BlackRock Strategist On Market Jitters: Expect Volatility, But Stay Positive On US Equities And This Emerging Market

BlackRock Strategist On Market Jitters: Expect Volatility, But Stay Positive On US Equities And This Emerging Market

Investors, brace yourselves for the rollercoaster that is September and October. But before hitting the panic button, BlackRock managing director Gargi Pal Chaudhuri offers reassurance, urging that investors not be alarmed by near-term volatility in U.S. equity markets.

投资者们,为即将到来的九月和十月的过山车式市场做好准备。但在按下恐慌键之前,贝莱德董事总经理加尔吉·帕尔·乔杜里(Gargi Pal Chaudhuri)提供了安慰,敦促投资者不要被美国股市的短期波动所惊慌。

In a recent CNBC interview, Chaudhuri — Head of BlackRock's iShares Investment Strategy-Americas — emphasized that whether it's small-cap stocks, large-caps, or the tech sector, "these months tend to be seasonally volatile, a trend observed over the past decade."

在最近的CNBC采访中,乔杜里,贝莱德iShares投资策略-美洲区的负责人,强调无论是小盘股、大盘股还是科技板块,“这几个月往往是季节性波动的,这是过去十年观察到的趋势。”

We looked into the past trend for validation.

我们调查了过去的趋势以进行验证。

Seasonal Market Swings: A Recurring Phenomenon

季节性市场波动:一种经常出现的现象

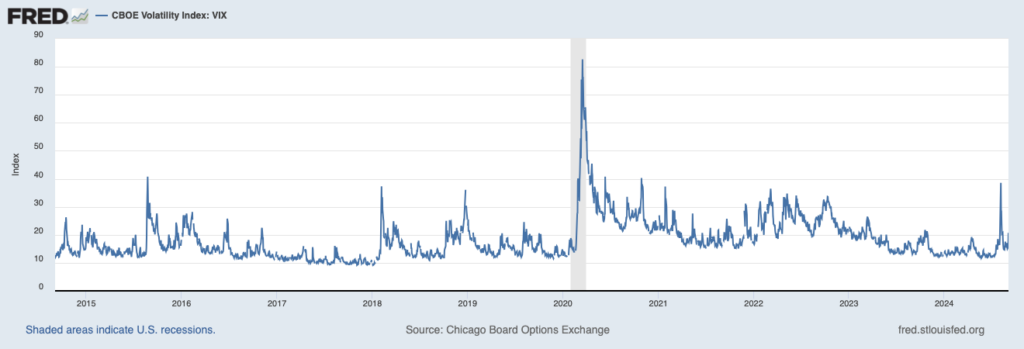

Above is the graph of the CBOE Volatility Index, also known as, VIX — over the past decade. It can be observed, that the index tends to gain strength during these two months Chaudhuri mentioned (taking into account that the extremely high wave in 2020 is accountable to Covid).

上图是CBOE波动指数,也称为VIX,过去十年的走势。可以观察到,在乔杜里所提到的这两个月中,指数往往会增强(考虑到2020年的极高波动是由Covid引起的)。

Investors who track market volatility often tend to book gains through its swings via ETFs such as the iPath Series B S&P 500 VIX Short-Term Futures ETN (NYSE:VXX) or the ProShares VIX Short-Term Futures ETF (NYSE:VIXY)

经常跟踪市场波动的投资者通常会通过etf(如iPath S&P 500 VIX短期期货etn(纽交所:VXX)或ProShares波动率指数短期期货etf(纽交所:VIXY))锁定收益。

Chaudhuri also mentioned that this year, the uncertainty around the upcoming U.S. election adds to the already jittery markets, creating more potential for fluctuations.

乔杜里还提到,今年,围绕即将到来的美国大选的不确定性加剧了已经焦虑的市场,进一步增加了波动的潜力。

Read Also: Institutional Investors Buy The Dip After August Volatility Spike: Wall Street Analyst

阅读更多:华尔街分析师表示,8月波动激增后,机构投资者买入低点。

Medium- To Long-Term? Still Bright

中长期?依然光明

Despite the near-term uncertainty, Chaudhuri remains upbeat about the medium- to long-term outlook for U.S. equities. She believes high-quality stocks are poised to perform well over the next six to twelve months, especially as the Federal Reserve is expected to begin cutting interest rates.

尽管存在短期不确定性,Chaudhuri对美国股票的中长期前景仍然持乐观态度。她认为,高质量股票在未来六至十二个月内有望表现良好,尤其是随着美联储预计将开始降息,情况将更加乐观。

Chaudhuri stated, "Historically, rate cuts have benefited both stocks and bonds," adding that she expects the Fed to start normalizing interest rates later this month with a 25-basis point cut.

Chaudhuri表示:“从历史上看,降息对股票和债券都有利。她补充说,她预计美联储将在本月晚些时候开始通过25个基点的降息来开始利率的正常化。”

India: The Emerging Market Opportunity

印度:新兴市场机遇

But Chaudhuri's focus isn't solely on the U.S. With India's growing influence on the global stage, she believes foreign investors should reconsider their current underweight positions.

但Chaudhuri的重点不仅仅是美国。随着印度在全球舞台上日益影响力的增长,她认为外国投资者应重新考虑其目前的轻仓头寸。

"I think investors need to at least get back to benchmark weights with respect to emerging markets (EMs) and with respect to India specifically. And I think that is the opportunity," she said.

“我认为投资者至少需要回到新兴市场(EMs)和特定于印度的基准权重。我认为这就是机会,”她说。

While India's market valuations are on the higher end, Chaudhuri noted that "this is not just about valuations." India's economic potential and its increasing importance make it a key area for future growth.

尽管印度的市场估值偏高,Chaudhuri指出“这不仅仅是关于估值。”印度的经济潜力和其日益增长的重要性使其成为未来增长的关键领域。

Popular ETFs tracking Indian equity include the iShares MSCI India ETF (NYSE:INDA), the WisdomTree India Earnings Fund (NYSE:EPI) and the Franklin FTSE India ETF (NYSE:FLIN)

追踪印度股票的热门etf包括iShares MSCI India ETF(纽交所:INDA)、WisdomTree India Earnings Fund(纽交所:EPI)和Franklin FTSE India ETF(纽交所:FLIN)

Overall, Chaudhuri's message is clear: ride out the short-term volatility and stay focused on the long-term opportunities.

总体而言,乔杜里的信息很明确:坚持短期波动,专注于长期机会。

- From Stocks To Bonds: CBOE's VIXTLT Index Adds New Twist To Volatility

- 从股票到债券: CBOE的VIXTLt指数为波动率增添了新的曲折

Above is the graph of the CBOE Volatility Index, also known as,

Above is the graph of the CBOE Volatility Index, also known as,