Exxon Mobil Options Trading: A Deep Dive Into Market Sentiment

Exxon Mobil Options Trading: A Deep Dive Into Market Sentiment

Financial giants have made a conspicuous bullish move on Exxon Mobil. Our analysis of options history for Exxon Mobil (NYSE:XOM) revealed 15 unusual trades.

金融巨头对埃克森美孚进行了明显的看好交易。我们对埃克森美孚(纽交所:XOM)期权历史进行分析,发现了15笔飞凡交易。

Delving into the details, we found 53% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $228,805, and 9 were calls, valued at $519,889.

深入细节后,我们发现53%的交易者看好,而33%显示了看跌倾向。在所有我们发现的交易中,有6笔看跌交易,价值228,805美元,而有9笔看涨交易,价值519,889美元。

Projected Price Targets

预计价格目标

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $90.0 to $125.0 for Exxon Mobil during the past quarter.

分析这些合约的成交量和未平仓量,似乎大型交易者一直瞄准埃克森美孚过去一个季度从90.0美元到125.0美元的价格区间。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

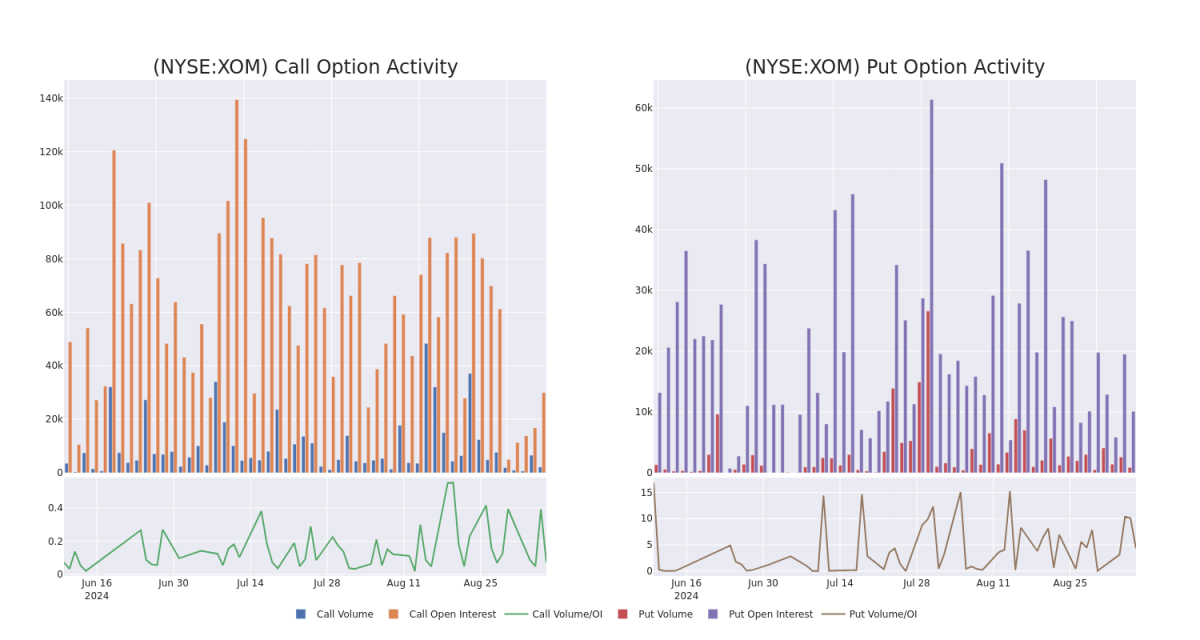

In terms of liquidity and interest, the mean open interest for Exxon Mobil options trades today is 3340.42 with a total volume of 3,072.00.

就流动性和利息而言,今天埃克森美孚期权交易的平均未平仓量为3340.42,总成交量为3,072.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Exxon Mobil's big money trades within a strike price range of $90.0 to $125.0 over the last 30 days.

