Looking At Arista Networks's Recent Unusual Options Activity

Looking At Arista Networks's Recent Unusual Options Activity

Financial giants have made a conspicuous bullish move on Arista Networks. Our analysis of options history for Arista Networks (NYSE:ANET) revealed 9 unusual trades.

金融巨头在Arista Networks上展开了显著的看好行动。我们对Arista Networks(纽交所:ANET)期权历史的分析显示出9笔飞凡交易。

Delving into the details, we found 22% of traders were bullish, while 22% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $131,430, and 6 were calls, valued at $650,160.

深入了解细节后,我们发现22%的交易员看好,而有22%显示出看淡倾向。在我们发现的所有交易中,有3笔看跌期权,价值131,430美元,有6笔看涨期权,价值650,160美元。

Projected Price Targets

预计价格目标

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $300.0 to $370.0 for Arista Networks over the recent three months.

根据交易活动,显然大型投资者以Arista Networks过去三个月的价格区间从300.0美元到370.0美元为目标。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

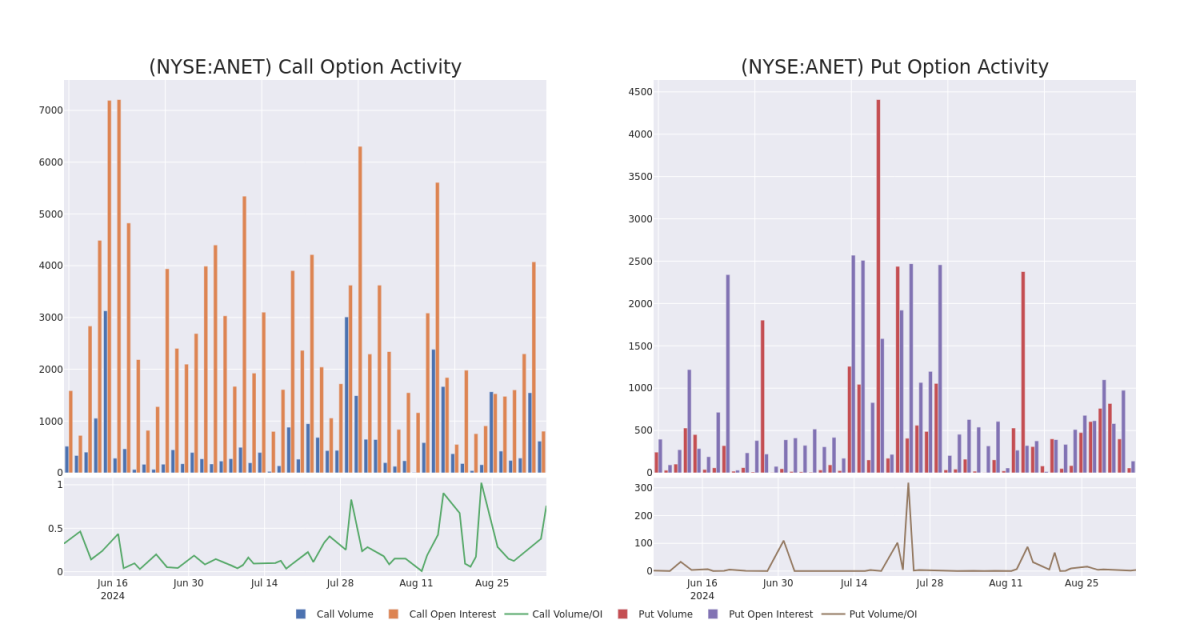

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Arista Networks's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Arista Networks's significant trades, within a strike price range of $300.0 to $370.0, over the past month.

通过分析成交量和持仓量,可为股票研究提供关键见解。这些信息对于评估Arista Networks特定行权价格期权的流动性和兴趣水平至关重要。以下,我们将呈现过去一个月Arista Networks重要交易中,300.0美元到370.0美元行权价格区间内看涨和看跌期权成交量和持仓量趋势的快照。

Arista Networks 30-Day Option Volume & Interest Snapshot

Arista Networks 30天期权成交量和未平仓合约快照

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ANET | CALL | SWEEP | NEUTRAL | 09/06/24 | $27.3 | $25.6 | $26.8 | $300.00 | $198.3K | 300 | 74 |

| ANET | CALL | TRADE | BULLISH | 06/20/25 | $60.4 | $57.2 | $59.7 | $320.00 | $119.4K | 396 | 20 |

| ANET | CALL | SWEEP | NEUTRAL | 09/06/24 | $28.3 | $26.1 | $27.2 | $300.00 | $111.5K | 300 | 224 |

| ANET | CALL | TRADE | NEUTRAL | 06/20/25 | $68.5 | $65.3 | $67.2 | $300.00 | $107.5K | 108 | 16 |

| ANET | CALL | SWEEP | BEARISH | 09/06/24 | $28.1 | $25.6 | $27.0 | $300.00 | $72.9K | 300 | 113 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ANET | 看涨 | SWEEP | 中立 | 09/06/24 | $27.3 | $25.6 | $26.8 | $ 300.00 | $198.3K | 300 | 74 |

| ANET | 看涨 | 交易 | 看好 | 06/20/25 | $60.4 | 59.7美元 | $320.00 | $119.4K | 396 | 20 | |

| ANET | 看涨 | SWEEP | 中立 | 09/06/24 | $28.3 | $26.1 | $27.2 | $ 300.00 | $111.5K | 300 | 224 |

| ANET | 看涨 | 交易 | 中立 | 06/20/25 | $68.5 | $65.3 | $67.2 | $ 300.00 | $107.5K | 108 | 16 |

| ANET | 看涨 | SWEEP | 看淡 | 09/06/24 | $28.1 | $25.6 | $27.0 | $ 300.00 | $72.9K | 300 | 113 |

About Arista Networks

关于Arista Networks

Arista Networks is a networking equipment provider that primarily sells Ethernet switches and software to data centers. Its marquee product is its extensible operating system, or EOS, that runs a single image across every single one of its devices. The firm operates as one reportable segment. It has steadily gained market share since its founding in 2004, with a focus on high-speed applications. Arista counts Microsoft and Meta Platforms as its largest customers and derives roughly three quarters of its sales from North America.

Arista Networks是一家网络设备提供商,主要销售以太网交换机和软件给数据中心。它的招牌产品是可扩展操作系统EOS,可以在所有设备上运行单个映像。该公司以一个报告段来运营。自2004年成立以来,它稳步增加市场份额,专注于高速应用。Arista的最大客户是微软和Meta Platforms,大约三分之三的销售来自北美。

In light of the recent options history for Arista Networks, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考虑到Arista Networks最近的期权历史,现在适合关注公司本身。我们旨在探讨其当前的表现。

Arista Networks's Current Market Status

Arista Networks的当前市场状况

- Currently trading with a volume of 851,143, the ANET's price is down by -0.13%, now at $326.28.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 54 days.

- RSI读数表明该股目前可能接近超买水平。

- 预计盈利发布还有54天。

What Analysts Are Saying About Arista Networks

关于Arista Networks分析师们在说些什么

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $369.0.

- Maintaining their stance, an analyst from UBS continues to hold a Neutral rating for Arista Networks, targeting a price of $369.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Arista Networks's options at certain strike prices. Below, we present a snapshot of the

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Arista Networks's options at certain strike prices. Below, we present a snapshot of the