Looking At Palantir Technologies's Recent Unusual Options Activity

Looking At Palantir Technologies's Recent Unusual Options Activity

Financial giants have made a conspicuous bearish move on Palantir Technologies. Our analysis of options history for Palantir Technologies (NYSE:PLTR) revealed 9 unusual trades.

金融巨头对palantir technologies采取了显眼的看淡行动。我们对Palantir Technologies(纽交所代码:PLTR)的期权交易历史进行了分析,发现有9笔异常交易。

Delving into the details, we found 22% of traders were bullish, while 55% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $119,877, and 7 were calls, valued at $283,155.

深入分析后,我们发现有22%的交易者看好,而55%的交易者显示出看淡倾向。在我们发现的所有交易中,有2笔看跌期权,价值为$119,877,有7笔看涨期权,价值为$283,155。

Predicted Price Range

预测价格区间

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $21.0 to $33.0 for Palantir Technologies over the last 3 months.

考虑到这些合约的成交量和持仓量,过去3个月来鲸鱼们一直在将目光聚焦在$21.0至$33.0的价格区间内的Palantir Technologies上。

Volume & Open Interest Trends

成交量和未平仓量趋势

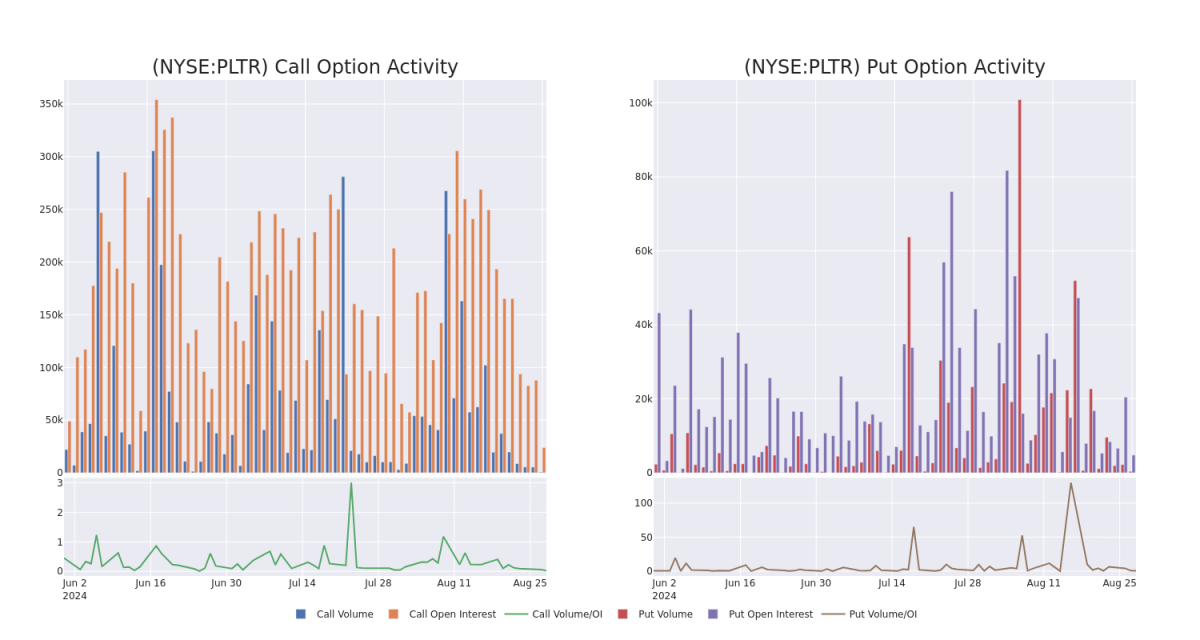

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Palantir Technologies's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Palantir Technologies's significant trades, within a strike price range of $21.0 to $33.0, over the past month.