在接下来的图表中,我们能够追踪过去30天内埃克森美孚大额交易的看涨和看跌期权的成交量和未平仓量发展情况,限定在90.0美元到125.0美元的行权价格区间内。

Exxon Mobil Option Volume And Open Interest Over Last 30 Days

过去30天内的埃克森美孚期权成交量和持仓量

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| XOM | CALL | TRADE | BEARISH | 01/17/25 | $4.0 | $3.95 | $3.95 | $120.00 | $165.5K | 15.3K | 420 |

| XOM | CALL | SWEEP | BULLISH | 10/18/24 | $2.76 | $2.74 | $2.76 | $115.00 | $82.3K | 4.7K | 717 |

| XOM | CALL | SWEEP | BULLISH | 10/18/24 | $3.2 | $3.1 | $3.2 | $115.00 | $76.8K | 4.7K | 391 |

| XOM | CALL | SWEEP | BEARISH | 01/16/26 | $27.75 | $27.5 | $27.61 | $90.00 | $55.2K | 900 | 21 |

| XOM | PUT | SWEEP | BULLISH | 02/21/25 | $10.35 | $10.25 | $10.25 | $120.00 | $53.3K | 16 | 53 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 埃克森美孚所有板块中涉及$80.0至$120.0范围内的鲸鱼活动的成交量和持仓量变化 | 看涨 | 交易 | 看淡 | 01/17/25 | $4.0 | $3.95 | $3.95 | $120.00 | $165.5K | 15.3K | 420 |

| 埃克森美孚所有板块中涉及$80.0至$120.0范围内的鲸鱼活动的成交量和持仓量变化 | 看涨 | SWEEP | 看好 | 10/18/24 | $2.76 | $2.74 | $2.76 | $115.00 | $82.3K | 4.7千 | 717 |

| 埃克森美孚所有板块中涉及$80.0至$120.0范围内的鲸鱼活动的成交量和持仓量变化 | 看涨 | SWEEP | 看好 | 10/18/24 | $3.2 | $3.1 | $3.2 | $115.00 | $76.8K | 4.7千 | 391 |

| 埃克森美孚所有板块中涉及$80.0至$120.0范围内的鲸鱼活动的成交量和持仓量变化 | 看涨 | SWEEP | 看淡 | 01/16/26 | $27.75 | $27.5 | 27.61美元 | $90.00 | $55.2K | 900 | 21 |

| 埃克森美孚所有板块中涉及$80.0至$120.0范围内的鲸鱼活动的成交量和持仓量变化 | 看跌 | SWEEP | 看好 | 02/21/25 | $10.35 | $10.25 | $10.25 | $120.00 | 53.3千美元 | 16 | 53 |

About Exxon Mobil

关于埃克森美孚

ExxonMobil is an integrated oil and gas company that explores for, produces, and refines oil around the world. In 2023, it produced 2.4 million barrels of liquids and 7.7 billion cubic feet of natural gas per day. At the end of 2023, reserves were 16.9 billion barrels of oil equivalent, 66% of which were liquids. The company is one of the world's largest refiners with a total global refining capacity of 4.5 million barrels of oil per day and is one of the world's largest manufacturers of commodity and specialty chemicals.

埃克森美孚是一家综合性石油和天然气公司,全球范围内进行石油勘探、生产和精炼。2023年每天生产240万桶液体和77亿立方英尺天然气。到2023年底,储量为169亿桶石油当量,其中66%为液体。该公司是世界上最大的炼油厂商之一,总全球炼油能力为450万桶/日,也是世界上最大的商品和特种化学品制造商之一。

Where Is Exxon Mobil Standing Right Now?

埃克森美孚目前处于何种地位?

- With a volume of 2,525,232, the price of XOM is down -0.6% at $112.49.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 49 days.

- 成交量为2,525,232,XOm的价格下跌了-0.6%,为112.49美元。

- RSI指标暗示基础股票可能接近超卖。

- 下一次盈利预计在49天内发布。

What The Experts Say On Exxon Mobil

专家对埃克森美孚的看法

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $157.0.

过去30天内,共有1位专业分析师对该股票发表了评论,设定了一个平均目标价为$157.0。

- Consistent in their evaluation, an analyst from UBS keeps a Buy rating on Exxon Mobil with a target price of $157.

- UBS的分析师对埃克森美孚持续评估,并给出了157美元的目标价。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Exxon Mobil with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供更高的利润潜力。精明的交易者通过持续教育、策略性交易调整、利用各种因子以及保持关注市场动态来减轻这些风险。使用Benzinga Pro了解埃克森美孚的最新期权交易,以获取实时提醒。

In terms of liquidity and interest, the mean open interest for Exxon Mobil options trades today is 3340.42 with a total volume of 3,072.00.

In terms of liquidity and interest, the mean open interest for Exxon Mobil options trades today is 3340.42 with a total volume of 3,072.00.