Behind the Scenes of UnitedHealth Group's Latest Options Trends

Behind the Scenes of UnitedHealth Group's Latest Options Trends

Deep-pocketed investors have adopted a bullish approach towards UnitedHealth Group (NYSE:UNH), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in UNH usually suggests something big is about to happen.

资金雄厚的投资者对联合健康集团(纽交所:UNH)采取了看好的态度,这是市场参与者不应忽视的事情。我们在Benzinga追踪公共期权记录的过程中今天揭示了这一重大举动。这些投资者的身份尚不知晓,但UNH发生如此重大的变化通常意味着即将发生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 13 extraordinary options activities for UnitedHealth Group. This level of activity is out of the ordinary.

我们从今天的观察中获得了这条信息,当Benzinga的期权扫描器突出显示了联合健康集团的13个非凡的期权活动。 这种活动水平是非同寻常的。

The general mood among these heavyweight investors is divided, with 46% leaning bullish and 46% bearish. Among these notable options, 9 are puts, totaling $437,393, and 4 are calls, amounting to $363,867.

这些重量级投资者中的整体情绪分为两派,46%看涨,46%看跌。 在这些显著的期权中,有9个看跌,总额为437,393美元,还有4个看涨,总额为363,867美元。

Projected Price Targets

预计价格目标

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $530.0 to $610.0 for UnitedHealth Group during the past quarter.

分析这些合约的成交量和未平仓量,似乎在过去的一季度里大型交易商一直在关注联合健康集团在530.0美元到610.0美元的价格区间。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

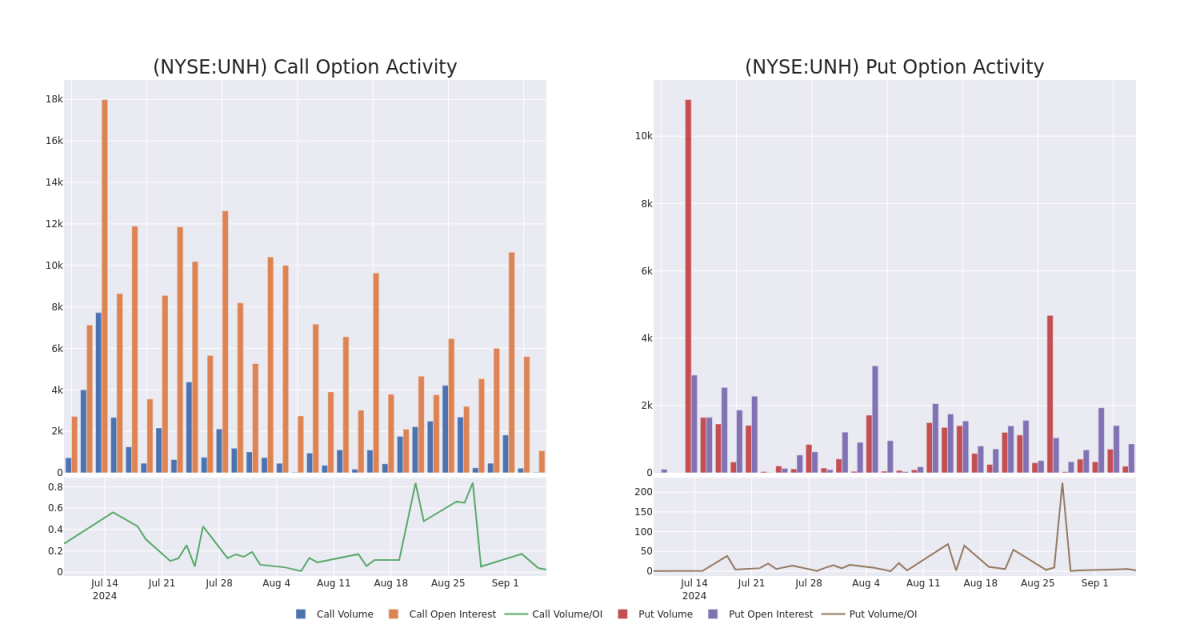

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for UnitedHealth Group's options for a given strike price.

这些数据能帮助你追踪联合健康特定行权价的期权的流动性和兴趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of UnitedHealth Group's whale activity within a strike price range from $530.0 to $610.0 in the last 30 days.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of UnitedHealth Group's whale activity within a strike price range from $530.0 to $610.0 in the last 30 days.

