of 3,209,934, the price of MRK is down by -0.19%, reaching $116.38.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 59 days from now.

- 当前RSI值表明该股票可能接近超买状态。

- 下次财报发布将在59天后。

Professional Analyst Ratings for Merck & Co

默沙东的专业分析师评级

In the last month, 4 experts released ratings on this stock with an average target price of $138.5.

- Consistent in their evaluation, an analyst from B of A Securities keeps a Buy rating on Merck & Co with a target price of $145.

- Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Merck & Co, targeting a price of $142.

- An analyst from Wells Fargo persists with their Equal-Weight rating on Merck & Co, maintaining a target price of $125.

- An analyst from UBS has decided to maintain their Buy rating on Merck & Co, which currently sits at a price target of $142.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Merck & Co options trades with real-time alerts from Benzinga Pro.

期权交易存在更高的风险和潜在回报。机智的交易者通过不断学习、调整他们的策略、监测多个因子和密切关注市场动向来控制这些风险。通过Benzinga Pro实时提醒了解最新的默沙东期权交易。