What the Options Market Tells Us About Citigroup

What the Options Market Tells Us About Citigroup

High-rolling investors have positioned themselves bullish on Citigroup (NYSE:C), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in C often signals that someone has privileged information.

富有的投资者对花旗集团(纽交所:C)持看好态度,零售交易者需要注意。 这一活动是通过Benzinga对公开可得到的期权数据进行跟踪后得知的。这些投资者的身份尚不明确,但是在C股票中出现如此重大的举措通常意味着某人拥有特权信息。

Today, Benzinga's options scanner spotted 14 options trades for Citigroup. This is not a typical pattern.

今天,Benzinga的期权扫描器发现了14个花旗集团的期权交易。这不是一种典型的模式。

The sentiment among these major traders is split, with 64% bullish and 35% bearish. Among all the options we identified, there was one put, amounting to $57,600, and 13 calls, totaling $3,419,602.

这些主要交易商之间的情绪分歧,有64%的看涨和35%的看跌。我们识别到的所有期权中,有一个看跌,金额为57,600美元,和13个看涨合计3,419,602美元。

Projected Price Targets

预计价格目标

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $45.0 to $70.0 for Citigroup over the recent three months.

根据交易活动,看出在最近三个月中,这些重要投资者希望花旗集团的股价在45.0美元至70.0美元的区间内。

Volume & Open Interest Trends

成交量和未平仓量趋势

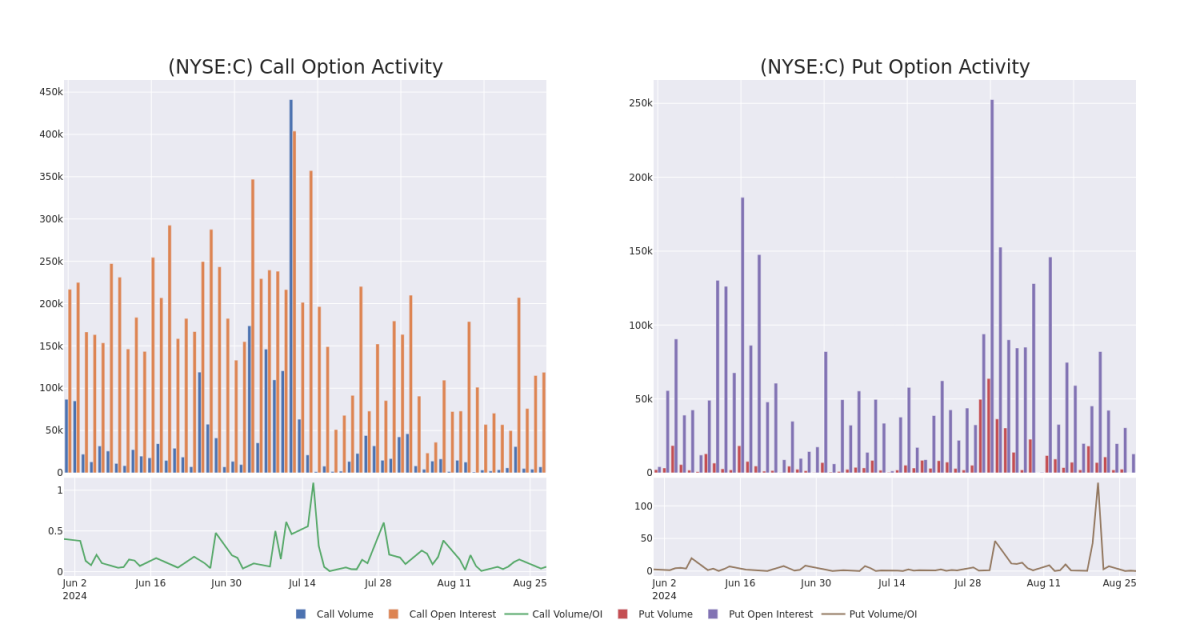

In today's trading context, the average open interest for options of Citigroup stands at 16450.88, with a total volume reaching 7,045.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Citigroup, situated within the strike price corridor from $45.0 to $70.0, throughout the last 30 days.

根据今天的交易情况来看,花旗集团期权的平均持有利益为16450.88,总成交量达到7,045.00。附图描述了在过去30天内,花旗集团高价位交易中看涨和看跌期权的成交量和持有利益的变化情况,这些期权处于45.0美元至70.0美元的行权价走廊内。

Citigroup Call and Put Volume: 30-Day Overview

花旗集团看涨和看跌期权成交量:30天概述

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| C | CALL | TRADE | BEARISH | 01/17/25 | $7.2 | $7.1 | $7.11 | $57.50 | $2.4M | 13.0K | 3.5K |

| C | CALL | SWEEP | BEARISH | 09/20/24 | $9.5 | $9.45 | $9.45 | $52.50 | $141.7K | 8.2K | 552 |

| C | CALL | SWEEP | BEARISH | 09/20/24 | $9.55 | $9.5 | $9.5 | $52.50 | $123.5K | 8.2K | 702 |

| C | CALL | SWEEP | BULLISH | 09/20/24 | $9.5 | $9.45 | $9.5 | $52.50 | $114.0K | 8.2K | 392 |

| C | CALL | TRADE | BEARISH | 01/17/25 | $2.92 | $2.9 | $2.9 | $65.00 | $107.3K | 46.5K | 386 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| C | 看涨 | 交易 | 看淡 | 01/17/25 | $7.2 | $7.1 | Current Position of Citigroup | $57.50 | $2.4M | 13.0千 | 3.5K |

| C | 看涨 | SWEEP | 看淡 | 09/20/24 | $9.5 | 9.45 | 9.45 | $52.50 | $141.7K | 8.2K | 552 |

| C | 看涨 | SWEEP | 看淡 | 09/20/24 | $9.55 | $9.5 | $9.5 | $52.50 | 123500美元 | 8.2K | 702 |

| C | 看涨 | SWEEP | 看好 | 09/20/24 | $9.5 | 9.45 | $9.5 | $52.50 | $114.0K | 8.2K | 392 |

| C | 看涨 | 交易 | 看淡 | 01/17/25 | $2.92 | $2.9 | $2.9 | $65.00 | $107.3K | 46.5千 | 386 |

About Citigroup

关于花旗集团

Citigroup is a global financial-services company doing business in more than 100 countries and jurisdictions. Citigroup's operations are organized into five primary segments: services, markets, banking, US personal banking, and wealth management. The bank's primary services include cross-border banking needs for multinational corporates, investment banking and trading, and credit card services in the United States.

花旗集团是一家跨越100多个国家和地区的全球金融服务公司。花旗集团的业务分为五个主要部门:服务、市场、银行、美国个人银行和财富管理。该银行的主要服务包括为跨国企业提供跨境银行需求、投资银行和交易以及在美国的信用卡服务。

In light of the recent options history for Citigroup, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考虑到花旗集团最近的期权历史,现在应该关注公司本身。我们旨在探讨其当前表现。

Current Position of Citigroup

花旗集团当前位置

- Currently trading with a volume of 2,762,746, the C's price is down by -0.44%, now at $61.41.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 44 days.

- RSI读数表明该股票目前处于中立状态,处于超买和超卖之间。

- 预期四十四天后公布收益。

What Analysts Are Saying About Citigroup

分析师对花旗集团的看法

In the last month, 1 experts released ratings on this stock with an average target price of $79.0.

- An analyst from Morgan Stanley has decided to maintain their Overweight rating on Citigroup, which currently sits at a price target of $79.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。