Market Whales and Their Recent Bets on LIN Options

Market Whales and Their Recent Bets on LIN Options

Whales with a lot of money to spend have taken a noticeably bullish stance on Linde.

有很多钱可以花的鲸鱼对Linde持有明显看好的态度。

Looking at options history for Linde (NASDAQ:LIN) we detected 9 trades.

观察Linde (NASDAQ: LIN) 的期权历史,我们检测到9笔交易。

If we consider the specifics of each trade, it is accurate to state that 55% of the investors opened trades with bullish expectations and 22% with bearish.

如果考虑到每笔交易的具体情况,可以准确地说,55%的投资者持看好态度,22%的投资者持看淡态度。

From the overall spotted trades, 3 are puts, for a total amount of $114,020 and 6, calls, for a total amount of $358,488.

从总体上看,我们发现了3笔看跌交易,总金额为$114,020,以及6笔看涨交易,总金额为$358,488。

Expected Price Movements

预期价格波动

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $470.0 and $500.0 for Linde, spanning the last three months.

在评估交易量和持仓量之后,显然主要市场动力正在专注于Linde在过去三个月的区间,价格为$470.0至$500.0。

Insights into Volume & Open Interest

成交量和持仓量分析

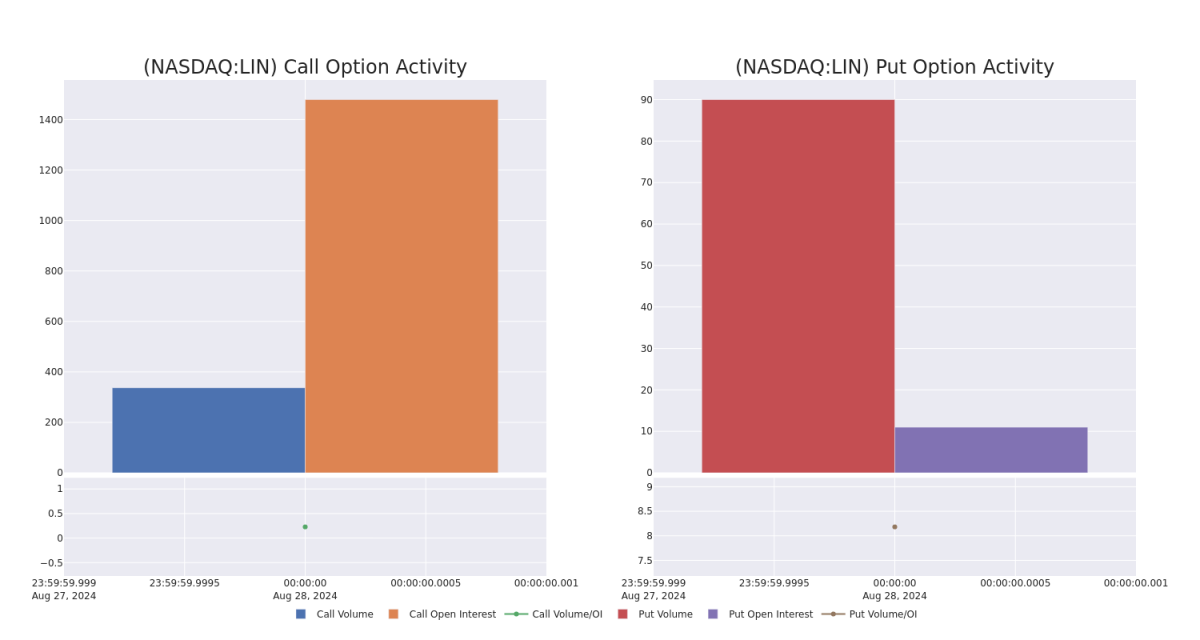

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for Linde's options for a given strike price.

这些数据可以帮助您追踪目标价给定调期标价的Linde期权的流动性和利率。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Linde's whale activity within a strike price range from $470.0 to $500.0 in the last 30 days.

