Constellation Energy's Options: A Look at What the Big Money Is Thinking

Constellation Energy's Options: A Look at What the Big Money Is Thinking

Whales with a lot of money to spend have taken a noticeably bullish stance on Constellation Energy.

资金充沛的鲸鱼在Constellation Energy方面采取了明显看好的立场。

Looking at options history for Constellation Energy (NASDAQ:CEG) we detected 8 trades.

查看Constellation Energy(纳斯达克:CEG)期权历史记录,我们检测到8次交易。

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 25% with bearish.

如果我们考虑每项交易的具体情况,可以准确地说,有50%的投资者以看好的预期开展交易,25%以看淡的预期开展交易。

From the overall spotted trades, 2 are puts, for a total amount of $241,695 and 6, calls, for a total amount of $2,000,565.

从整体交易情况来看,有2笔看跌期权交易,总额为$241,695,有6笔看涨期权交易,总额为$2,000,565。

Predicted Price Range

预测价格区间

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $160.0 to $200.0 for Constellation Energy over the last 3 months.

考虑到这些合约的成交量和持仓量,看来鲸鱼们近3个月一直把庄能源的价格范围定在$160.0至$200.0之间。

Volume & Open Interest Trends

成交量和未平仓量趋势

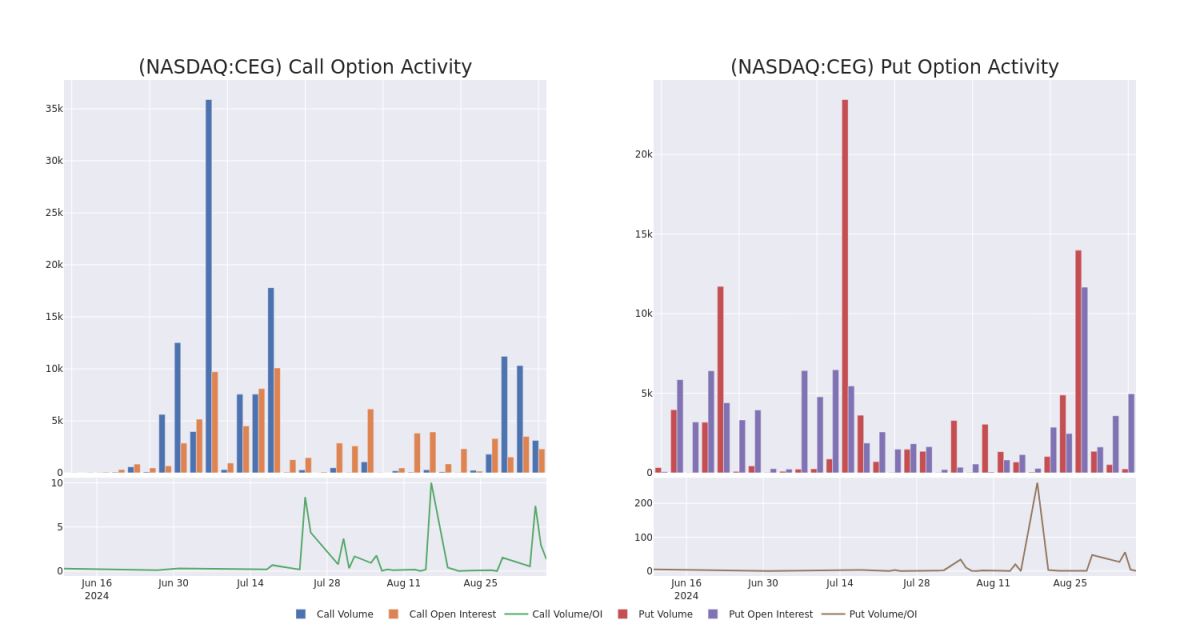

In today's trading context, the average open interest for options of Constellation Energy stands at 1451.8, with a total volume reaching 3,352.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Constellation Energy, situated within the strike price corridor from $160.0 to $200.0, throughout the last 30 days.