审视成交量和持仓量提供了对股票研究的重要见解。这些信息对于衡量Palantir Technologies期权在特定行使价上的流动性和兴趣水平至关重要。下面,我们呈现了过去一个月内,Palantir Technologies在$21.0至$33.0行使价范围内的看涨和看跌期权交易量和持仓量的趋势快照。

Palantir Technologies Call and Put Volume: 30-Day Overview

Palantir Technologies看涨和看跌期权的成交量:30天概述

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PLTR | PUT | SWEEP | BULLISH | 10/18/24 | $3.35 | $3.3 | $3.3 | $33.00 | $92.0K | 833 | 279 |

| PLTR | CALL | TRADE | BEARISH | 09/20/24 | $8.85 | $8.6 | $8.6 | $22.00 | $86.0K | 3.2K | 100 |

| PLTR | CALL | SWEEP | BEARISH | 11/15/24 | $2.98 | $2.95 | $2.95 | $31.00 | $44.2K | 4.4K | 173 |

| PLTR | CALL | SWEEP | BEARISH | 01/17/25 | $2.99 | $2.97 | $2.98 | $33.00 | $42.3K | 2.6K | 196 |

| PLTR | CALL | TRADE | BEARISH | 09/20/24 | $9.6 | $9.5 | $9.53 | $21.00 | $28.5K | 3.5K | 30 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PLTR | 看跌 | SWEEP | 看好 | 10/18/24 | $3.35 | $3.3 | $3.3 | $33.00 | $92.0K | 833 | 279 |

| PLTR | 看涨 | 交易 | 看淡 | 09/20/24 | $8.85 | $8.6美元 | $8.6美元 | $22.00 | $86.0K | 3.2K | 100 |

| PLTR | 看涨 | SWEEP | 看淡 | 11/15/24 | $2.98 | $2.95应翻译为$2.95 | $2.95应翻译为$2.95 | $31.00 | $44.2K | 4.4K | 173 |

| PLTR | 看涨 | SWEEP | 看淡 | 01/17/25 | $2.99 | $2.97 | $2.98 | $33.00 | $42.3K | 2.6K | 196 |

| PLTR | 看涨 | 交易 | 看淡 | 09/20/24 | 9.6 | $9.5 | $9.53 | 21.00美元 | $28.5K | 3.5K | 30 |

About Palantir Technologies

关于Palantir Technologies

Palantir is an analytical software company that focuses on leveraging data to create efficiencies in its clients' organizations. The firm serves commercial and government clients via its Foundry and Gotham platforms, respectively. The Denver-based company was founded in 2003 and went public in 2020.

Palantir是一家专注于利用数据创造客户组织效率的分析软件公司,该公司通过其Foundry和Gotham平台为商业和政府客户提供服务。总部位于丹佛的该公司成立于2003年,并于2020年上市。

After a thorough review of the options trading surrounding Palantir Technologies, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

经过对Palantir Technologies周边期权交易的全面审查,我们将进一步审查该公司。其中包括对其当前市场地位和表现的评估。

Where Is Palantir Technologies Standing Right Now?

Palantir Technologies目前处于什么位置?

- With a volume of 5,574,674, the price of PLTR is down -1.74% at $30.3.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 64 days.

- RSI指标暗示该股票可能要超买了。

- 下一个收益预计会在64天内发布。

What The Experts Say On Palantir Technologies

专家对Palantir Technologies的观点

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $20.8.

过去30天内,共有5位专业分析师对此股票发表了看法,设定了平均目标价为20.8美元。

- An analyst from Goldman Sachs persists with their Neutral rating on Palantir Technologies, maintaining a target price of $16.

- An analyst from Raymond James persists with their Outperform rating on Palantir Technologies, maintaining a target price of $30.

- Maintaining their stance, an analyst from Deutsche Bank continues to hold a Sell rating for Palantir Technologies, targeting a price of $21.

- An analyst from DA Davidson has decided to maintain their Neutral rating on Palantir Technologies, which currently sits at a price target of $28.

- Reflecting concerns, an analyst from RBC Capital lowers its rating to Underperform with a new price target of $9.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Palantir Technologies's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Palantir Technologies's significant trades, within a strike price range of $21.0 to $33.0, over the past month.

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Palantir Technologies's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Palantir Technologies's significant trades, within a strike price range of $21.0 to $33.0, over the past month.