Check Out What Whales Are Doing With AMZN

Check Out What Whales Are Doing With AMZN

Financial giants have made a conspicuous bearish move on Amazon.com. Our analysis of options history for Amazon.com (NASDAQ:AMZN) revealed 11 unusual trades.

金融巨头在亚马逊上采取了明显的看跌举动。我们对亚马逊(纳斯达克股票代码:AMZN)期权历史的分析显示了11笔不寻常的交易。

Delving into the details, we found 36% of traders were bullish, while 54% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $248,634, and 5 were calls, valued at $646,190.

深入研究细节,我们发现36%的交易者看涨,而54%的交易者表现出看跌趋势。在我们发现的所有交易中,有6笔是看跌期权,价值为248,634美元,5笔是看涨期权,价值646,190美元。

Projected Price Targets

预计价格目标

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $140.0 to $200.0 for Amazon.com during the past quarter.

分析这些合约的交易量和未平仓合约,看来大型企业一直在关注亚马逊在过去一个季度的价格范围从140.0美元到200.0美元不等。

Insights into Volume & Open Interest

对交易量和未平仓合约的见解

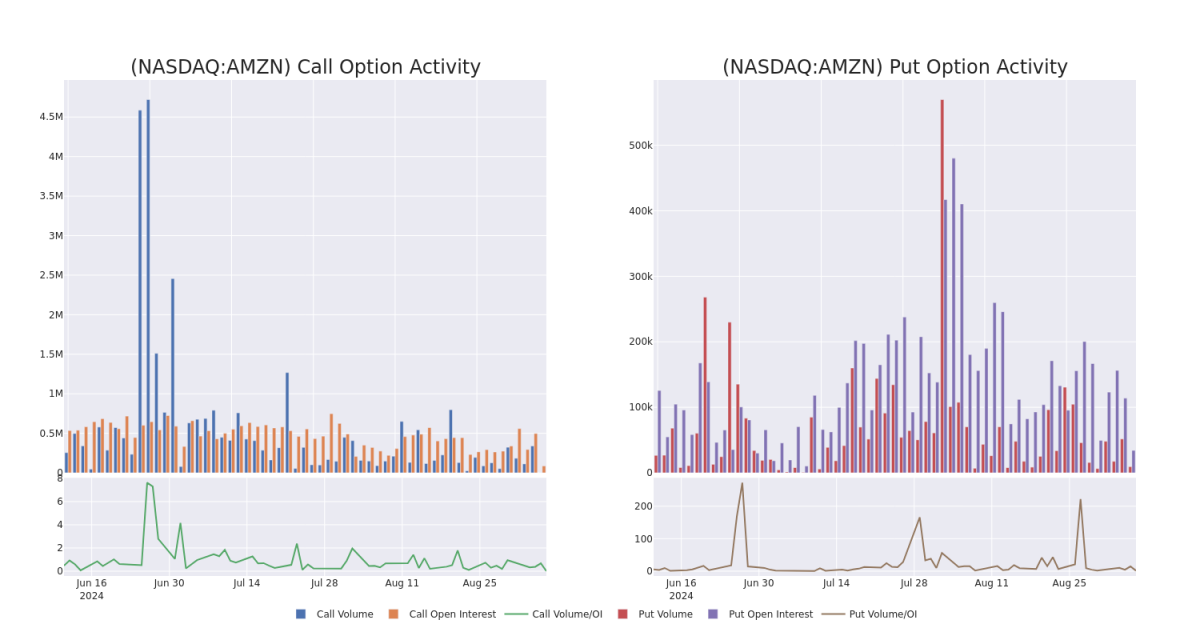

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Amazon.com's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Amazon.com's significant trades, within a strike price range of $140.0 to $200.0, over the past month.