在今天的交易背景下,庄能源期权的平均持仓量为1451.8,总成交量达到3,352.00。配套的图表描述了过去30天中庄能源高价值交易的看涨和看跌期权成交量和持仓量的变化情况,这些交易位于$160.0至$200.0的行权价格区间内。

Constellation Energy Call and Put Volume: 30-Day Overview

Constellation Energy看涨和看跌期权的成交量概述:30天。

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CEG | CALL | TRADE | BULLISH | 12/20/24 | $15.0 | $14.6 | $15.0 | $180.00 | $1.7M | 9 | 1.3K |

| CEG | PUT | SWEEP | BULLISH | 10/18/24 | $4.7 | $4.4 | $4.5 | $160.00 | $185.8K | 4.9K | 225 |

| CEG | CALL | SWEEP | NEUTRAL | 12/20/24 | $14.2 | $14.1 | $14.2 | $180.00 | $58.2K | 9 | 1.3K |

| CEG | CALL | SWEEP | BULLISH | 12/20/24 | $15.0 | $14.6 | $14.95 | $180.00 | $58.2K | 9 | 130 |

| CEG | PUT | TRADE | BEARISH | 10/18/24 | $27.9 | $27.3 | $27.9 | $200.00 | $55.8K | 34 | 20 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CEG | 看涨 | 交易 | 看好 | 12/20/24 | $15.0 | 14.6美元 | $15.0 | 180.00美元 | $1.7M | 9 | 1.3K |

| CEG | 看跌 | SWEEP | 看好 | 10/18/24 | $4.7 | $4.4 | $4.5 | $160.00 | 185.8千美元 | 4.9K | 225 |

| CEG | 看涨 | SWEEP | 中立 | 12/20/24 | 14.2 | $14.1 | 14.2 | 180.00美元 | $58.2K | 9 | 1.3K |

| CEG | 看涨 | SWEEP | 看好 | 12/20/24 | $15.0 | 14.6美元 | $14.95 | 180.00美元 | $58.2K | 9 | 130 |

| CEG | 看跌 | 交易 | 看淡 | 10/18/24 | $27.9 | $27.3 | $27.9 | 。 | $55.8K | 34 | 20 |

About Constellation Energy

Constellation Energy

Constellation Energy Corp offers energy solutions. It provides clean energy and sustainable solutions to homes, businesses, the public sector, community aggregations, and a range of wholesale customers (such as municipalities, cooperatives, and other strategics). The company offers comprehensive energy solutions and a variety of pricing options for electric, natural gas, and renewable energy products for companies of any size.

Constellation Energy Corp提供能源解决方案。它为家庭、企业、公共部门、社区集合体和各种批发客户(如市政当局、合作社和其他战略客户)提供清洁能源和可持续解决方案。公司为各种规模的企业提供综合能源解决方案和各种定价选项,包括电力、天然气和可再生能源产品。

In light of the recent options history for Constellation Energy, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考虑到康斯特能源的最近期权历史,现在专注于该公司本身是合适的。我们的目标是探索其当前业绩。

Current Position of Constellation Energy

Constellation Energy的当前位置

- Trading volume stands at 1,297,444, with CEG's price down by -1.78%, positioned at $172.93.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 59 days.

- 交易量为1,297,444,CEG的价格下跌了-1.78%,位于172.93美元。

- RSI指标显示该股票可能正接近超卖。

- 盈利公告将于59天内发布。

What Analysts Are Saying About Constellation Energy

分析师对康斯特雷能源的看法

4 market experts have recently issued ratings for this stock, with a consensus target price of $210.25.

4位市场专家最近对该股票发表了评级意见,一致认为目标价为210.25美元。

- Consistent in their evaluation, an analyst from B of A Securities keeps a Neutral rating on Constellation Energy with a target price of $208.

- An analyst from Barclays downgraded its action to Overweight with a price target of $211.

- Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Constellation Energy, targeting a price of $233.

- An analyst from Mizuho has decided to maintain their Neutral rating on Constellation Energy, which currently sits at a price target of $189.

- BofA证券的分析师一直给予康斯特雷能源中立评级,目标价为208美元,保持了稳定的评估。

- 巴克莱的分析师将其评级下调为超配,目标价为211美元。

- 摩根士丹利的分析师继续维持对康斯特雷能源的超配评级,目标价为233美元。

- 瑞穗的分析师决定维持对康斯特雷能源的中立评级,目前的目标价为189美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。