Spotlight on AT&T: Analyzing the Surge in Options Activity

Spotlight on AT&T: Analyzing the Surge in Options Activity

Whales with a lot of money to spend have taken a noticeably bearish stance on AT&T.

资金雄厚的鲸鱼们对AT&t持有明显的看淡态度。

Looking at options history for AT&T (NYSE:T) we detected 8 trades.

查看AT&t (纽交所:T) 的期权历史,我们发现了8次交易。

If we consider the specifics of each trade, it is accurate to state that 25% of the investors opened trades with bullish expectations and 75% with bearish.

如果考虑每个交易的具体情况,可以准确地说,有25%的投资者以看好期望来开仓,75%以看淡为主。

From the overall spotted trades, 3 are puts, for a total amount of $399,640 and 5, calls, for a total amount of $449,366.

从总体交易中看,看跌期权共有3笔,总金额为399,640美元;看涨期权共有5笔,总金额为449,366美元。

Expected Price Movements

预期价格波动

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $15.0 to $25.0 for AT&T during the past quarter.

通过分析这些合约的成交量和持仓量,我们发现大户对AT&T股票在过去的一个季度中将价格窗口设定在15.0到25.0美元之间。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

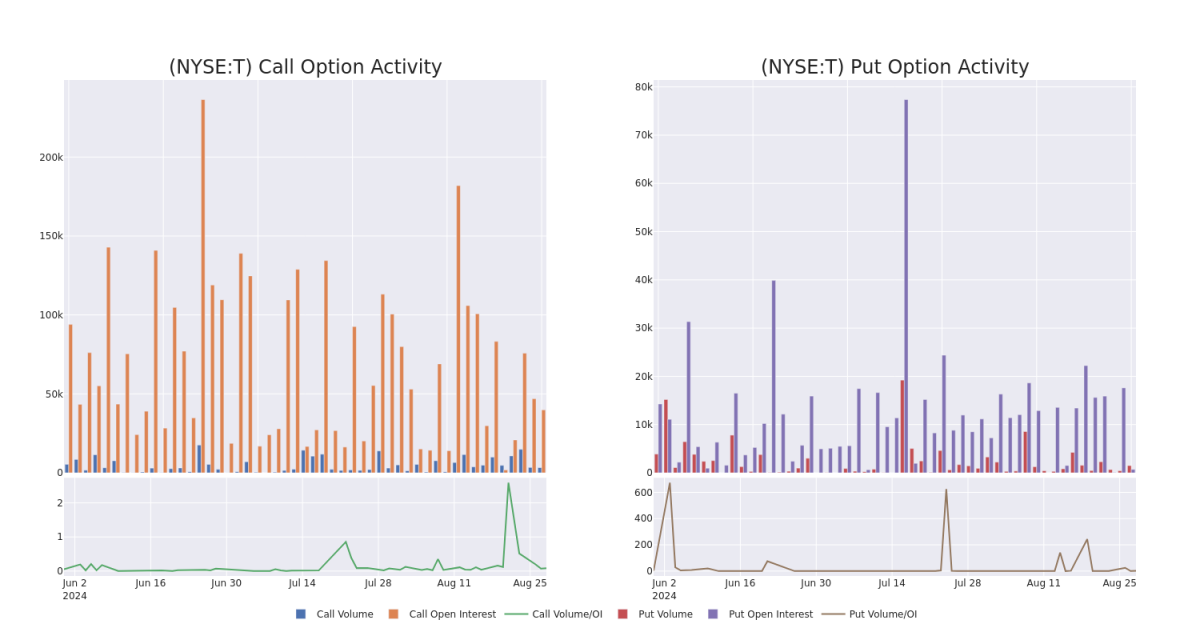

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for AT&T's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of AT&T's whale trades within a strike price range from $15.0 to $25.0 in the last 30 days.

