Market Mover | Marvell Technology Shares up 7% After Reporting Q2 Financial Results

Market Mover | Marvell Technology Shares up 7% After Reporting Q2 Financial Results

August 30, 2024 - $Marvell Technology (MRVL.US)$ shares rose 7.37% to $74.99 in early trading on Friday.

2024年8月30日 - $迈威尔科技 (MRVL.US)$ 在周五早盘交易中,股票上涨7.37%,达到74.99美元。

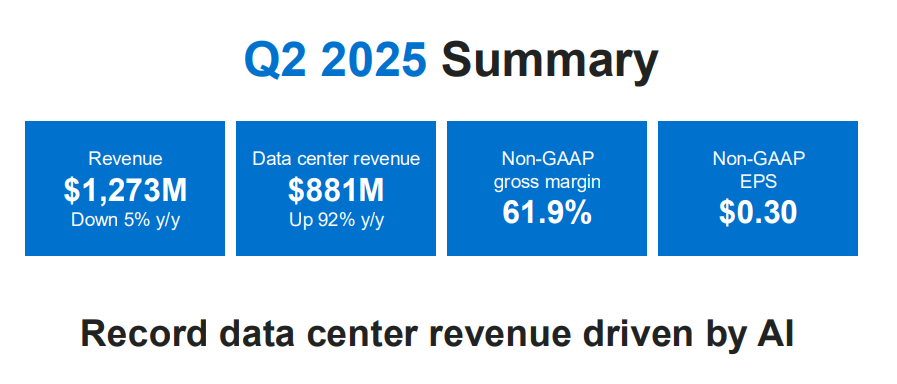

The company reported the financial results for the second quarter of the fiscal year 2025. It reported net loss narrowed, and revenue exceeded Wall Street revenue estimates in its Q2, driven by a surge in artificial intelligence demand and the ramp-up of its custom AI programs.

该公司公布了2025财年第二季度的财务结果。 Q2净亏损缩小,营业收入超过华尔街营业收入预期,得益于人工智能需求的激增和自定义AI项目的扩张。

Financial Outlook for the Q2 FY2025

2025财年第二季度财务展望

Q2 Net Revenue: $1.273 billion, declined by 5% year-on-year.

Q2 Gross Margin: 46.2% GAAP gross margin; 61.9% non-GAAP gross margin.

Q2 Diluted income (loss) per share: $(0.22) GAAP diluted loss per share; $0.30 non-GAAP diluted income per share.

Q2净营业收入:12.73亿美元,同比下降5%。

Q2毛利率:46.2% GAAP毛利率;61.9% 非GAAP毛利率。

Q2每股摊薄收益(损失):$(0.22) GAAP摊薄亏损每股;$0.30 非GAAP摊薄收益每股。

"Marvell's second quarter revenue grew 10% sequentially, above the mid-point of guidance driven by strong demand from AI. We saw strong growth from our electro-optics products and our custom AI programs began to ramp," said Matt Murphy, Marvell's Chairman and CEO. "Next quarter, we expect our combined enterprise networking and carrier end markets to return to growth, while our data center end market growth accelerates. As a result, for the third quarter of fiscal 2025, we expect all our end markets to grow sequentially, with consolidated revenue forecasted to grow 14% sequentially at the mid-point, accompanied by a significant increase in operating leverage."

“迈威尔第二季度的营业收入环比增长10%,高于预期中点,主要受到人工智能需求的强劲推动。我们的光电产品增长强劲,定制的人工智能项目也开始加速发展,”迈威尔董事长兼首席执行官马特·墨菲(Matt Murphy)表示。“下一季度,我们预计企业网络和运营商终端市场将恢复增长,而数据中心终端市场的增长将加速。因此,预计2025财年第三季度,所有终端市场将顺序增长,预计综合营业收入将以中点处的14%的环比增长,伴随着营业费用明显增加。”

Financial Outlook for the FY2025

FY2025年财政展望

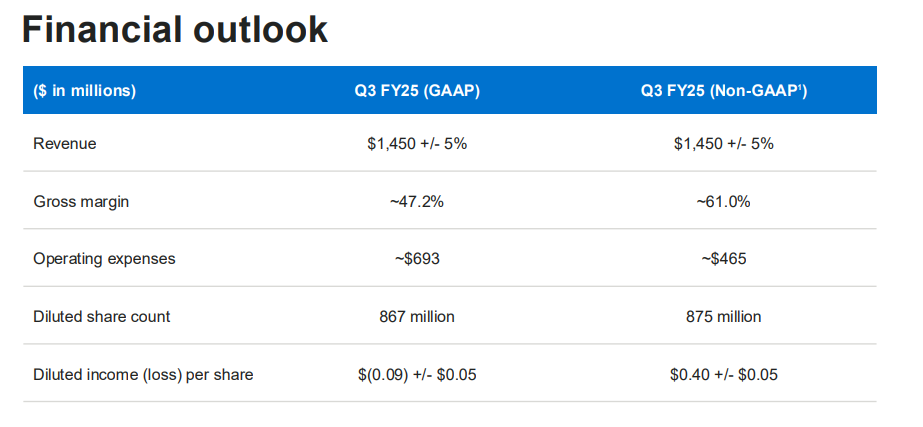

Net revenue is expected to be $1.450 billion +/- 5%.

GAAP gross margin is expected to be approximately 47.2%.

Non-GAAP gross margin is expected to be approximately 61%.

GAAP operating expenses are expected to be approximately $693 million.

Non-GAAP operating expenses are expected to be approximately $465 million.

Basic weighted-average shares outstanding are expected to be 867 million.

Diluted weighted-average shares outstanding are expected to be 875 million.

GAAP diluted loss per share is expected to be $(0.09) +/- $0.05 per share.

Non-GAAP diluted income per share is expected to be $0.40 +/- $0.05 per share.

预计净营业收入将为14.5亿美元+/- 5%。

预计按照美国通用会计准则,毛利率约为47.2%。

预计非GAAP毛利率约为61%。

预计按照GAAP标准计算,营业费用约为69300万美元。

预计非通用会计原则下的营业费用将约为46500万美元。

预计基本加权平均每股流通股数为86700万。

预计稀释后加权平均已发行股份为87500万。

预计每股按照美国通用会计准则调整后的亏损为每股$(0.09) +/- $0.05。

预计非通用会计净收入每股为$0.40 +/- $0.05。

Q2 Gross

Q2 Gross