Monolithic Power Systems Unusual Options Activity

Monolithic Power Systems Unusual Options Activity

Financial giants have made a conspicuous bearish move on Monolithic Power Systems. Our analysis of options history for Monolithic Power Systems (NASDAQ:MPWR) revealed 11 unusual trades.

金融巨头对monolithic power systems采取了明显的看淡策略。我们对纳斯达克代码为MPWR的期权历史进行分析,发现了11笔异常交易。

Delving into the details, we found 0% of traders were bullish, while 45% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $59,670, and 9 were calls, valued at $306,839.

深入细节后,我们发现0%的交易者持看涨意愿,而45%显示了看淡倾向。在我们发现的所有交易中,有2笔看跌期权,价值59670美元,以及9笔买入期权,价值306839美元。

Projected Price Targets

预计价格目标

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $450.0 to $840.0 for Monolithic Power Systems over the last 3 months.

考虑到这些合约的成交量和未平仓合约数,似乎大鳄们一直将monolithic power systems的目标价范围定在450.0至840.0美元之间,持续三个月。

Insights into Volume & Open Interest

成交量和持仓量分析

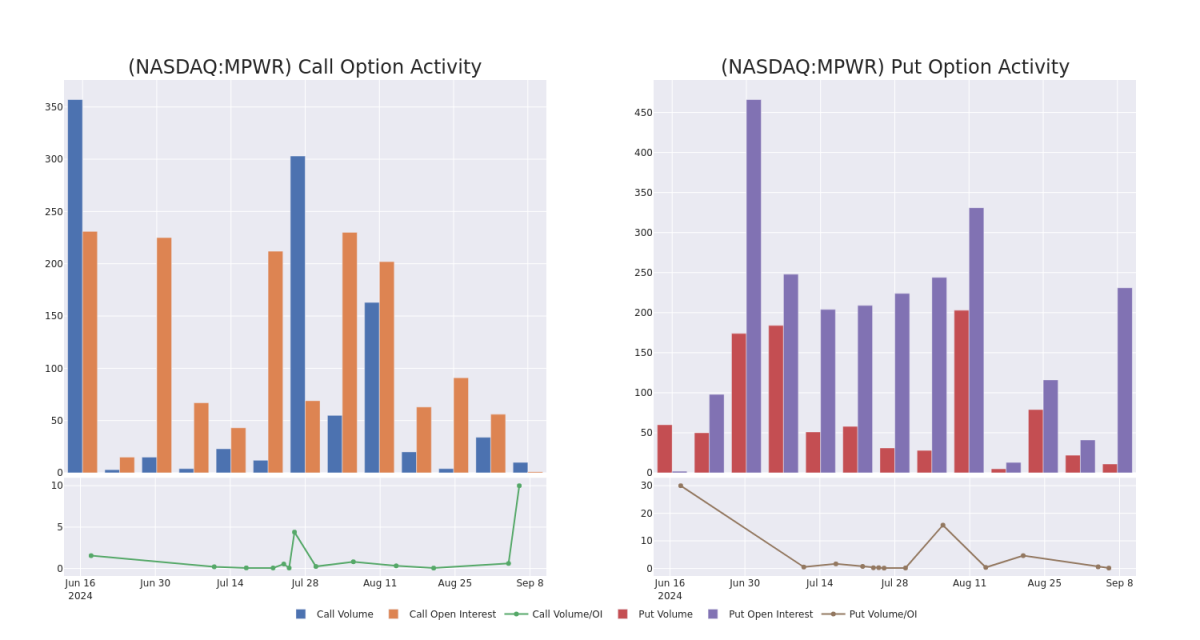

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for Monolithic Power Systems's options for a given strike price.

这些数据可以帮助您跟踪Monolithic Power Systems在给定执行价格的期权的流动性和兴趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Monolithic Power Systems's whale activity within a strike price range from $450.0 to $840.0 in the last 30 days.

