Lucid -9% Tuesday, Compared to Rivian -1%, How are They Solving Cash Burn?

Lucid -9% Tuesday, Compared to Rivian -1%, How are They Solving Cash Burn?

$Rivian Automotive (RIVN.US)$ and $Lucid Group (LCID.US)$ are two EV startups that share a lot of similarities. Both are based in California, have made compelling EV products, are eyeing expansion of their addressable market with cheaper offerings, and are – all this while – yet to turn a profit.

$Rivian Automotive (RIVN.US)$和页面。$Lucid Group (LCID.US)$ 两家电动汽车初创公司有许多相似之处。两家公司都位于加利福尼亚,推出了引人注目的电动汽车产品,计划通过推出更便宜的产品扩大其可触及市场,并且在这期间仍未能实现盈利。

The two EV makers, however, are continuing to invest big in research and development activities, as they gear to start production of their next major offering. While Lucid is looking to start production of its Lucid Gravity, Rivian is looking forward to launching its R2 SUV.

然而,这两家电动汽车制造商继续大力投资研发活动,以便开始生产下一款重要产品。Lucid计划开始生产其Lucid Gravity,而Rivian则期待推出其R2 SUV。

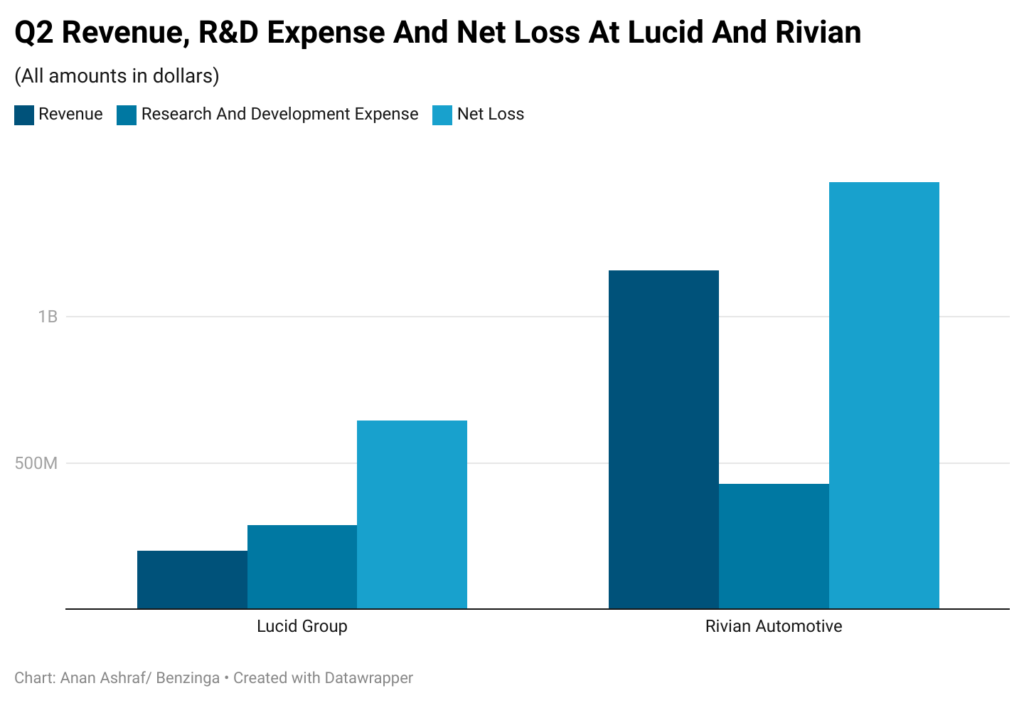

In the quarter that ended on June 30, Lucid spent $287.17 million in research and development, or about 143% of its revenue totaling $200.58 million in the period.

在截至6月30日的季度里,Lucid在研发上投入了287.17百万元,占其营业收入200.58百万元的143%左右。

As for Rivian, the company spent $428 million in research and development, accounting for 37% of its revenue in the period.