在交易期权时,观察成交量和持仓量是一个重要的步骤。这些数据可以帮助你跟踪AT&T期权在特定行使价上的流动性和兴趣。下面,我们可以观察到过去30天内,对于价格区间在15.0到25.0美元之间的AT&T特大交易的看涨期权和看跌期权的成交量和持仓量的演变。

AT&T 30-Day Option Volume & Interest Snapshot

AT&T 30天期权成交量和持仓量快照

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| T | CALL | SWEEP | BEARISH | 10/18/24 | $3.05 | $2.93 | $2.93 | $17.00 | $175.8K | 5.1K | 600 |

| T | PUT | SWEEP | BEARISH | 12/20/24 | $4.45 | $4.4 | $4.45 | $24.00 | $133.5K | 702 | 600 |

| T | PUT | SWEEP | BEARISH | 12/20/24 | $4.45 | $4.4 | $4.45 | $24.00 | $133.0K | 702 | 601 |

| T | PUT | SWEEP | BEARISH | 12/20/24 | $4.45 | $4.4 | $4.45 | $24.00 | $133.0K | 702 | 300 |

| T | CALL | SWEEP | BEARISH | 06/20/25 | $5.1 | $5.0 | $5.0 | $15.00 | $100.0K | 15.3K | 207 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| T | 看涨 | SWEEP | 看淡 | 10/18/24 | $3.05 | $2.93 | $2.93 | $17.00 | $175.8K | 5.1K | 600 |

| T | 看跌 | SWEEP | 看淡 | 12/20/24 | $4.45 | $4.4 | $4.45 | 24.00美元 | $133.5K | 702 | 600 |

| T | 看跌 | SWEEP | 看淡 | 12/20/24 | $4.45 | $4.4 | $4.45 | 24.00美元 | $133.0K | 702 | 601 |

| T | 看跌 | SWEEP | 看淡 | 12/20/24 | $4.45 | $4.4 | $4.45 | 24.00美元 | $133.0K | 702 | 300 |

| T | 看涨 | SWEEP | 看淡 | 06/20/25 | $5.1 | $5.0 | $5.0 | 15.00美元 | $100.0K | 15.3K | 207 |

About AT&T

关于AT&T

The wireless business contributes nearly 70% of AT&T's revenue. The firm is the third-largest US wireless carrier, connecting 72 million postpaid and 17 million prepaid phone customers. Fixed-line enterprise services, which account for about 16% of revenue, include internet access, private networking, security, voice, and wholesale network capacity. Residential fixed-line services, about 11% of revenue, primarily consist of broadband internet access, serving 14 million customers. AT&T also has a sizable presence in Mexico, with 23 million customers, but this business only accounts for 4% of revenue. The firm still holds a 70% equity stake in satellite television provider DirecTV but does not consolidate this business in its financial statements.

无线业务贡献了近70%的AT&T收入。该公司是美国第三大无线运营商,连接着7200万后付费和1700万预付费手机客户。固定线企业服务占收入的16%,包括互联网接入、私人网络、安全、语音和批发网络容量。住宅固定线服务占收入约11%,主要包括宽带互联网接入,为1400万客户提供服务。AT&T在墨西哥也拥有较大的业务,有2300万客户,但这项业务只占其财务报表的4%。该公司仍然持有卫星电视提供商DirecTV的70%股权,但不会将其纳入财务报表。

Having examined the options trading patterns of AT&T, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在审查了AT&T的期权交易模式后,我们的注意力现在直接转向了该公司。 这一转变使我们能够深入了解其目前的市场地位和绩效。

Where Is AT&T Standing Right Now?

- Currently trading with a volume of 8,256,974, the T's price is up by 0.61%, now at $19.77.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 56 days.

- RSI读数表明该股目前可能接近超买水平。

- 预计的盈利发布还有56天。

What Analysts Are Saying About AT&T

In the last month, 1 experts released ratings on this stock with an average target price of $18.0.

在过去的一个月中,有1个专家对该股票发表了评级,平均目标价为18.0美元。

- Consistent in their evaluation, an analyst from MoffettNathanson keeps a Neutral rating on AT&T with a target price of $18.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

From the overall spotted trades, 3 are puts, for a total amount of $399,640 and 5, calls, for a total amount of $449,366.

From the overall spotted trades, 3 are puts, for a total amount of $399,640 and 5, calls, for a total amount of $449,366.