ShanDongDenghai Seeds Co.,Ltd (SZSE:002041) Analysts Are More Bearish Than They Used To Be

ShanDongDenghai Seeds Co.,Ltd (SZSE:002041) Analysts Are More Bearish Than They Used To Be

The latest analyst coverage could presage a bad day for ShanDongDenghai Seeds Co.,Ltd (SZSE:002041), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. Both revenue and earnings per share (EPS) estimates were cut sharply as the analysts factored in the latest outlook for the business, concluding that they were too optimistic previously. At CN¥8.13, shares are up 6.7% in the past 7 days. We'd be curious to see if the downgrade is enough to reverse investor sentiment on the business.

最新的分析师覆盖可能预示着山东登海种业(SZSE:002041)将迎来一个不太好的日子,分析师们对他们的法定估算进行了全面削减,这可能让股东们有些震惊。营业收入和每股收益(EPS)的估算都被大幅削减,因分析师们认为之前的预期过于乐观。股价8.13元,在过去7天中上涨了6.7%。我们会好奇看到这次的下调是否足以改变对公司的投资者情绪。

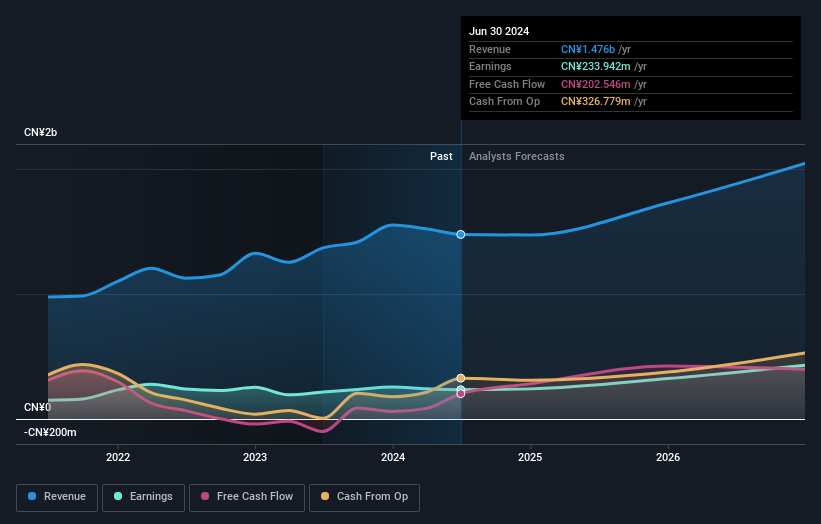

Following this downgrade, ShanDongDenghai SeedsLtd's five analysts are forecasting 2024 revenues to be CN¥1.5b, approximately in line with the last 12 months. Statutory earnings per share are forecast to be CN¥0.27, approximately in line with the last 12 months. Prior to this update, the analysts had been forecasting revenues of CN¥1.7b and earnings per share (EPS) of CN¥0.33 in 2024. Indeed, we can see that the analysts are a lot more bearish about ShanDongDenghai SeedsLtd's prospects, administering a measurable cut to revenue estimates and slashing their EPS estimates to boot.

在此次下调后,山东登海种业有限公司的五位分析师预测2024年的营业收入将达到15亿人民币,与过去12个月基本持平。预计每股收益将为0.27元,与过去12个月基本持平。在此次更新之前,分析师们预测2024年的营业收入为17亿人民币,每股收益为0.33元。确实,我们可以看到分析师们对山东登海种业的前景更为悲观,他们对营业收入的估算进行了可观的下调,并大幅削减了每股收益的估算。

It'll come as no surprise then, to learn that the analysts have cut their price target 21% to CN¥9.51.

毫无疑问,分析师们将其目标价下调了21%,至9.51元。

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. We would highlight that sales are expected to reverse, with a forecast 0.7% annualised revenue decline to the end of 2024. That is a notable change from historical growth of 15% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 11% per year. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - ShanDongDenghai SeedsLtd is expected to lag the wider industry.

了解这些预测背后更多的背景信息的一种方法是看看它们与过去的表现以及同行业其他公司的表现相比如何。我们要强调的是,销售预计将发生逆转,预计至2024年年底,年化营业收入将下降0.7%。这与过去五年15%的历史增长相比是一个显著变化。与我们的数据相比较,同行业其他公司的营业收入预计每年将增长11%。因此,尽管山东登海种业的营业收入预计将收缩,但这片云朵并没有银边,预计将落后于整个行业。

The Bottom Line

最重要的事情是分析师增加了它对下一年每股亏损的估计。令人欣慰的是,营收预测未发生重大变化,业务仍有望比整个行业增长更快。共识价格目标稳定在28.50美元,最新估计不足以对价格目标产生影响。

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that ShanDongDenghai SeedsLtd's revenues are expected to grow slower than the wider market. After such a stark change in sentiment from analysts, we'd understand if readers now felt a bit wary of ShanDongDenghai SeedsLtd.

最重要的是,分析师下调了每股收益预测,预计业务状况将明显下滑。不幸的是,分析师还下调了收入预测,并且行业数据表明山东登海种业的收入增长预计将低于整个市场。在分析师情绪发生如此明显的变化之后,如果读者感到有些谨慎,我们可以理解。

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple ShanDongDenghai SeedsLtd analysts - going out to 2026, and you can see them free on our platform here.

尽管如此,业务的长期前景比明年的收益更重要。我们有多位山东登海种业的分析师对2026年的预测,您可以免费在我们的平台上查看。

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies backed by insiders.

跟踪管理层是购买还是销售,是寻找可能达到关键点的有趣公司的另一种方法,我们的免费公司列表由内部支持的增长公司组成。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. We would highlight that sales are expected to reverse, with a forecast 0.7% annualised revenue decline to the end of 2024. That is a notable change from historical growth of 15% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 11% per year. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - ShanDongDenghai SeedsLtd is expected to lag the wider industry.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. We would highlight that sales are expected to reverse, with a forecast 0.7% annualised revenue decline to the end of 2024. That is a notable change from historical growth of 15% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 11% per year. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - ShanDongDenghai SeedsLtd is expected to lag the wider industry.