检查交易量和未平仓合约为股票研究提供了至关重要的见解。这些信息是衡量亚马逊期权在特定行使价下的流动性和利息水平的关键。下面,我们简要介绍了过去一个月亚马逊重大交易的看涨期权和未平仓合约的趋势,行使价区间为140.0美元至200.0美元。

Amazon.com Option Activity Analysis: Last 30 Days

亚马逊期权活动分析:过去 30 天

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMZN | CALL | SWEEP | NEUTRAL | 09/13/24 | $16.75 | $15.85 | $16.1 | $160.00 | $478.1K | 1.9K | 710 |

| AMZN | PUT | SWEEP | BULLISH | 12/20/24 | $1.7 | $1.64 | $1.64 | $140.00 | $73.6K | 7.4K | 1.1K |

| AMZN | CALL | TRADE | BEARISH | 09/13/24 | $1.95 | $1.87 | $1.88 | $180.00 | $56.4K | 13.5K | 150 |

| AMZN | PUT | SWEEP | BULLISH | 09/20/24 | $2.69 | $2.65 | $2.66 | $172.50 | $47.2K | 8.5K | 552 |

| AMZN | CALL | TRADE | BEARISH | 12/18/26 | $31.65 | $31.3 | $31.3 | $200.00 | $43.8K | 3.4K | 15 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMZN | 打电话 | 扫 | 中立 | 09/13/24 | 16.75 美元 | 15.85 美元 | 16.1 美元 | 160.00 美元 | 478.1 万美元 | 1.9K | 710 |

| AMZN | 放 | 扫 | 看涨 | 12/20/24 | 1.7 美元 | 1.64 | 1.64 | 140.00 美元 | 73.6 万美元 | 7.4K | 1.1K |

| AMZN | 打电话 | 贸易 | 粗鲁的 | 09/13/24 | 1.95 美元 | 1.87 美元 | 1.88 美元 | 180.00 美元 | 56.4 万美元 | 13.5K | 150 |

| AMZN | 放 | 扫 | 看涨 | 09/20/24 | 2.69 美元 | 2.65 美元 | 2.66 美元 | 172.50 美元 | 47.2 万美元 | 8.5K | 552 |

| AMZN | 打电话 | 贸易 | 粗鲁的 | 12/18/26 | 31.65 美元 | 31.3 美元 | 31.3 美元 | 200.00 美元 | 43.8 万美元 | 3.4K | 15 |

About Amazon.com

关于亚马逊

Amazon is the leading online retailer and marketplace for third party sellers. Retail related revenue represents approximately 75% of total, followed by Amazon Web Services' cloud computing, storage, database, and other offerings (15%), advertising services (5% to 10%), and other the remainder. International segments constitute 25% to 30% of Amazon's non-AWS sales, led by Germany, the United Kingdom, and Japan.

亚马逊是领先的在线零售商和第三方卖家市场。零售相关收入约占总收入的75%,其次是亚马逊网络服务的云计算、存储、数据库和其他产品(15%)、广告服务(5%至10%)以及其他其余收入。国际细分市场占亚马逊非AWS销售额的25%至30%,以德国、英国和日本为首。

Having examined the options trading patterns of Amazon.com, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了亚马逊的期权交易模式之后,我们的注意力现在直接转向了该公司。这种转变使我们能够深入研究其目前的市场地位和表现

Where Is Amazon.com Standing Right Now?

亚马逊现在处于什么位置?

- With a volume of 4,244,653, the price of AMZN is down -1.29% at $175.6.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 48 days.

- 亚马逊的交易量为4,244,653美元,下跌了-1.29%,至175.6美元。

- RSI指标暗示标的股票可能接近超买。

- 下一份财报预计将在48天后公布。

What Analysts Are Saying About Amazon.com

分析师对亚马逊的看法

4 market experts have recently issued ratings for this stock, with a consensus target price of $237.5.

4位市场专家最近发布了该股的评级,共识目标价为237.5美元。

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $230.

- Consistent in their evaluation, an analyst from JMP Securities keeps a Market Outperform rating on Amazon.com with a target price of $265.

- An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $230.

- Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on Amazon.com with a target price of $225.

- 坎托·菲茨杰拉德的一位分析师谨慎地将其评级下调至增持,将目标股价定为230美元。

- JMP Securities的一位分析师在评估中保持了亚马逊市场跑赢大盘的评级,目标价为265美元。

- 坎托·菲茨杰拉德的一位分析师已将其评级下调至增持,将目标股价调整为230美元。

- 富国银行的一位分析师在评估中保持亚马逊增持评级,目标价为225美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Amazon.com options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。借助Benzinga Pro的实时提醒,随时了解最新的亚马逊期权交易。