Behind the Scenes of Merck & Co's Latest Options Trends

Behind the Scenes of Merck & Co's Latest Options Trends

Investors with a lot of money to spend have taken a bearish stance on Merck & Co (NYSE:MRK).

有大量资金的投资者采取了看淡默克与有限公司(NYSE:MRK)的立场。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

我们在这里追踪的公开期权历史记录中发现,今天这些头寸已经出现了。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with MRK, it often means somebody knows something is about to happen.

不管这些人是机构还是富人,我们无从得知。但是,当这样的大事发生在MRK身上时,通常意味着有人知道即将发生的事情。

Today, Benzinga's options scanner spotted 8 options trades for Merck & Co.

今天,Benzinga期权扫描器发现了8个默沙东的期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 37% bullish and 50%, bearish.

这些大额交易者的总体情绪分别为37%看涨和50%看淡。

Out of all of the options we uncovered, there was 1 put, for a total amount of $74,400, and 7, calls, for a total amount of $356,298.

在我们发现的所有期权中,有1个看跌,总金额为74400美元,还有7个看涨,总金额为356298美元。

Expected Price Movements

预期价格波动

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $100.0 to $117.0 for Merck & Co over the recent three months.

根据交易活动情况,看来重要投资者们的目标价位是默沙东在最近三个月内的股价区间从100.0到117.0美元。

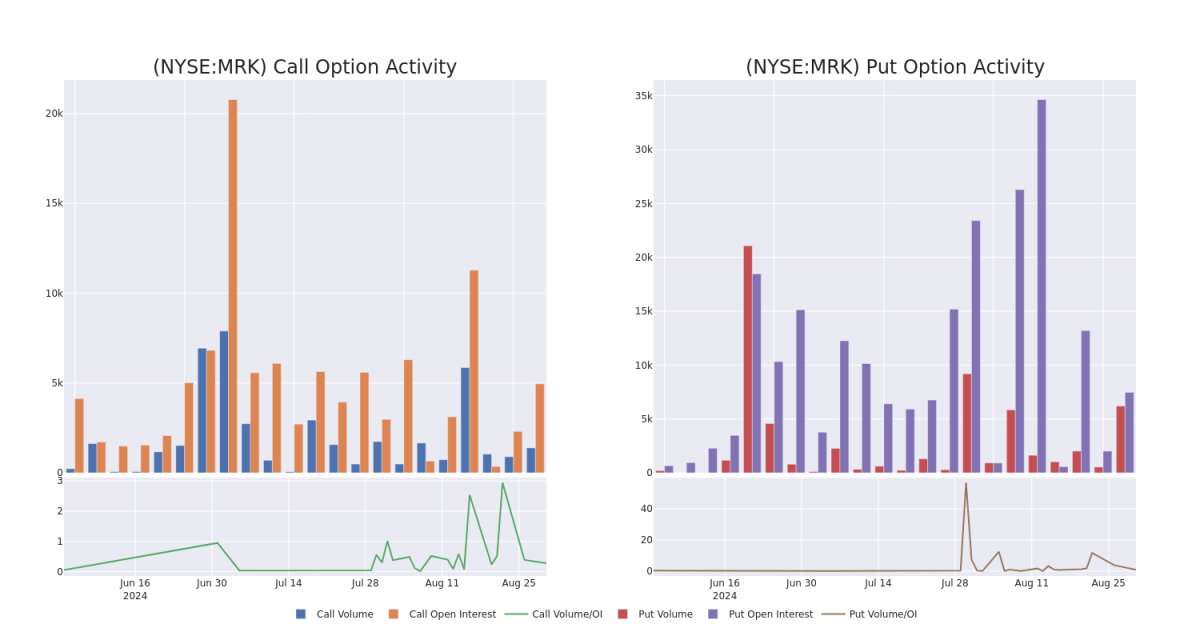

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Merck & Co's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Merck & Co's significant trades, within a strike price range of $100.0 to $117.0, over the past month.

