AMD Vs. Nvidia: AMD's Surprising Strategy Shift in Gaming GPU Battle

AMD Vs. Nvidia: AMD's Surprising Strategy Shift in Gaming GPU Battle

Advanced Micro Devices, Inc. (NASDAQ:AMD) is shifting its focus to the gaming GPU market, prioritizing a strategy to gain a larger market share.

Advanced Micro Devices, Inc.(纳斯达克股票代码:AMD)正在将重点转移到游戏GPU市场,优先考虑一项获得更大市场份额的战略。

This approach marks a significant shift away from competing directly with Nvidia Corp's (NASDAQ:NVDA) highest-end gaming GPUs, at least for now, Tom's Hardware cites Jack Huynh, AMD's Senior Vice President and General Manager.

Tom's Hardware援引AMD高级副总裁兼总经理杰克·休恩的话说,这种方法标志着人们从直接与英伟达公司(纳斯达克股票代码:NVDA)的最高端游戏GPU竞争发生了重大转变,至少目前是如此。

In an interview during IFA 2024, Huynh emphasized that AMD aims to capture 40%-50% of the total addressable market by focusing on mainstream and mid-range GPUs.

在IFA 2024期间的一次采访中,Huynh强调说,AMD的目标是通过专注于主流和中端GPU,占领整个潜在市场的40%-50%。

Nvidia currently holds 88% of the discrete GPU market, leaving AMD with just 12%, compelling the latter to focus on building scale.

英伟达目前占有独立GPU市场的88%,而AMD仅占12%,这迫使后者专注于扩大规模。

AMD remains engaged in many activities to boost shareholder value as analysts continue to claim Nvidia as the key AI beneficiary.

随着分析师继续声称Nvidia是主要的人工智能受益者,AMD仍在参与许多提高股东价值的活动。

Recently, AMD tapped Nvidia's Keith Strier, who was responsible for boosting Nvidia's commercial engagements with foreign governments. AMD also shared plans to snap AI server company ZT Systems for $4.9 billion as its Ryzen 9000 series failed to gain traction.

最近,AMD聘请了英伟达的基思·斯特里尔,他负责促进英伟达与外国政府的商业合作。由于其锐龙9000系列未能获得关注,AMD还分享了以49亿美元收购人工智能服务器公司Zt Systems的计划。

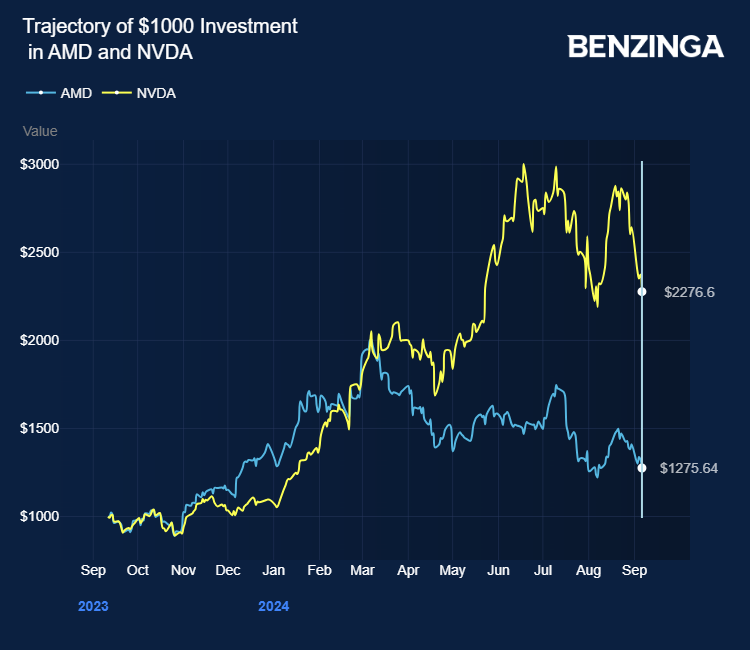

AMD has been up 28% in the last 12 months versus Nvidia, which has gained 128%.

在过去的12个月中,AMD上涨了28%,而英伟达上涨了128%。

Semiconductor and AI-linked stocks, including Nvidia and AMD, faced a continued selloff despite strong quarterly results from Nvidia and Broadcom Inc (NASDAQ:AVGO). VanEck Semiconductor ETF (NASDAQ:SMH) and iShares Semiconductor ETF (NASDAQ:SOXX) dropped over 12% in the past five days.

尽管英伟达和博通公司(纳斯达克股票代码:AVGO)的季度业绩强劲,但包括英伟达和AMD在内的半导体和人工智能相关股票仍面临持续抛售。VanEck半导体ETF(纳斯达克股票代码:SMH)和iShares半导体ETF(纳斯达克股票代码:SOXX)在过去五天中下跌了12%以上。

Price Actions: AMD stock is up 1.37% at $136.20 at the last check on Monday. NVDA is up 1.22% at $104.05.

价格走势:在周一的最后一次检查中,AMD股价上涨1.37%,至136.20美元。NVDA上涨1.22%,至104.05美元。

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

免责声明:此内容部分是在人工智能工具的帮助下制作的,并由Benzinga的编辑审阅和发布。

Photo via Shutterstock

照片来自 Shutterstock

Nvidia currently holds 88% of the discrete GPU market, leaving AMD with just 12%, compelling the latter to focus on building scale.

Nvidia currently holds 88% of the discrete GPU market, leaving AMD with just 12%, compelling the latter to focus on building scale.