Spotlight on Wells Fargo: Analyzing the Surge in Options Activity

Spotlight on Wells Fargo: Analyzing the Surge in Options Activity

Financial giants have made a conspicuous bullish move on Wells Fargo. Our analysis of options history for Wells Fargo (NYSE:WFC) revealed 16 unusual trades.

金融巨头在富国银行上做出了引人注目的看好举动。我们对富国银行(纽交所:WFC)的期权历史进行了分析,发现有16次异常的交易。

Delving into the details, we found 50% of traders were bullish, while 37% showed bearish tendencies. Out of all the trades we spotted, 7 were puts, with a value of $619,448, and 9 were calls, valued at $1,189,714.

深入了解细节后发现,50%的交易者看涨,而37%的交易者则表现出看淡趋势。在我们发现的所有交易中,有7次看跌交易,价值619,448美元,而有9次看涨交易,价值1,189,714美元。

What's The Price Target?

目标价是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $37.5 to $65.0 for Wells Fargo during the past quarter.

分析这些合约的成交量和持仓量,看起来大型投资者在过去的季度里一直将富国银行的价格区间从37.5美元到65.0美元视为关注窗口。

Insights into Volume & Open Interest

成交量和持仓量分析

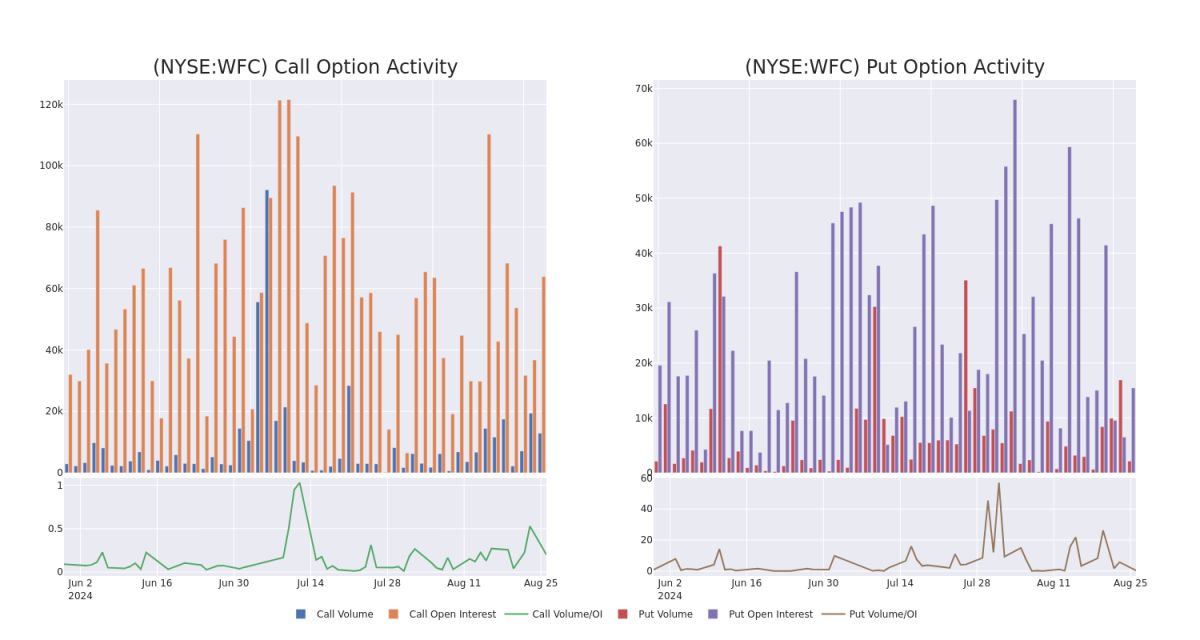

In terms of liquidity and interest, the mean open interest for Wells Fargo options trades today is 3679.36 with a total volume of 5,395.00.

就流动性和兴趣而言,富国银行的期权交易今天的平均持仓量为3679.36,总成交量为5,395.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Wells Fargo's big money trades within a strike price range of $37.5 to $65.0 over the last 30 days.

在下面的图表中,我们可以追踪过去30天富国银行看涨和看跌期权的成交量和持仓量的发展情况,这些期权的行权价范围在37.5美元到65.0美元之间。

Wells Fargo Option Activity Analysis: Last 30 Days

沃尔斯·法戈期权活动分析:最近30天

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WFC | CALL | SWEEP | BULLISH | 06/20/25 | $9.9 | $9.8 | $9.9 | $50.00 | $245.5K | 6.7K | 436 |

| WFC | PUT | TRADE | BULLISH | 01/16/26 | $1.38 | $0.98 | $1.11 | $37.50 | $222.0K | 1.7K | 2.0K |

| WFC | PUT | SWEEP | BEARISH | 04/17/25 | $9.4 | $9.3 | $9.4 | $65.00 | $218.0K | 0 | 233 |

| WFC | CALL | SWEEP | BULLISH | 09/19/25 | $7.5 | $7.4 | $7.5 | $55.00 | $209.2K | 452 | 282 |

| WFC | CALL | SWEEP | BULLISH | 06/20/25 | $11.75 | $11.65 | $11.75 | $47.50 | $195.0K | 653 | 222 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 富国银行 | 看涨 | SWEEP | 看好 | 06/20/25 | $9.9 | $9.8 | $9.9 | $50.00 | Next earnings report is scheduled for 45 days from now. | 6.7千 | 436 |

| 富国银行 | 看跌 | 交易 | 看好 | 01/16/26 | $1.38应翻译为1.38美元 | $0.98 | $1.11 | $37.50 | $222.0K | 1.7K | 2.0K |

| 富国银行 | 看跌 | SWEEP | 看淡 | 04/17/25 | 9.4美元 | $9.3 | 9.4美元 | $65.00 | $218.0K | 0 | 233 |

| 富国银行 | 看涨 | SWEEP | 看好 | 09/19/25 | $7.5 | $7.4 | $7.5 | $55.00 | $209.2K | 452 | 282 |

| 富国银行 | 看涨 | SWEEP | 看好 | 06/20/25 | 11.75美元 | $11.65 | 11.75美元 | $47.50 | $195.0K | 653 | 222 |

About Wells Fargo

关于富国银行

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company has four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management. It is almost entirely focused on the U.S.

富国银行是美国最大的银行之一,资产负债表资产约为1.9万亿美元。该公司有四个主要业务板块:消费银行、商业银行、公司和投资银行以及财富和投资管理。它几乎完全专注于美国市场。

Where Is Wells Fargo Standing Right Now?

Wells Fargo现在的状况如何?

- With a trading volume of 6,968,000, the price of WFC is down by -0.81%, reaching $56.26.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 45 days from now.

- 目前的RSI值表明该股票目前处于超买和超卖之间的中立状态。

- 下个收益报告将在45天后公布。

Professional Analyst Ratings for Wells Fargo

富国银行的专业分析师评级

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $68.0.

- Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Wells Fargo, targeting a price of $68.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Wells Fargo options trades with real-time alerts from Benzinga Pro.

期权交易存在更高的风险和潜在回报。敏锐的交易者通过持续教育自己、调整策略、监控多种因子并密切关注市场走势来管理这些风险。通过Benzinga Pro实时警报,了解最新的Wells Fargo期权交易信息。

In terms of liquidity and interest, the mean open interest for Wells Fargo options trades today is 3679.36 with a total volume of 5,395.00.

In terms of liquidity and interest, the mean open interest for Wells Fargo options trades today is 3679.36 with a total volume of 5,395.00.