下面,我们可以观察到Linde的看涨和看跌期权的成交量和未平仓量的演变,分别涵盖了过去30天内标的价区间从$470.0到$500.0的所有交易活动。

Linde 30-Day Option Volume & Interest Snapshot

Linde 30天期权成交量及利息快照

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LIN | CALL | SWEEP | NEUTRAL | 01/16/26 | $38.6 | $36.3 | $38.17 | $500.00 | $152.4K | 226 | 47 |

| LIN | CALL | SWEEP | NEUTRAL | 01/17/25 | $20.0 | $19.9 | $19.95 | $480.00 | $57.6K | 909 | 31 |

| LIN | PUT | SWEEP | BULLISH | 01/16/26 | $32.5 | $32.2 | $32.3 | $470.00 | $51.7K | 11 | 18 |

| LIN | CALL | SWEEP | BEARISH | 01/17/25 | $19.0 | $18.9 | $18.9 | $480.00 | $43.4K | 909 | 68 |

| LIN | CALL | SWEEP | BEARISH | 01/17/25 | $26.2 | $26.0 | $26.06 | $470.00 | $39.1K | 344 | 84 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LIN | 看涨 | SWEEP | 中立 | 01/16/26 | $38.6 | $36.3 | Current Position of Linde | $500.00 | RSI readings suggest the stock is currently may be approaching overbought. | 226 | 47 |

| LIN | 看涨 | SWEEP | 中立 | 01/17/25 | $20.0 | $19.9 | $19.95 | 该公司的股票上周五收于$74.31。 | $57.6K | 909 | 31 |

| LIN | 看跌 | SWEEP | 看好 | 01/16/26 | $32.5 | $32.2 | $32.3 | $470.00 | $51.7K | 11 | 18 |

| LIN | 看涨 | SWEEP | 看淡 | 01/17/25 | $19.0 | $18.9 | $18.9 | 该公司的股票上周五收于$74.31。 | $43.4K | 909 | 68 |

| LIN | 看涨 | SWEEP | 看淡 | 01/17/25 | $26.2 | $26.0 | $470.00 | 39,100美元 | 344 | 84 |

About Linde

关于Linde

Linde is the largest industrial gas supplier in the world, with operations in over 100 countries. The firm's main products are atmospheric gases (including oxygen, nitrogen, and argon) and process gases (including hydrogen, carbon dioxide, and helium), as well as equipment used in industrial gas production. Linde serves a wide variety of end markets, including chemicals, manufacturing, healthcare, and steelmaking. Linde generated approximately $33 billion in revenue in 2023.

Linde PLC分红历程概览

After a thorough review of the options trading surrounding Linde, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Linde

Linde的现状

- Currently trading with a volume of 515,141, the LIN's price is down by -0.25%, now at $471.15.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 57 days.

- RSI读数表明该股目前可能接近超买水平。

- 预计收益发布还有57天。

What Analysts Are Saying About Linde

分析师对Linde的评论

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $495.75.

- Maintaining their stance, an analyst from BMO Capital continues to hold a Outperform rating for Linde, targeting a price of $477.

- Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for Linde, targeting a price of $480.

- An analyst from Barclays persists with their Overweight rating on Linde, maintaining a target price of $510.

- An analyst from B of A Securities has decided to maintain their Buy rating on Linde, which currently sits at a price target of $516.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Linde with Benzinga Pro for real-time alerts.

交易期权涉及较高的风险,但也有可能获得更高的利润。精明的交易者通过持续的教育、战略性交易调整,利用各种因子,保持对市场动态的敏锐感知来减少这些风险。使用Benzinga Pro进行实时提醒,了解Linde的最新期权交易动态。

From the overall spotted trades, 3 are puts, for a total amount of $114,020 and 6, calls, for a total amount of $358,488.

From the overall spotted trades, 3 are puts, for a total amount of $114,020 and 6, calls, for a total amount of $358,488.