Smart Money Is Betting Big In PGR Options

Smart Money Is Betting Big In PGR Options

Financial giants have made a conspicuous bearish move on Progressive. Our analysis of options history for Progressive (NYSE:PGR) revealed 10 unusual trades.

金融巨头在Progressive公司做出了引人注目的看淡动作。我们对Progressive (NYSE:PGR)的期权历史进行分析发现了10笔异样交易。

Delving into the details, we found 0% of traders were bullish, while 90% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $240,885, and 6 were calls, valued at $514,532.

深入研究后,我们发现0%的交易员看涨,而90%的交易员表现出看淡倾向。在我们发现的所有交易中,有4笔是看跌期权,价值为$240,885,而6笔是看涨期权,价值为$514,532。

Expected Price Movements

预期价格波动

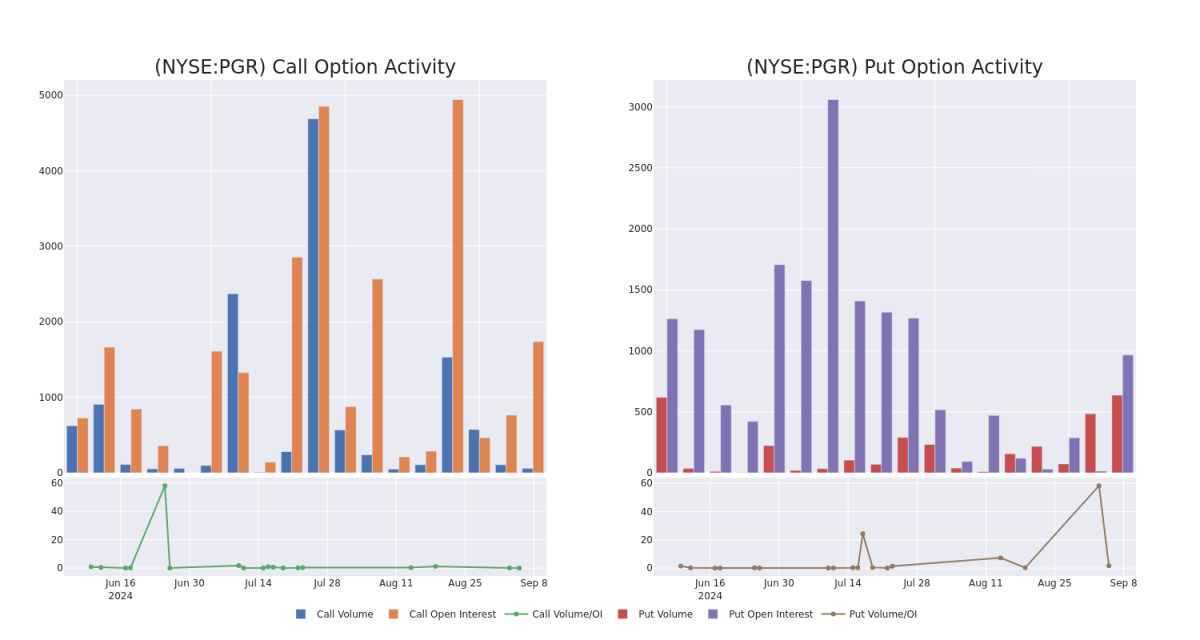

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $200.0 and $300.0 for Progressive, spanning the last three months.

在评估成交量和持仓量后,显然主要市场参与者正专注于Progressive股票的价格区间,即$200.0到$300.0之间,跨越过去三个月。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Progressive's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Progressive's whale trades within a strike price range from $200.0 to $300.0 in the last 30 days.

在交易期权时,查看成交量和持仓量是一项强大的手段。这些数据可以帮助您跟踪Progressive期权在给定执行价下的流动性和兴趣。在下面,我们可以观察到过去30天内Progressive所有看涨和看跌期权成交量和持仓量的演变,其执行价范围为$200.0到$300.0。