至于Rivian,该公司在研发上投入了428百万元,占该期营业收入的37%。

While Rivian spent more, it also incurred more revenue in the quarter, thanks to its larger sales volume in the quarter. While Lucid delivered just 2,394 units of its Lucid Air sedan, Rivian delivered 13,790 units of its R1 vehicles, including its R1S SUV and R1T truck.

尽管Rivian的投入更多,但其季度营业收入也更高,这要归功于其大幅提高的销售数量。Lucid仅交付了2,394辆Lucid Air轿车,而Rivian交付了13,790辆R1车型,包括R1S SUV和R1T千亿卡车。

Despite its larger delivery volume, Rivian reported a net loss of $1,457 million for the quarter, more than double the net loss of $643.39 million reported by Lucid.

尽管交付量更高,Rivian在该季度报告了1.457亿美元的净亏损,超过Lucid报告的643.39百万元的净亏损的两倍以上。

Rivian intends to start production of R2 in the first half of 2026. The R2 SUV is expected to be priced at around $45,000, making it a cheaper and more mass-market offering than the company's R1 vehicles which have a starting price of around $70,000.

Rivian计划在2026年上半年开始生产R2。R2 SUV的预期售价约为45,000美元,比公司起售价约为70,000美元的R1车型更便宜且更面向大众市场。

Lucid has already commenced pre-production of its Lucid Gravity SUV and expects to start production later this year. The Gravity SUV is expected to start under $80,000, at a price point higher than the company's Air sedan whose cheapest version starts at $69,900.

Lucid已经开始预生产其Lucid Gravity SUV,预计将于今年晚些时候开始生产。Gravity SUV的价格预计将低于80,000美元,比公司的Air轿车的最低版售价69,900美元要高。

While Rivian's R2 will be up against Tesla's best-selling Model Y SUV, Gravity will be up against Tesla's more premium and low-volume Model X SUV.

而Rivian的R2将与特斯拉畅销的Model Y SUV竞争,而Gravity将与特斯拉更高端、低产量的Model X SUV竞争。

Rivian is optimistic. The company said during its second-quarter earnings call that it intends to deliver modest gross profit in the last quarter of 2024 and for the full year 2025.

Rivian持乐观态度。公司在第二季度业绩会上表示,计划在2024年最后一个季度和2025年整年取得适度的毛利润。

Lucid, however, is yet to provide a timeline. Earlier this month, Lucid CFO Gagan Dhingra said that the company has already narrowed down its losses and will be in a "better position than competition" with scale.

然而,Lucid尚未提供具体的时间表。本月早些时候,Lucid的首席财务官Gagan Dhingra表示,公司已经缩小了损失,并将在规模上比竞争对手更有竞争力。

Both Lucid and Rivian became publicly listed companies in the second half of 2021. While Lucid's stock is up 2.7% year-to-date, as of last close, Rivian is down 32%.

Lucid和Rivian都在2021年下半年成为上市公司。截至最后收盘,Lucid股价年初至今上涨2.7%,而Rivian下跌了32%。

Rivian shares closed at $14.36 on Monday and Lucid shares at $4.26, according to data from Benzinga Pro.

根据Benzinga Pro的数据,周一Rivian的股价收盘价为14.36美元,Lucid的股价为4.26美元。

Had an investor put in $1,000 into Lucid stock at the onset of 2024, their investment would now be worth marginally higher than $1,000. But had the investor put their money in Rivian stock, they would have lost over $300.

如果一个投资者在2024年初将1,000美元投资到Lucid股票中,现在他们的投资价值略高于1,000美元。但如果投资者将他们的资金投资到Rivian股票中,他们会亏损超过300美元。

As for Rivian, the company spent $428 million in research and development, accounting for 37% of its revenue in the period.

As for Rivian, the company spent $428 million in research and development, accounting for 37% of its revenue in the period.