Tennis and Invest: What We Can Learn From Federer's 54% Point-Winning Rate

Tennis and Invest: What We Can Learn From Federer's 54% Point-Winning Rate

Understanding the rules of a tennis match reveals that it is not merely a contest of stamina and technique but also a battle of minds and spirits. For investors, tennis teaches us to focus on long-term goals, avoid dwelling on mistakes, and avoid making wrong decisions during emotional fluctuations. These principles are applicable not only to tennis but also to investing, and to the whole life.

了解网球比赛的规则会发现,这不仅是一场耐力和技巧的竞赛,也是一场思想和精神之战。对于投资者来说,网球教会我们专注于长期目标,避免沉迷于错误,避免在情绪波动中做出错误的决定。这些原则不仅适用于网球,也适用于投资和一生。

Lessons from Roger Federer's 54% point-winning rate

罗杰·费德勒54%的得分率的教训

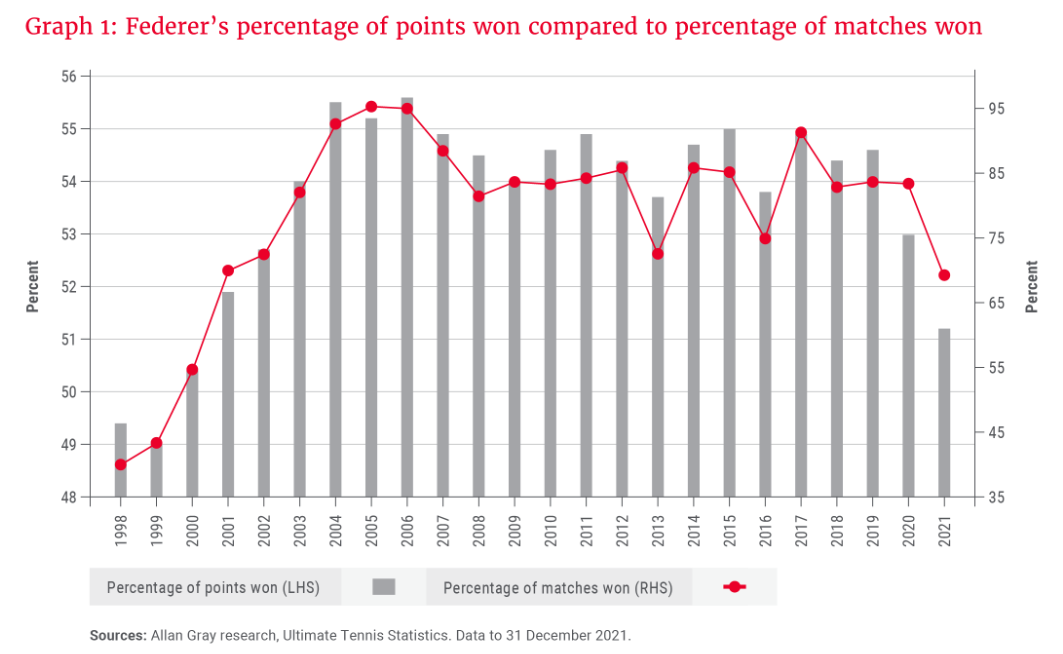

Roger Federer, one of the greatest tennis players of all time, has won 20 Grand Slam titles and held the world number one ranking for a total of 310 weeks. In June 2024, Federer delivered an insightful speech at Dartmouth College:

罗杰·费德勒是有史以来最伟大的网球运动员之一,他赢得了20个大满贯冠军,总共保持了310周的世界排名第一。2024年6月,费德勒在达特茅斯学院发表了富有洞察力的演讲:

"In tennis, perfection is impossible. In the 1,526 singles matches I played in my career, I won almost 80% of those matches. Now, I have a question for you. What percentage of points do you think I won in those matches? Only 54%. In other words, even top-ranked tennis players win barely more than half of the points they play."

"When you lose every second point on average, you learn not to dwell on every shot. You teach yourself to think, 'It's only a point.' "

“在网球比赛中,完美是不可能的。在我职业生涯中参加的1526场单打比赛中,我赢了将近80%的比赛。现在,我有一个问题要问你。你认为我在那些比赛中赢了多少百分比的积分?只有 54%。换句话说,即使是排名第一的网球运动员也只能获得他们所得分的一半以上。”

“当你平均每输一分时,你就会学会不要沉迷于每一次射门。你要自学思考:“这只是一个问题。'”