下面,我们可以观察过去30天内所有monolithic power systems大鳄活动所涉及的看涨期权和看跌期权的成交量和未平仓合约数的变化。这些活动的执行价范围从450.0至840.0美元。

Monolithic Power Systems Option Volume And Open Interest Over Last 30 Days

在过去的30天内,Monolithic Power Systems的期权成交量和持仓量变化

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MPWR | CALL | TRADE | NEUTRAL | 09/20/24 | $268.5 | $253.5 | $260.42 | $550.00 | $52.0K | 1 | 0 |

| MPWR | CALL | TRADE | NEUTRAL | 09/20/24 | $369.5 | $355.7 | $362.6 | $450.00 | $36.2K | 0 | 2 |

| MPWR | CALL | TRADE | NEUTRAL | 09/20/24 | $369.6 | $355.6 | $361.93 | $450.00 | $36.1K | 0 | 1 |

| MPWR | CALL | TRADE | NEUTRAL | 09/20/24 | $349.4 | $335.7 | $341.58 | $470.00 | $34.1K | 0 | 1 |

| MPWR | CALL | TRADE | BEARISH | 09/20/24 | $349.4 | $335.7 | $341.03 | $470.00 | $34.1K | 0 | 2 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MPWR | 看涨 | 交易 | 中立 | 09/20/24 | 目标价268.5美元 | 目标价253.5美元 | 目标价260.42美元 | $550.00 | $52000 | 1 | 0 |

| MPWR | 看涨 | 交易 | 中立 | 09/20/24 | 369.5美元 | 355.7美元 | 362.6美元 | $450.00 | 36200美元 | 0 | 2 |

| MPWR | 看涨 | 交易 | 中立 | 09/20/24 | 369.6美元 | 355.6美元 | 361.93美元 | $450.00 | $36.1K | 0 | 1 |

| MPWR | 看涨 | 交易 | 中立 | 09/20/24 | 349.4美元 | 335.7美元 | $341.58 | $470.00 | $34.1K | 0 | 1 |

| MPWR | 看涨 | 交易 | 看淡 | 09/20/24 | 349.4美元 | 335.7美元 | 341.03美元 | $470.00 | $34.1K | 0 | 2 |

About Monolithic Power Systems

关于Monolithic Power Systems,Inc.(“MPS”)MPS是一家提供高性能基于半导体的电力电子解决方案的全球无厂商公司。MPS的使命是减少能源和材料的消耗,提高生活品质的各个方面,并创造一个可持续的未来。MPS由我们的首席执行官邢国民于1997年创立,具有系统水平的深入知识、强大的半导体设计专业知识,以及半导体工艺、系统集成和封装领域的创新专有技术等三种核心优势。这些优势的结合使MPS能够提供可靠、紧凑和单片解决方案,具有高效节能、经济实用和环境负责的特点,同时为我们的股东提供一致的投资回报。MPS可以透过其网站或全球的支持办事处联系。

Monolithic Power Systems is an analog and mixed-signal chipmaker, specializing in power management solutions. The firm's mission is to reduce total energy consumption in end systems, and it serves the computing, automotive, industrial, communications, and consumer end markets. MPS uses a fabless manufacturing model, partnering with third-party chip foundries to host its proprietary BCD process technology.

Monolithic Power Systems是一家模拟和混合信号芯片制造商,专注于电源管理解决方案。该公司的使命是降低终端系统的总能耗,为计算机、汽车、工业、通信和消费者终端市场提供服务。MPS采用无晶圆厂造模式,与第三方芯片代工厂合作,托管其专有的BCD工艺技术。

Following our analysis of the options activities associated with Monolithic Power Systems, we pivot to a closer look at the company's own performance.

在分析与monolithic power systems相关的期权活动后,我们转而更仔细地观察该公司自身的表现。

Present Market Standing of Monolithic Power Systems

Monolithic Power Systems目前的市场地位

- Currently trading with a volume of 308,618, the MPWR's price is down by -5.17%, now at $798.01.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 52 days.

- 目前交易量为308,618的MPWR价格下跌了-5.17%,目前为798.01美元。

- RSI读数表明该股票目前处于中立状态,处于超买和超卖之间。

- 预计将于52天后公布收益。

Professional Analyst Ratings for Monolithic Power Systems

Monolithic Power Systems的专业分析师评级

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $1100.0.

在过去30天里,共有1位专业分析师对这支股票发表了自己的看法,设定了一个平均目标价为$1100.0。

- An analyst from TD Cowen persists with their Buy rating on Monolithic Power Systems, maintaining a target price of $1100.

- TD Cowen的一位分析师坚持对Monolithic Power Systems给予买入评级,并维持目标价为$1100。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Monolithic Power Systems with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高的利润潜力。精明的交易者通过持续的教育、战略性交易调整、利用各种指标以及保持对市场动态的关注来减轻这些风险。通过Benzinga Pro获取Monolithic Power Systems的最新期权交易,以获得实时提醒。

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.