What the Options Market Tells Us About PDD Holdings

What the Options Market Tells Us About PDD Holdings

Financial giants have made a conspicuous bearish move on PDD Holdings. Our analysis of options history for PDD Holdings (NASDAQ:PDD) revealed 50 unusual trades.

金融巨头对PDD Holdings进行了明显的看淡操作。我们对PDD Holdings (纳斯达克:PDD) 期权历史的分析显示出50笔飞凡交易。

Delving into the details, we found 44% of traders were bullish, while 48% showed bearish tendencies. Out of all the trades we spotted, 37 were puts, with a value of $4,169,408, and 13 were calls, valued at $1,278,012.

深入细节,我们发现44%的交易者持有看好意见,而48%表现出看淡倾向。在所有我们发现的交易中,有37笔看跌交易,价值4169408美元,以及13笔看涨交易,价值1278012美元。

Predicted Price Range

预测价格区间

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $65.0 to $148.0 for PDD Holdings during the past quarter.

分析这些合约的成交量和持仓量,似乎大型投资者在过去一个季度一直瞄准PDD Holdings的价格区间从65.0美元到148.0美元。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

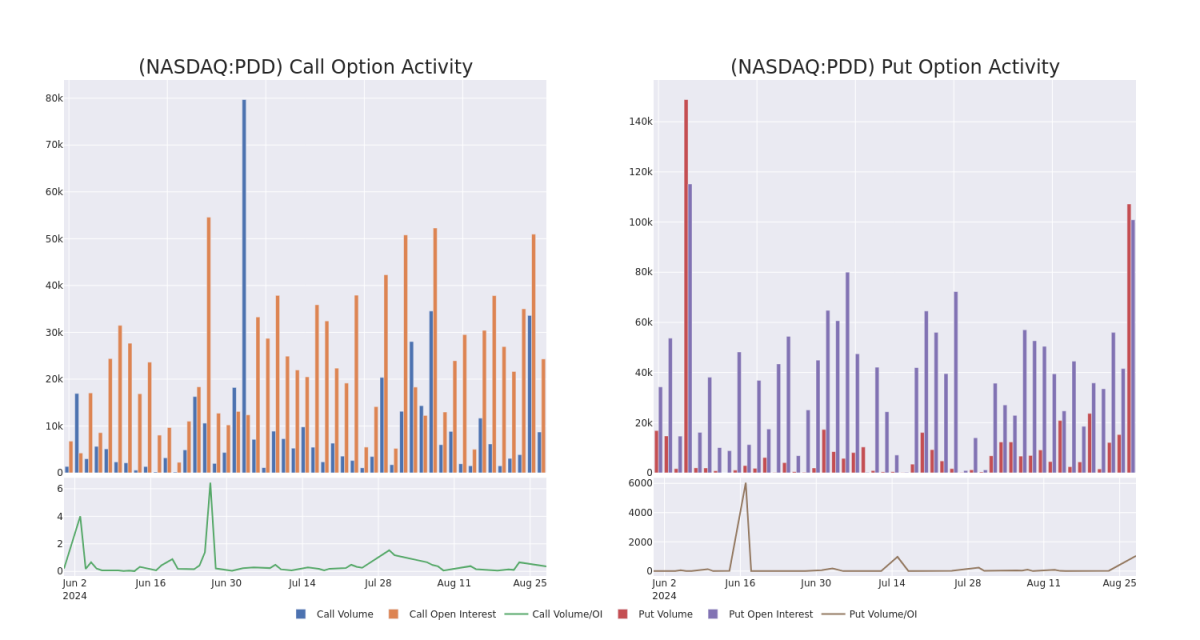

In terms of liquidity and interest, the mean open interest for PDD Holdings options trades today is 3577.03 with a total volume of 115,887.00.

就流动性和兴趣而言,今天PDD Holdings期权交易的平均持仓量为3577.03,总成交量为115887.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for PDD Holdings's big money trades within a strike price range of $65.0 to $148.0 over the last 30 days.

