Stock Of The Day: Exxon Mobil Hits A Ceiling?

Stock Of The Day: Exxon Mobil Hits A Ceiling?

Resistance levels are a large concentration of traders and investors who are looking to sell their shares at, or close to, the same price. The "level" is typically more of a range than a particular price.

支撑位是一大批希望以或接近同一价格卖出股票的交易者和投资者的集中地。这个“位”通常更多是一个区间而不是一个具体的价格。

Sometimes these levels and ranges are clear and well-defined.

有时这些位和区间是清晰和明确的。

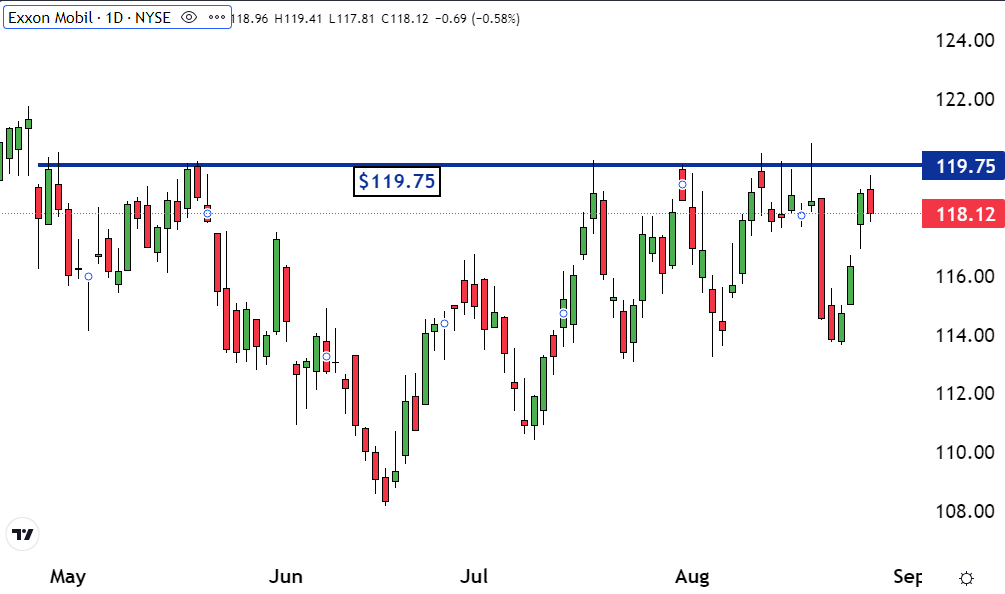

As you can see on the following chart, that is the case with the $119.75 level for Exxon Mobil Corp (NYSE:XOM). This is why it's the Stock of the Day.

正如您在下图中所看到的,对于埃克森美孚股票(纽交所:XOM)来说,$119.75的位是明确的。这就是为什么它是当日的热门股票。

Markets are driven by supply and demand. If there is more demand (buy orders) than supply (sell orders), the shares will move higher as the traders outbid each other to attract sellers.

市场是由供需驱动的。如果有更多的需求(买单)而供应(卖单)不足,股票将上涨,因为交易者争相出价吸引卖家。

At resistance levels, there is enough supply to satisfy all of the demand. This is why rallies tend to end or pause when they reach them.

在支撑位上,有足够的供应来满足所有的需求。这就是为什么当股票涨到这个位时,涨势往往会停止或暂停。

Sometimes when a stock reaches a resistance level it reverses and heads lower. That has been the case with ExxonMobil and the $119.75 level since May. Each time the shares reached it a sell-off followed.

有时,当股票达到支撑位时,它会转头向下走。这正是埃克森美孚和$119.75位自5月以来的情况。每次股票到达这个位后,都会出现抛售。

Read Also: Linde Invests Over $2B For Clean Hydrogen, Inks Supply Deal With Dow: Details

阅读更多:Linde投资超过20亿美元用于清洁氢气,与陶氏化学签订供应协议:详情

This happens when some traders and investors who created the resistance with their sell orders become nervous. They know that the buyers will go to the seller willing to sell their shares at the lowest price.

这种情况发生在一些交易员和投资者通过他们的卖单创建支撑位后变得紧张。他们知道买家会转向愿意以最低价卖出股票的卖家。

As a result, they reduce the prices they are willing to sell their shares for. Other nervous traders and investors see this and do the same. It starts a snowball effect of sellers undercutting each other.

结果是他们降低了他们愿意以哪个价格卖出股票。其他紧张的交易员和投资者看到这一点,也会这样做。这启动了一个卖方之间相互压低价格的连锁反应。

This results in the shares moving in a downtrend.

这导致股票走势向下。

Resistance levels can stay intact for a long time. This means that if ExxonMobil reaches this resistance again, there's a good chance another sell-off follows.

支撑位能够长时间保持完整。这意味着如果埃克森美孚再次触及这个支撑位,很有可能会出现另一轮抛售。

Resistance can stay intact because of buyer's remorse. There are investors and traders who bought the stock while it was at resistance who think they made a mistake when the price heads lower.

支撑位能够长时间保持完整是因为买家后悔。在支撑位时购买该股票的投资者和交易员认为当价格下跌时犯了错误。

They decide that they want to sell their stock. So, if the shares eventually rally back to the resistance, these remorseful buyers place sell orders. If there are enough of these order, it will create resistance at the same level that had previously been resistance.

他们决定要卖出他们的股票。因此,如果股票最终反弹到支撑位,这些后悔的买家会下卖单。如果有足够多的这类订单,将会在之前的支撑位上形成新的支撑位。

Photo: Del Henderson Jr. via Shutterstock

图片: Del Henderson Jr.通过shutterstock

Markets are driven by supply and demand. If there is more demand (buy orders) than supply (sell orders), the shares will move higher as the traders outbid each other to attract sellers.

Markets are driven by supply and demand. If there is more demand (buy orders) than supply (sell orders), the shares will move higher as the traders outbid each other to attract sellers.