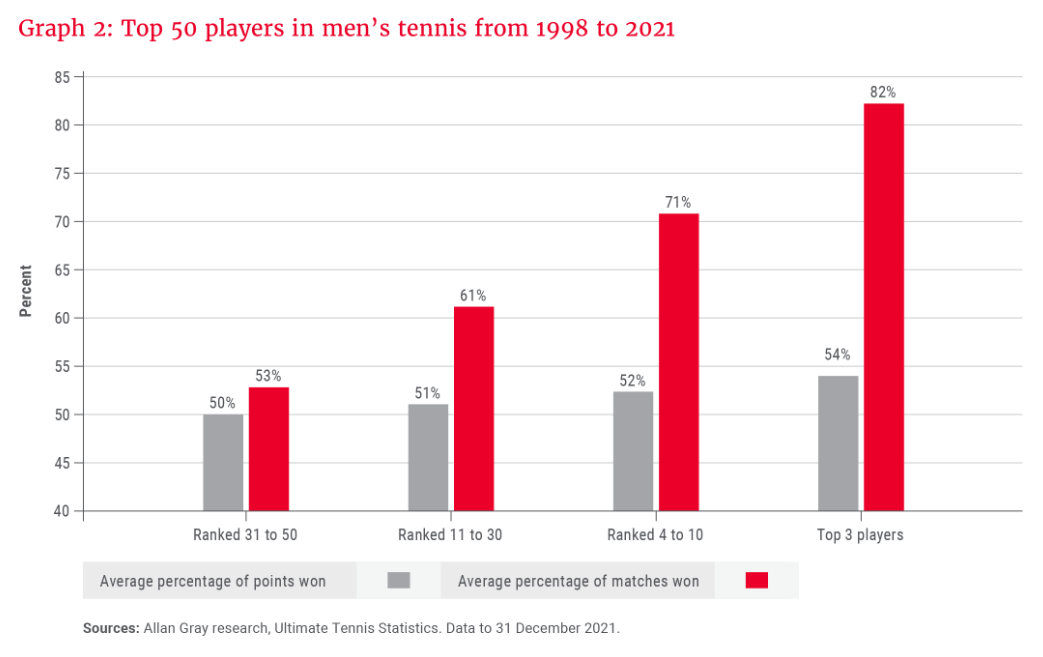

Though Federer won almost 80% of the matches, but he only won 54% of the point in those matches. The top 50 male tennis players exhibited a similar pattern, based on the data from 1998 to 2021. The top two groups of players scored only 1%-3% points higher than the bottom two groups, but their match-winning percentages were significantly higher by 10%-30%.

尽管费德勒赢了将近80%的比赛,但他在这些比赛中只赢了54%的积分。根据1998年至2021年的数据,前50名男子网球运动员表现出类似的模式。前两组选手的得分仅比倒数第二组高出1%-3%,但他们的比赛获胜百分比明显高出10%-30%。