Progressive 30-Day Option Volume & Interest Snapshot

Progressive 30天期权成交量和持仓量快照

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PGR | CALL | TRADE | BEARISH | 01/16/26 | $37.0 | $36.3 | $36.3 | $250.00 | $214.1K | 173 | 0 |

| PGR | PUT | SWEEP | BEARISH | 06/20/25 | $20.4 | $19.9 | $20.37 | $250.00 | $120.1K | 55 | 60 |

| PGR | CALL | SWEEP | BEARISH | 01/16/26 | $47.2 | $46.5 | $46.71 | $230.00 | $116.5K | 76 | 2 |

| PGR | CALL | SWEEP | BEARISH | 01/17/25 | $30.1 | $28.6 | $28.98 | $230.00 | $71.7K | 246 | 25 |

| PGR | PUT | TRADE | NEUTRAL | 11/15/24 | $51.3 | $47.4 | $49.05 | $300.00 | $49.0K | 10 | 0 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PGR | 看涨 | 交易 | 看淡 | 01/16/26 | $37.0 | $36.3 | $36.3 | $250.00 | 214.1K美元 | 173 | 0 |

| PGR | 看跌 | SWEEP | 看淡 | 06/20/25 | $20.4 | $19.9 | $20.37 | $250.00 | $120.1K | 55 | 60 |

| PGR | 看涨 | SWEEP | 看淡 | 01/16/26 | $47.2 | $46.5 | $46.71 | $230.00 | 116.5K美元 | 76 | 2 |

| PGR | 看涨 | SWEEP | 看淡 | 01/17/25 | 30.1美元 | $28.6 | 28.98美元 | $230.00 | $71.7K | 246 | 25 |

| PGR | 看跌 | 交易 | 中立 | 11/15/24 | TRADE | $47.4 | 49.05美元 | $ 300.00 | $49.0千 | 10 | 0 |

About Progressive

关于Progressive

Progressive underwrites private and commercial auto insurance and specialty lines; it has almost 20 million personal auto policies in force and is one of the largest auto insurers in the United States. Progressive markets its policies through independent insurance agencies in the US and Canada and directly via the internet and telephone. Its premiums are split roughly equally between the agent and the direct channel. The company also offers commercial auto policies and entered homeowners insurance through an acquisition in 2015.

Progressive承保私人和商用汽车保险和专业领域;它拥有近2000万份个人汽车保单,是美国最大的汽车保险商之一。Progressive通过美国和加拿大的独立保险机构以及通过互联网和电话直接销售保险。其保费大约被分为代理和直销渠道。该公司还提供商业汽车保险,并通过2015年收购进入了住宅保险领域。

After a thorough review of the options trading surrounding Progressive, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对Progressive周围的期权交易进行全面审查后,我们决定对该公司进行更详细的研究。这包括对其当前市场地位和业绩的评估。

Present Market Standing of Progressive

Progressive目前的市场地位

- Currently trading with a volume of 2,309,712, the PGR's price is down by -1.72%, now at $249.54.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 36 days.

- 目前成交量为2,309,712,PGR的价格下跌了-1.72%,现在为249.54美元。

- RSI读数表明股票目前可能超买。

- 预计的收益发布还有36天。

What Analysts Are Saying About Progressive

关于Progressive,分析师们有这样的观点。

5 market experts have recently issued ratings for this stock, with a consensus target price of $295.6.

市场上有5位专家对这只股票发表了意见,一致看好的目标价为295.6美元。

- Maintaining their stance, an analyst from Piper Sandler continues to hold a Overweight rating for Progressive, targeting a price of $252.

- Maintaining their stance, an analyst from B of A Securities continues to hold a Buy rating for Progressive, targeting a price of $294.

- An analyst from HSBC has elevated its stance to Buy, setting a new price target at $253.

- In a cautious move, an analyst from Barclays downgraded its rating to Equal-Weight, setting a price target of $367.

- An analyst from B of A Securities persists with their Buy rating on Progressive, maintaining a target price of $312.

- 派杰投资的一位分析师继续持有Progressive的超配股票评级,目标价为252美元。

- 美国银行证券的一位分析师继续持有Progressive的买入评级,目标价为294美元。

- 汇丰银行的一位分析师将其评级上调为买入,设定了一个新的价格目标为253美元。

- 巴克莱银行的一位分析师采取谨慎态度,将其评级下调为等权重,设定价格目标为367美元。

- 美国银行证券的一位分析师坚持对Progressive的买入评级,并维持目标价为312美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Progressive's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Progressive's whale trades within a strike price range from $200.0 to $300.0 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Progressive's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Progressive's whale trades within a strike price range from $200.0 to $300.0 in the last 30 days.