Top 3 Consumer Stocks That Could Blast Off This Quarter

Top 3 Consumer Stocks That Could Blast Off This Quarter

今年第一季度可能会大涨的前三消费股票

The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies.

消费不可或缺板块中最被低估的公司股票出现了买入机会。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI指标是一种动量指标,它比较了股票在价格上涨时的强度与在价格下跌时的强度。与股票的价格走势进行比较,可以给交易者更好的了解股票短期内表现的良好程度。当RSI低于30时,资产通常被认为是超卖的,根据Benzinga Pro的数据。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是本行业板块最近的主要超卖股票列表,RSI接近或低于30。

Red Robin Gourmet Burgers Inc (NASDAQ:RRGB)

红罗宾美食汉堡股份有限公司(纳斯达克:RRGB)

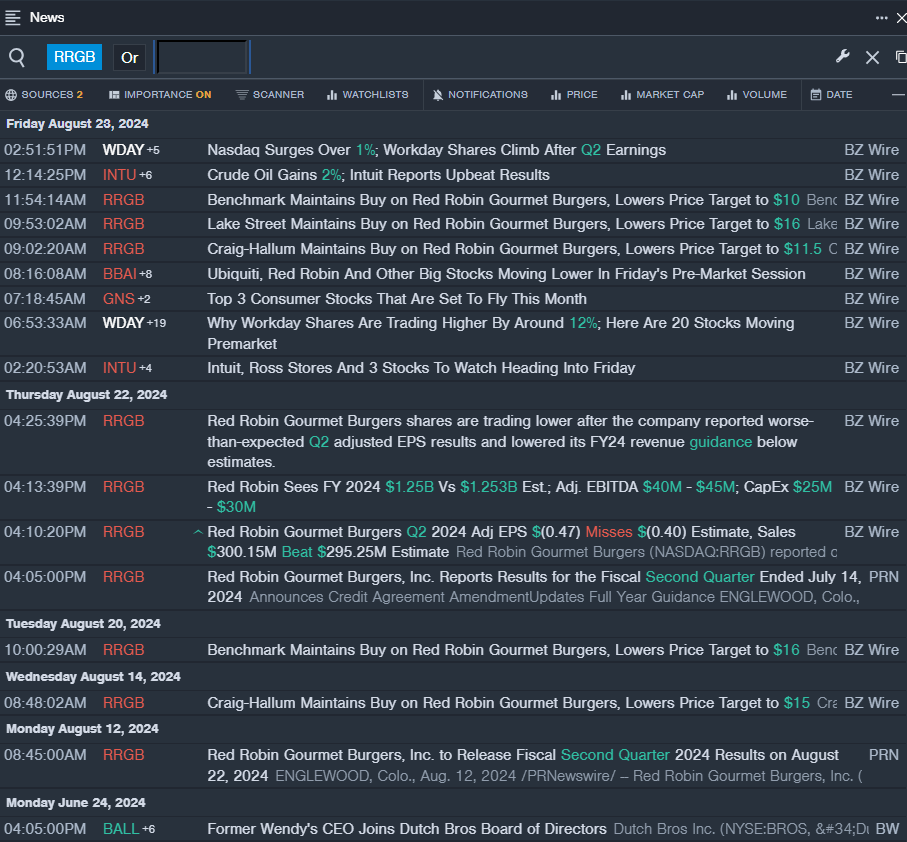

- On Aug. 22, Red Robin Gourmet Burgers reported worse-than-expected second-quarter adjusted EPS results and lowered its FY24 revenue guidance below estimates.. The company's stock fell around 38% over the past month and has a 52-week low of $3.28.

- RSI Value: 28.02

- RRGB Price Action: Shares of Red Robin fell 4.6% to close at $3.34 on Tuesday.

- Benzinga Pro's real-time newsfeed alerted to latest RRGB news.

- 8月22日,红罗宾美食汉堡报告了低于预期的第二季度调整后的每股收益结果,并将其FY24收入指导下调至低于预期。该公司的股价在过去一个月内下跌了约38%,创下了52周的最低价$3.28。

- RSI数值:28.02

- 红罗宾股份的价格走势:周二红罗宾的股价下跌了4.6%,收于3.34美元。

- Benzinga Pro的实时新闻提供了最新的红罗宾新闻。

Advance Auto Parts, Inc. (NYSE:AAP)

Advance Auto Parts 公司 (纽交所:AAP)

- On Aug. 22, The company reported earnings per share of 75 cents, missing the street view of $1.07. Quarterly sales of $2.683 billion beat the street view of $2.679 billion. Revenues remained flat, while comparable store sales increased 0.4%. Advance Auto Parts has revised its FY24 outlook, lowering its earnings per share forecast to $2.00 – $2.50 from the previous range of $3.75 – $4.25, which contrasts with the $3.63 estimate. The company's stock fell around 26% over the past month. It has a 52-week low of $43.70.

