Nvidia Plunges In Thursday's Premarket: What's Behind Stock's Incessant Sell-Off?

Nvidia Plunges In Thursday's Premarket: What's Behind Stock's Incessant Sell-Off?

Nvidia Corp. (NASDAQ:NVDA) stock appears on track to fall yet again on Thursday as macroeconomic concerns sap the risk appetite of traders.

英伟达公司(纳斯达克: NVDA)股票似乎再次有望在周四下跌,因宏观经济担忧抑制交易者的风险偏好。

Nvidia Woes: Despite Nvidia's earnings getting high praise from sell-side analysts, investors have been incessantly selling the stock on fears that the Jensen Huang-led company can't keep on delivering superlative financial performance. The stock peaked at $140.76 on an intraday basis on June 20, shortly after the stock split took effect and the ex-dividend date. The record closing high is $135.58 reached on June 18.

尽管英伟达的收益受到卖方分析师的高度赞誉,但投资者一直在担心由Jensen Huang领导的公司无法继续提供出色的财务业绩而不断抛售股票。该股票在6月20日的盘中最高触及140.76美元,这是股票分割生效和除息日期后不久。最高收盘价是6月18日达到的135.58美元。

Nvidia shares were on a broad consolidation move since then before the yen carry trade unwinding wrecked the global markets and the artificial intelligence stalwart's stock came down with them.

此后一直在广泛整固中的英伟达股票,在日元carry贸易逆转破坏了全球市场之后,这家人工智能巨头的股票也跟随下跌。

On the day of the Aug. 5 global sell-off, the stock hit a low of $90.69 and bottomed at $98.91 on a closing basis two sessions later. Even as it staged a comeback, the second-quarter earnings report served as a downside trigger despite the company reporting year-over-year and sequential earnings and revenue growth. Revenue from data center revenue, a segment that includes hardware, especially AI accelerators sold to cloud service providers, reached a record. The third-quarter revenue guidance, though upbeat, was panned by some as marking the smallest increase relative to the consensus in several quarters.

在8月5日的全球抛售背景下,该股票最低触及90.69美元,并在两个交易日后触及98.91美元的收盘价。尽管英伟达实现了公司年度和环比盈利和营业收入增长,该季度的盈利报告仍然触发了下行风险。数据中心业务收入(包括硬件,特别是销往云服务提供商的AI加速器)创下新高。尽管第三季度的营收预测值乐观,但一些人认为相对一致的增长率比几个季度低。

A lack of resolution regarding the Blackwell 200 shipment timing also exerted downward pressure.

黑威尔200货运时间的解决未能达成一致,也对股票造成了下行压力。

Macro Shock: The stock's struggles aggravated further as soft economic data stirred recession concerns and this heavily impacted growth stocks. To make matters worse, reports of a Department of Justice subpoena regarding monopoly in AI chips did the rounds although the company denied it.

股票的困境进一步恶化,因为经济数据疲软引发了经济衰退的担忧,这严重影响了增长股。更糟糕的是,有关AI芯片垄断的司法部传票的报道四处流传,尽管该公司予以否认。

After the recent weakness, the stock trades at a forward price/earnings multiple of 37.88. Most analysts, convinced of its AI supremacy, recommend buying the stock on its weakness.

在最近的弱势之后,该股票的前进市盈率为37.88倍。大多数分析师相信其在人工智能领域的卓越地位,建议在其疲软期间购买该股票。

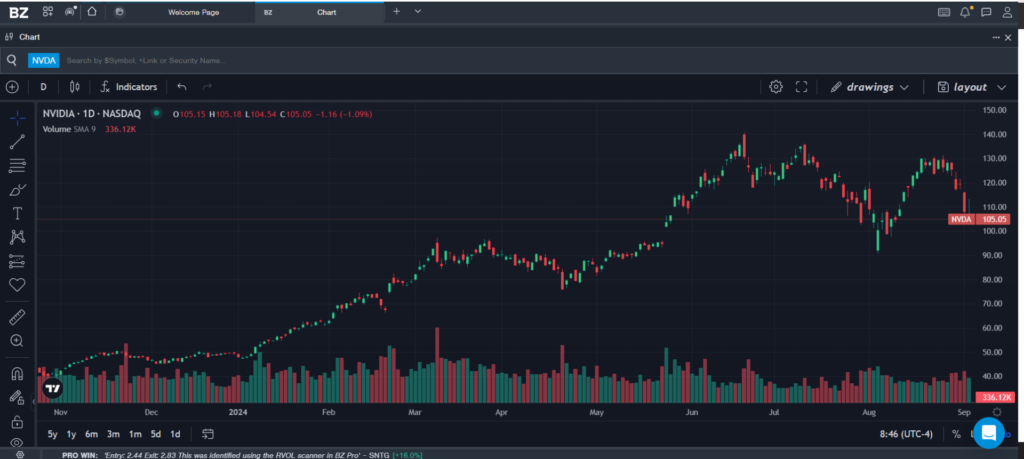

Immediate support is around $103.6 and a break below the level could take the stock to $101.50, the level to which it gapped up in late May. On the further downside, it could drop to the psychological resistance of $100. The next support is around the $95 level.

即支撑位在103.6美元左右,如果跌破该水平,可能会将股票拉至101.50美元,即在5月底跳空上涨的水平。在进一步下行风险下,可能会跌至心理支撑位100美元左右。下一个支撑位在95美元左右。

On the upside, overhead resistance is around $106.5 and around the $115 level.

在上行过程中,阻力位在106.5美元左右和115美元附近。

Source: Benzinga Pro

信息来源:Benzinga Pro

In premarket trading, the stock fell 0.89% to $105.26, according to Benzinga Pro data, with the weakness aggravating after a very weak ADP payrolls report.

根据Benzinga Pro的数据,在盘前交易中,该股下跌0.89%,至105.26美元,随着ADP薪资报告的深度不佳,股价的弱势加剧。

Nvidia Stock Loses The Value Of McDonald's, Disney, Coinbase Combined Since Q2 Earnings: AI Darling's Decline Continues Tuesday

Nvidia的股票价值自第二季度盈利报告以来已经损失了麦当劳、迪士尼和Coinbase的市值总和:这个人工智能宠儿的下跌在周二继续。

Image via Shutterstock

图片来自shutterstock。