检视成交量和未平仓合约可为股票研究提供关键洞察。这些信息对于评估默沙东公司特定行权价格期权的流动性和兴趣水平至关重要。下面我们展示了过去一个月默沙东公司100.0到117.0美元行权价格期权的看涨和看跌成交量和未平仓合约趋势快照。

Merck & Co 30-Day Option Volume & Interest Snapshot

默沙东30天期权成交量及持仓量快照

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRK | CALL | TRADE | BULLISH | 08/30/24 | $10.8 | $10.55 | $10.7 | $107.00 | $80.2K | 181 | 181 |

| MRK | CALL | SWEEP | BEARISH | 10/18/24 | $4.6 | $4.5 | $4.55 | $115.00 | $75.9K | 1.6K | 167 |

| MRK | PUT | TRADE | BEARISH | 09/20/24 | $0.14 | $0.05 | $0.12 | $100.00 | $74.4K | 7.4K | 6.2K |

| MRK | CALL | SWEEP | BULLISH | 09/06/24 | $1.97 | $1.92 | $1.95 | $117.00 | $47.3K | 939 | 568 |

| MRK | CALL | TRADE | BULLISH | 08/30/24 | $11.0 | $10.8 | $10.93 | $107.00 | $43.7K | 181 | 40 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRK | 看涨 | 交易 | 看好 | 08/30/2024 | $10.8 | $10.55 | $10.7 | 107.00美元 | $80.2K | 181 | 181 |

| MRK | 看涨 | SWEEP | 看淡 | 10/18/24 | $4.6 | $4.5 | 4.55 | $115.00 | $75.9K | 1.6K | 167 |

| MRK | 看跌 | 交易 | 看淡 | 09/20/24 | 0.14美元 | $0.05 | $0.12 | $100.00。 | $74.4K | 7.4K | 6.2千 |

| MRK | 看涨 | SWEEP | 看好 | 09/06/24 | $1.97 | $1.92 | $1.95 | $117.00 | $47.3K | 939 | 568 |

| MRK | 看涨 | 交易 | 看好 | 08/30/2024 | $11.0 | $10.8 | $10.93 | 107.00美元 | $43.7千美元 | 181 | 40 |

About Merck & Co

关于默沙东

Merck makes pharmaceutical products to treat several conditions in a number of therapeutic areas, including cardiometabolic disease, cancer, and infections. Within cancer, the firm's immuno-oncology platform is growing as a major contributor to overall sales. The company also has a substantial vaccine business, with treatments to prevent pediatric diseases as well as human papillomavirus, or HPV. Additionally, Merck sells animal health-related drugs. From a geographical perspective, just under half of the company's sales are generated in the United States.

默沙东生产多种药品,治疗多种领域的疾病,包括心代谢症、癌症和感染。在癌症领域,该公司的免疫肿瘤学平台正在成为总销售额的主要贡献者。该公司还具有实质性的疫苗业务,包括预防儿童疾病以及人类乳头瘤病毒(HPV)治疗。此外,默沙东出售与动物健康相关的药品。从地理角度来看,公司销售额的近一半来自于美国境内。

Merck & Co's Current Market Status

- Currently trading with a volume of 8,678,562, the MRK's price is up by 0.84%, now at $118.45.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 55 days.

- RSI读数表明该股目前可能接近超买水平。

- 预计的盈利发布时间为55天后。

Expert Opinions on Merck & Co

专家对默沙东的意见

In the last month, 1 experts released ratings on this stock with an average target price of $155.0.

- Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $155.

- 考虑到风险,康泰纳菲分析师将评级下调为增持,并设定了155美元的新目标价。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Merck & Co with Benzinga Pro for real-time alerts.

期权交易涉及更大的风险,但也提供了更高的利润潜力。精明的交易者通过持续教育、战略性交易调整、利用各种因子和关注市场动态来降低这些风险。使用 Benzinga Pro 获取默沙东的最新期权交易实时警报。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with MRK, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with MRK, it often means somebody knows something is about to happen.