在下图中,我们可以追踪过去30天内PDD Holdings大宗交易的看涨和看跌期权的成交量和持仓量的发展,它们的执行价格范围为65.0美元到148.0美元。

PDD Holdings Call and Put Volume: 30-Day Overview

PDD Holdings看涨期权和看跌期权成交量:30天概览

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PDD | PUT | TRADE | BULLISH | 01/17/25 | $32.7 | $31.0 | $31.0 | $125.00 | $620.0K | 7.1K | 200 |

| PDD | CALL | TRADE | BEARISH | 01/17/25 | $12.05 | $11.7 | $11.8 | $90.00 | $555.7K | 1.3K | 1.3K |

| PDD | PUT | TRADE | BEARISH | 11/15/24 | $25.75 | $25.5 | $25.65 | $115.00 | $477.0K | 1.3K | 600 |

| PDD | PUT | SWEEP | BEARISH | 01/17/25 | $18.5 | $18.1 | $18.49 | $105.00 | $362.4K | 4.1K | 457 |

| PDD | PUT | SWEEP | BEARISH | 08/30/24 | $3.8 | $3.65 | $3.75 | $95.00 | $298.1K | 19.5K | 4.1K |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PDD | 看跌 | 交易 | 看好 | 01/17/25 | $32.7 | $31.0 | $31.0 | $125.00 | $620.0K | 7.1K | 200 |

| PDD | 看涨 | 交易 | 看淡 | 01/17/25 | $12.05 | $11.7 | $11.8 | $90.00 | PDD Holdings is a multinational commerce group that owns and operates a portfolio of businesses. PDD aims to bring more businesses and people into the digital economy so that local communities and small businesses can benefit from the increased productivity and new opportunities. PDD has built a network of sourcing, logistics, and fulfillment capabilities that support its underlying businesses. | 1.3K | 1.3K |

| PDD | 看跌 | 交易 | 看淡 | 11/15/24 | $25.75 | 25.5美元 | $25.65 | $115.00 | $477.0K | 1.3K | 600 |

| PDD | 看跌 | SWEEP | 看淡 | 01/17/25 | $18.5 | $18.1 | $105.00 | 4.1K | 457 | ||

| PDD | 看跌 | SWEEP | 看淡 | 08/30/2024 | $3.8 | $3.65 | $3.75 | $ 95.00 | 19.5K | 4.1K |

About PDD Holdings

关于pdd holdings

PDD Holdings is a multinational commerce group that owns and operates a portfolio of businesses. PDD aims to bring more businesses and people into the digital economy so that local communities and small businesses can benefit from the increased productivity and new opportunities. PDD has built a network of sourcing, logistics, and fulfillment capabilities that support its underlying businesses.

PDD Holdings是一家跨国商业集团,拥有和经营一系列业务。PDD的目标是将更多的企业和人们引入数字经济,从而使当地社区和小企业能从增加的生产率和新的机会中受益。PDD建立了一个支持其基础业务的采购、物流和履行能力网络。

Having examined the options trading patterns of PDD Holdings, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了PDD Holdings的期权交易模式后,我们现在将直接转向该公司。这种转变使我们能够深入了解其当前的市场地位和表现。

PDD Holdings's Current Market Status

PDD Holdings的当前市场状况

- With a trading volume of 15,389,960, the price of PDD is down by -5.69%, reaching $90.45.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 90 days from now.

- 当前RSI指标表明该股可能被超卖。

- 下一次财报将在90天后公布。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for PDD Holdings with Benzinga Pro for real-time alerts.

交易期权存在更大的风险,但也可以获得更高的利润潜力。精明的交易者通过持续教育、战略交易调整、利用各种因子和保持注意市场动态来减轻这些风险。通过Benzinga Pro获取PDD Holdings的最新期权交易,获取实时提醒。

In terms of liquidity and interest, the mean open interest for PDD Holdings options trades today is 3577.03 with a total volume of 115,887.00.

In terms of liquidity and interest, the mean open interest for PDD Holdings options trades today is 3577.03 with a total volume of 115,887.00.