UnitedHealth Group Option Activity Analysis: Last 30 Days

联合健康集团期权活动分析:过去30天

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UNH | CALL | TRADE | BEARISH | 10/11/24 | $45.75 | $43.4 | $43.4 | $560.00 | $217.0K | 0 | 0 |

| UNH | PUT | SWEEP | BULLISH | 06/20/25 | $41.65 | $37.75 | $37.75 | $580.00 | $68.0K | 209 | 24 |

| UNH | CALL | SWEEP | BEARISH | 09/20/24 | $66.85 | $64.7 | $64.7 | $530.00 | $64.6K | 831 | 10 |

| UNH | PUT | SWEEP | BULLISH | 09/20/24 | $10.9 | $10.8 | $10.8 | $592.50 | $54.1K | 67 | 50 |

| UNH | PUT | TRADE | BULLISH | 11/15/24 | $33.6 | $32.65 | $32.65 | $610.00 | $52.2K | 167 | 16 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 联合健康 | 看涨 | 交易 | 看淡 | 10/11/24 | $45.75 | $43.4 | $43.4 | $560.00 | 217千美元 | 0 | 0 |

| 联合健康 | 看跌 | SWEEP | 看好 | 06/20/25 | $41.65 | $37.75 | $37.75 | $68.0K | 209 | 24 | |

| 联合健康 | 看涨 | SWEEP | 看淡 | 09/20/24 | 66.85美元 | $64.7 | $64.7 | $530.00 | $64.6K | 831 | 10 |

| 联合健康 | 看跌 | SWEEP | 看好 | 09/20/24 | $10.9 | $10.8 | $10.8 | $592.50 | $54.1千美元 | 67 | 50 |

| 联合健康 | 看跌 | 交易 | 看好 | 11/15/24 | $33.6 | $32.65 | $32.65 | $610.00 | 52,200 美元 | 167 | 16 |

About UnitedHealth Group

关于联合健康集团

UnitedHealth Group is one of the largest private health insurers, providing medical benefits to about 50 million members globally, including 1 million outside the us as June 2024. As a leader in employer-sponsored, self-directed, and government-backed insurance plans, UnitedHealth has obtained massive scale in managed care. Along with its insurance assets, UnitedHealth's continued investments in its Optum franchises have created a healthcare services colossus that spans everything from medical and pharmaceutical benefits to providing outpatient care and analytics to both affiliated and third-party customers.

联合健康集团是全球最大的私人医疗保险提供商之一,为包括2024年6月外美国的约5000万会员提供医疗保障。作为雇主赞助、自主选择和政府支持的保险计划的领导者,联合健康在托管护理方面获得了大规模的规模。除了其保险资产外,联合健康继续投资于其Optum公司,创造了一个医疗保健服务巨头,涵盖从医疗和药品福利到为关联和第三方客户提供门诊护理和分析。

After a thorough review of the options trading surrounding UnitedHealth Group, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对联合健康集团的期权交易进行彻底审查后,我们决定更详细地研究该公司。这包括对其当前市场地位和业绩的评估。

Where Is UnitedHealth Group Standing Right Now?

联合健康目前处于什么位置?

- With a trading volume of 264,746, the price of UNH is up by 0.19%, reaching $596.64.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 35 days from now.

- 交易量为264,746,UNH的价格上涨0.19%,达到596.64美元。

- 当前RSI值表明股票可能已经超买。

- 下一份财报将于35天后公布。

Expert Opinions on UnitedHealth Group

联合健康集团专家意见

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $591.0.

过去30天中,共有1位专业分析师对该股票进行了评估,设定了平均目标价为591.0美元。

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $591.

- 在一个小心谨慎的举动中,Cantor Fitzgerald的一位分析师将其评级下调为“增持”,并设定了591美元的目标价。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for UnitedHealth Group with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高的利润潜力。精明的交易者通过持续教育、战略性交易调整、利用各种因子并保持对市场动态的敏感来缓解这些风险。使用Benzinga Pro获取联合健康集团的最新期权交易实时提醒。

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $530.0 to $610.0 for UnitedHealth Group during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $530.0 to $610.0 for UnitedHealth Group during the past quarter.