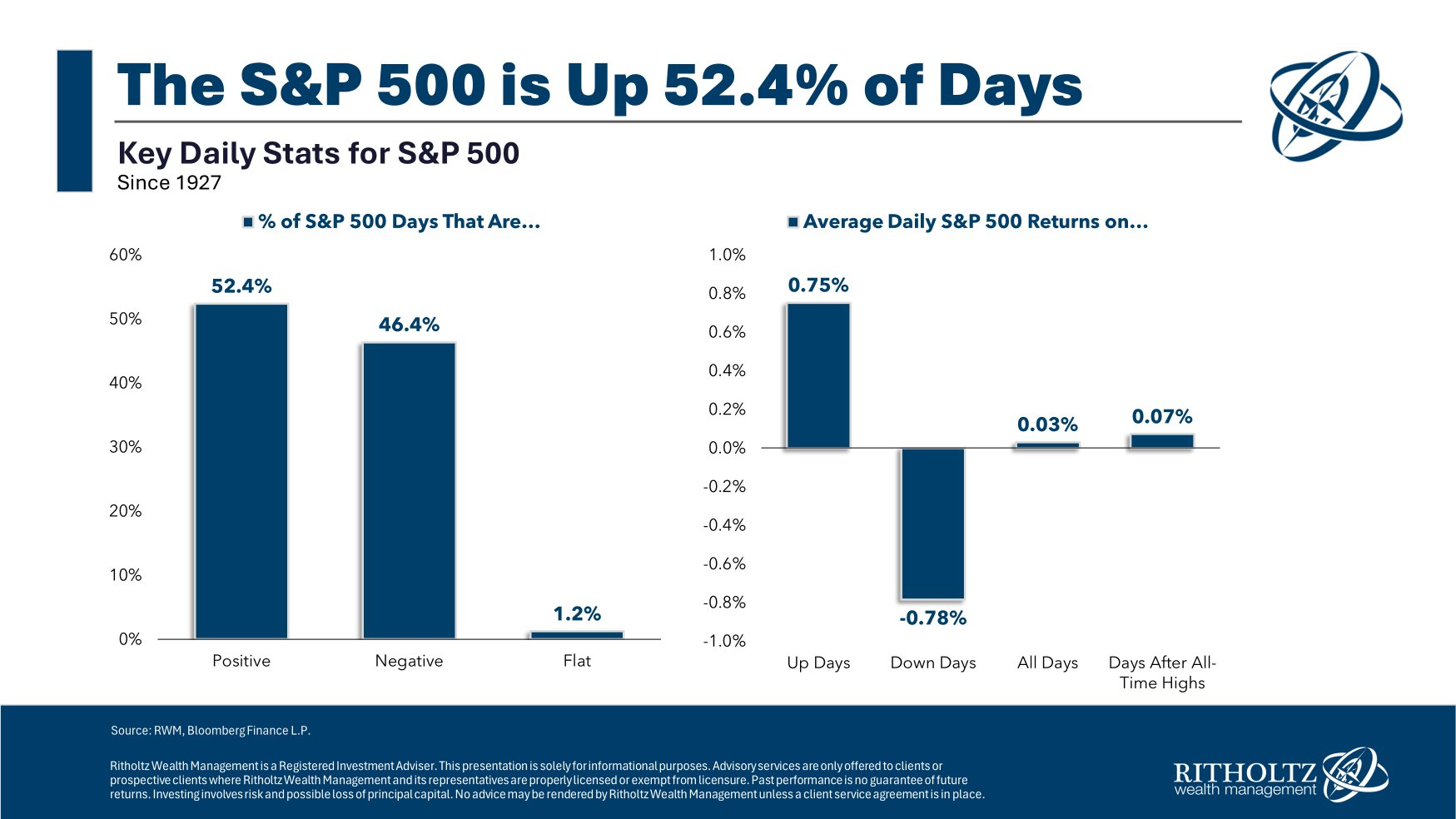

The same applies to investment. There are roughly 250 trading days in a year, and the goal for investor is not to profit on every single day but to achieve long-term returns. The stock market is highly volatile in the short term but has a high success rate over the long term. Over the past nearly 100 years, the S&P 500 index has shown single-day positive or flat returns around 54% of the time, similar to Federer's point-winning rate. Interestingly, the average decline on down days is slightly larger than the average gain on up days.

这同样适用于投资。一年中大约有250个交易日,投资者的目标不是每天都获利,而是实现长期回报。股票市场在短期内波动很大,但从长远来看,成功率很高。在过去的近100年中,标准普尔500指数的单日回报率约为54%,与费德勒的得分率相似。有趣的是,下跌日的平均降幅略大于上涨日的平均涨幅。