- RSI Value: 21.42

- AAP Price Action: Shares of Advance Auto Parts closed at $43.72 on Tuesday.

- Benzinga Pro's charting tool helped identify the trend in AAP stock.

- 8月22日,该公司报告每股收益为75美分,低于华尔街预期的1.07美元。季度销售额达到268.3亿美元,超过了华尔街预期的267.9亿美元。营收保持不变,而可比店铺销售增长了0.4%。Advance Auto Parts已调整了其FY24前景,将每股收益预测下调至2.00美元至2.50美元,相比之前的3.75美元至4.25美元范围,与3.63美元的估值形成鲜明对比。该公司股票在过去一个月内下跌了约26%。其52周最低价为43.70美元。

- RSI值:21.42

- AAP 价格走势:Advance Auto Parts 的股票周二收于43.72美元。

Designer Brands Inc (NYSE:DBI)

Designer Brands 公司 (纽交所:DBI)

- On June 4, Designer Brands reported worse-than-expected first-quarter earnings. The company reported first-quarter FY24 sales growth of 0.6% year-on-year to $746.596 million, beating the analyst consensus estimate of $741.630 million. The company's shares fell around 22% over the past five days and has a 52-week low of $5.99.

- RSI Value: 29.52

- DBI Price Action: Shares of Designer Brands closed at $6.13 on Tuesday.

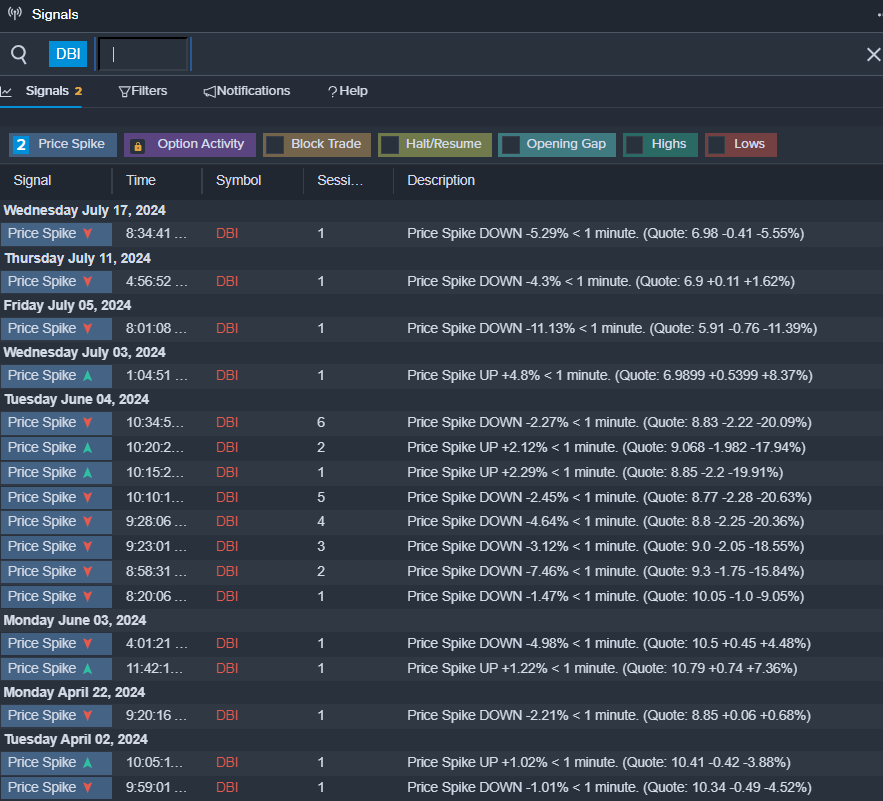

- Benzinga Pro's signals feature notified of a potential breakout in DBI shares.

- 6月4日,designer brands公布了低于预期的第一季度收益。该公司公布的2024财年第一季度销售增长0.6%,同比达到74659.6万美元,超过了分析师共识的74163万美元的预期。该公司的股票在过去五个交易日中下跌了约22%,52周最低价为5.99美元。

- RSI值:29.52

- designer brands的股票在周二收盘价为6.13美元。

- Benzinga Pro的信号功能通知发现DBI股票可能有突破。

- Dollar Tree, Dick's Sporting Goods And 3 Stocks To Watch Heading Into Wednesday

- 美元树公司、迪克体育用品和3只股票值得关注,即将进入星期三