YTLPOWR's stock price surges over 3%, reaching RM4.00; may face significant resistance.

YTLPOWR's stock price surges over 3%, reaching RM4.00; may face significant resistance.

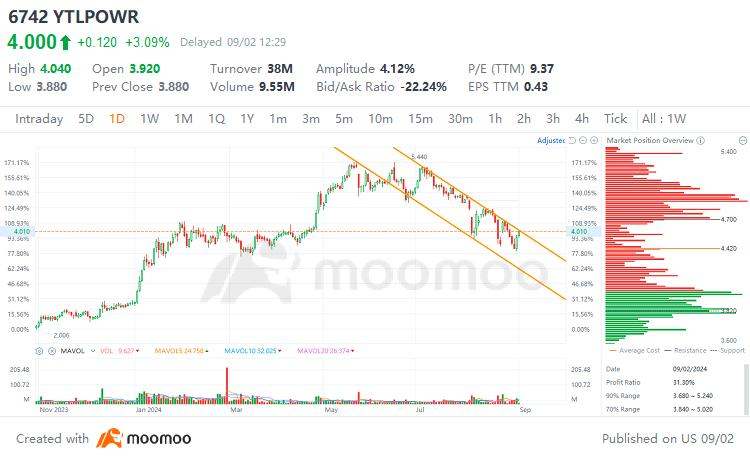

YTLPOWR Technical Analysis Chart:

YTLPOWR 技术面分析图表:

Technical Analysis:

技术面分析:

Support level at RM3.88, resistance level at RM4.14

支撑位在RM3.88,压力位在RM4.14

Facing significant resistance after reaching RM3.975 due to high trading volume

在达到RM3.975后面临重要的压力位,原因是成交量大

Market News:

市场资讯:

On August 21st, YTL Power released its second quarter financial report for the fiscal year, with a net profit of RM3.5 billion, a 75% increase compared to the previous year's RM2 billion , an increase of RM1.5 billion. The group attributed the profit increase to better performance in the power generation sector. For the fiscal year ending June 30, 2024, YTLPOWR's operating income was RM22.32 billion, an increase of RM430 million compared to June 30, 2023, representing a 2.0% increase. The increase in pre-tax profit was mainly due to the better profit margin in the power generation sector, lower interest expenses due to loan repayments, and the strength of the Singapore Dollar against the Malaysian Ringgit. However, the decrease in operating income was mainly due to lower pool prices, partially offsetting the strength of the Singapore Dollar against the Malaysian Ringgit.

YTL Power在8月21日发布了截至2024年6月30日的第二季度财报,净利润为35亿令吉,相比去年的20亿令吉增长了75%,增加了15亿令吉。该集团将利润增长归因于发电部门业绩的提升。截至2024年6月30日的财政年度,YTLPOWR的营业收入为223.2亿令吉,较2023年6月30日增加了43000万令吉,增长了2.0%。税前利润的增加主要归因于发电部门利润率的改善,还有由于偿还贷款而导致的较低利息费用,以及新加坡元对马来西亚令吉的升值。然而,营业收入的减少主要是由于低池价格,部分抵消了新加坡元对马来西亚令吉的升值。

Overall Analysis:

总体分析:

In terms of technical analysis, the key levels for the stock price are the high trading volume area at RM3.975 and the resistance level at RM4.14. On the news front, the strong financial performance should provide support for the stock price. Overall, there is short-term upward momentum for the stock price, but a failure to break through the RM3.975 resistance level may lead to a pullback. In the long term, if the company can maintain strong operational performance, the stock price is likely to continue to rise.

在技术面分析方面,股价的关键水平是RM3.975的大成交量区域和RM4.14的压力位。在新闻方面,良好的财务表现应该为股价提供支持。总体而言,股价存在短期上涨势头,但未能突破RM3.975的压力位可能会引发回调。从长期来看,如果公司能保持强劲的运营业绩,股价可能会继续上涨。