Decoding Palo Alto Networks's Options Activity: What's the Big Picture?

Decoding Palo Alto Networks's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bearish move on Palo Alto Networks. Our analysis of options history for Palo Alto Networks (NASDAQ:PANW) revealed 22 unusual trades.

金融巨头对Palo Alto Networks采取了明显的看淡举措。我们对Palo Alto Networks(纳斯达克:PANW)期权历史进行了分析,发现了22次异常交易。

Delving into the details, we found 36% of traders were bullish, while 59% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $1,034,771, and 16 were calls, valued at $693,750.

深入了解细节,我们发现36%的交易者看好,而59%的交易者看淡。在我们发现的所有交易中,有6次看跌期权交易,价值为1034771美元,有16次看涨期权交易,价值为693750美元。

What's The Price Target?

目标价是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $180.0 to $500.0 for Palo Alto Networks over the last 3 months.

考虑到这些合约的成交量和未平仓合约数,过去3个月以来大鳄们一直在瞄准Palo Alto Networks的价格区间为180.0至500.0美元。

Volume & Open Interest Trends

成交量和未平仓量趋势

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for Palo Alto Networks's options for a given strike price.

这些数据可以帮助您跟踪Palo Alto Networks的期权对于给定行权价格的流动性和兴趣。

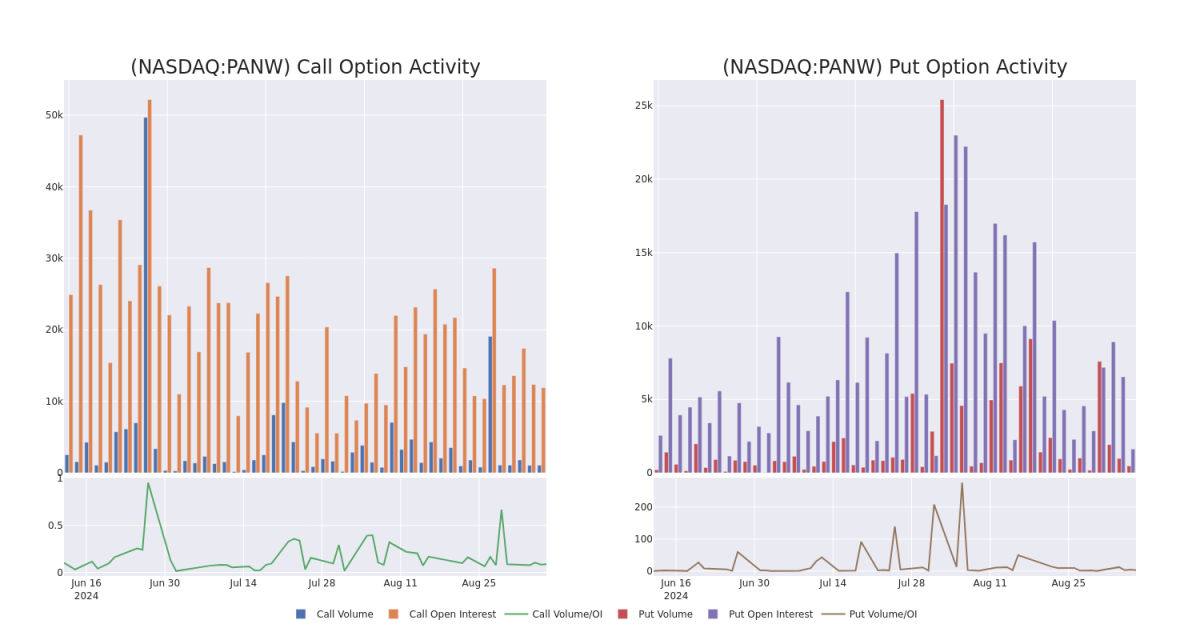

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Palo Alto Networks's whale activity within a strike price range from $180.0 to $500.0 in the last 30 days.

下面,我们可以观察到过去30天内,Palo Alto Networks的看涨和看跌期权的成交量和未平仓合约变化情况,对应的行权价格范围为180.0至500.0美元。

Palo Alto Networks Option Volume And Open Interest Over Last 30 Days

过去30天内Palo Alto Networks期权的成交量和持仓量

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PANW | PUT | TRADE | BULLISH | 03/21/25 | $26.8 | $26.3 | $26.5 | $320.00 | $795.0K | 220 | 305 |

| PANW | CALL | TRADE | BULLISH | 01/17/25 | $31.8 | $31.5 | $31.68 | $340.00 | $142.5K | 823 | 51 |

| PANW | PUT | SWEEP | BEARISH | 01/17/25 | $10.6 | $9.7 | $10.6 | $293.33 | $75.2K | 405 | 51 |

| PANW | CALL | TRADE | BEARISH | 06/20/25 | $22.3 | $21.4 | $21.4 | $420.00 | $59.9K | 309 | 0 |

| PANW | CALL | SWEEP | BEARISH | 01/17/25 | $42.0 | $41.85 | $42.0 | $320.00 | $58.8K | 2.1K | 26 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PANW | 看跌 | 交易 | 看好 | 03/21/25 | $26.8 | $26.3美元 | $26.5 | $320.00 | $795.0K | 220 | 305 |

| PANW | 看涨 | 交易 | 看好 | 01/17/25 | $31.8 | $31.5 | $31.68 | $340.00 | $142.5K | 823 | 51 |

| PANW | 看跌 | SWEEP | 看淡 | 01/17/25 | $10.6 | 9.7 | $10.6 | 293.33美元 | $75.2K | 405 | 51 |

| PANW | 看涨 | 交易 | 看淡 | 06/20/25 | $22.3 | $21.4 | $21.4 | $420.00 | $59.9千美元 | 309 | 0 |

| PANW | 看涨 | SWEEP | 看淡 | 01/17/25 | $42.0 | $41.85 | $42.0 | $320.00 | $58.8K | 2.1K | 26 |

About Palo Alto Networks

关于Palo Alto Networks

Palo Alto Networks is a platform-based cybersecurity vendor with product offerings covering network security, cloud security, and security operations. The California-based firm has more than 80,000 enterprise customers across the world, including more than three fourths of the Global 2000.

Palo Alto Networks是一个基于平台的网络安全供应商,其产品涵盖网络安全、云安全和安全运营。这家总部位于加利福尼亚的公司在全球拥有超过80,000家企业客户,其中包括全球2000强的四分之三以上。

After a thorough review of the options trading surrounding Palo Alto Networks, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

经过对Palo Alto Networks期权交易的全面审查,我们深入研究了该公司的市场现状和业绩。

Where Is Palo Alto Networks Standing Right Now?

Palo Alto Networks现在的情况如何?

- With a trading volume of 2,291,703, the price of PANW is down by -2.3%, reaching $335.82.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 68 days from now.

- 成交量为2,291,703,PANW的价格下跌2.3%,达到335.82美元。

- 目前的RSI值表明该股票目前处于超买和超卖之间的中立状态。

- 下一份财报将于68天后发布。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Palo Alto Networks options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在回报。精明的交易者通过不断学习、调整策略、监控多种因子并密切关注市场行情来管理这些风险。通过Benzinga Pro的实时提醒保持对Palo Alto Networks期权交易的最新动态了解。

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.