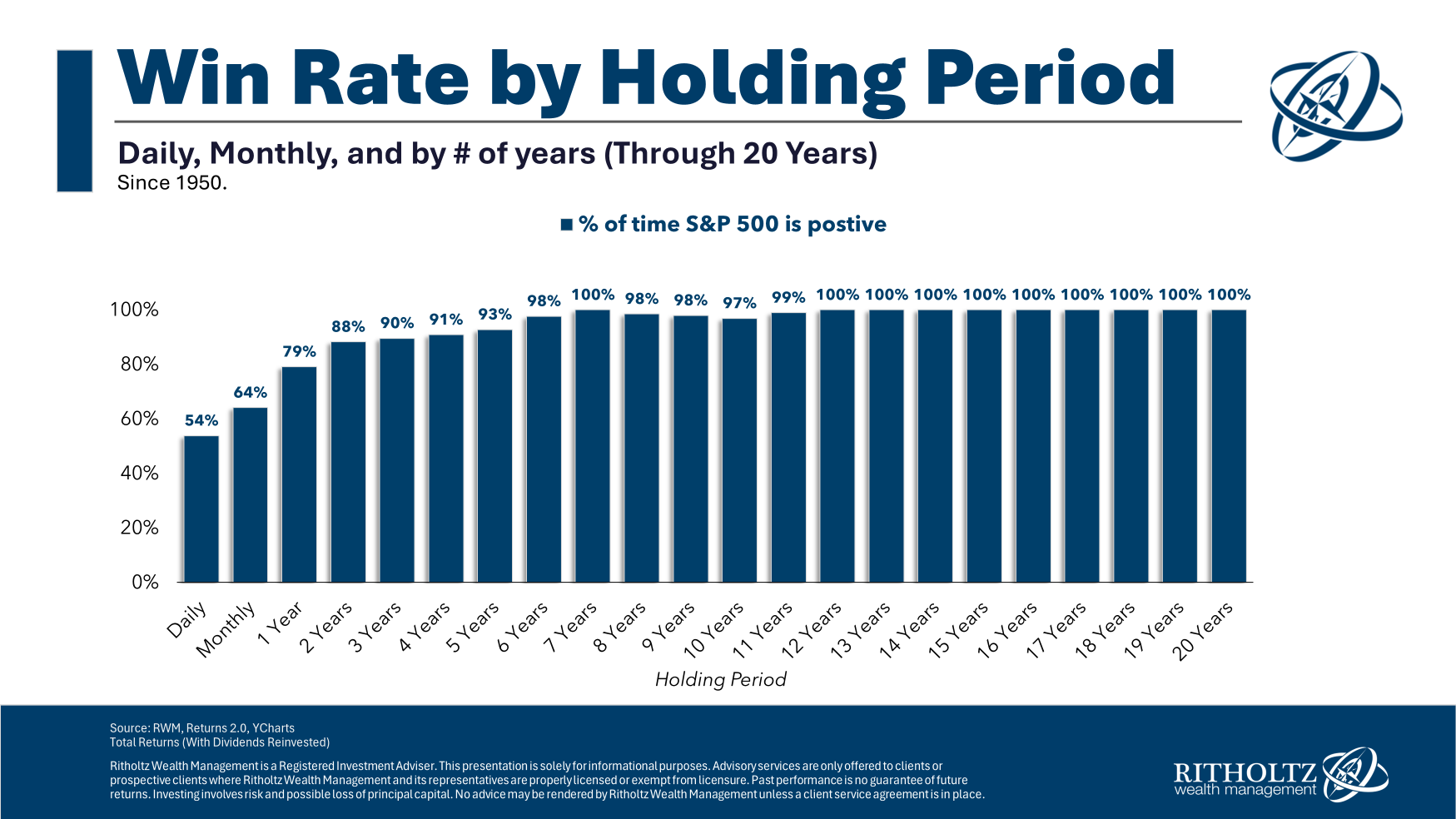

Despite this, the S&P 500 index demonstrates impressive compounded returns over the long term. Ignoring daily fluctuations, the compounded gains remain substantial. The longer the investment horizon, the higher the success rate. Since 1950, the success rate for holding the S&P 500 is only 54% on a daily basis and 64% on a monthly basis, but for holding it for over 6 years, the success rate is over 98%.

尽管如此,标准普尔500指数在长期内仍表现出令人印象深刻的复合回报。忽略每日波动,复合收益仍然可观。投资期限越长,成功率越高。自1950年以来,每天持有标普500指数的成功率仅为54%,每月持有64%,但持有超过6年的成功率超过98%。

The power of long-term thinking

长期思考的力量

Federer exemplifies long-termism: his playing style is smooth and efficient, avoiding excessive physical strain; he peaks during the most crucial Grand Slam events, even if he faces some losses in earlier tournaments. Sometimes, he takes higher risks in smaller events to practice new tactics for long-term benefits.

费德勒体现了长期主义:他的比赛风格流畅而高效,避免了过度的身体压力;他在最关键的大满贯赛事中处于巅峰状态,尽管他在之前的锦标赛中面临一些损失。有时,他在小型赛事中冒更高的风险来练习新的策略以获得长期利益。

Investment guru Benjamin Graham once said, "In the short run, the market is a voting machine, but in the long run, it is a weighing machine." This means that while stock prices in the short term are unpredictable, correct analysis will ultimately yield its due value in the long term. Ignoring daily volatility and focusing on a company's long-term prospects is more likely to result in outstanding investment returns.

投资大师本杰明·格雷厄姆曾经说过:“从短期来看,市场是一台投票机,但从长远来看,它是一台称重机。”这意味着,尽管短期内的股票价格是不可预测的,但正确的分析最终将在长期内产生应有的价值。忽视每日波动而关注公司的长期前景更有可能带来丰厚的投资回报。

In conclusion, whether in tennis or investing, the key to success lies in adhering to long-termism, not being influenced by short-term fluctuations, and focusing on the process and long-term goals.

总之,无论是在网球还是投资领域,成功的关键在于坚持长期主义,不受短期波动的影响,专注于过程和长期目标。

"When you lose every second point on average, you learn not to dwell on every shot. You teach yourself to think, '

"When you lose every second point on average, you learn not to dwell on every shot. You teach yourself to think, '