5 Behavioral Biases in Investing and How to Overcome Them

5 Behavioral Biases in Investing and How to Overcome Them

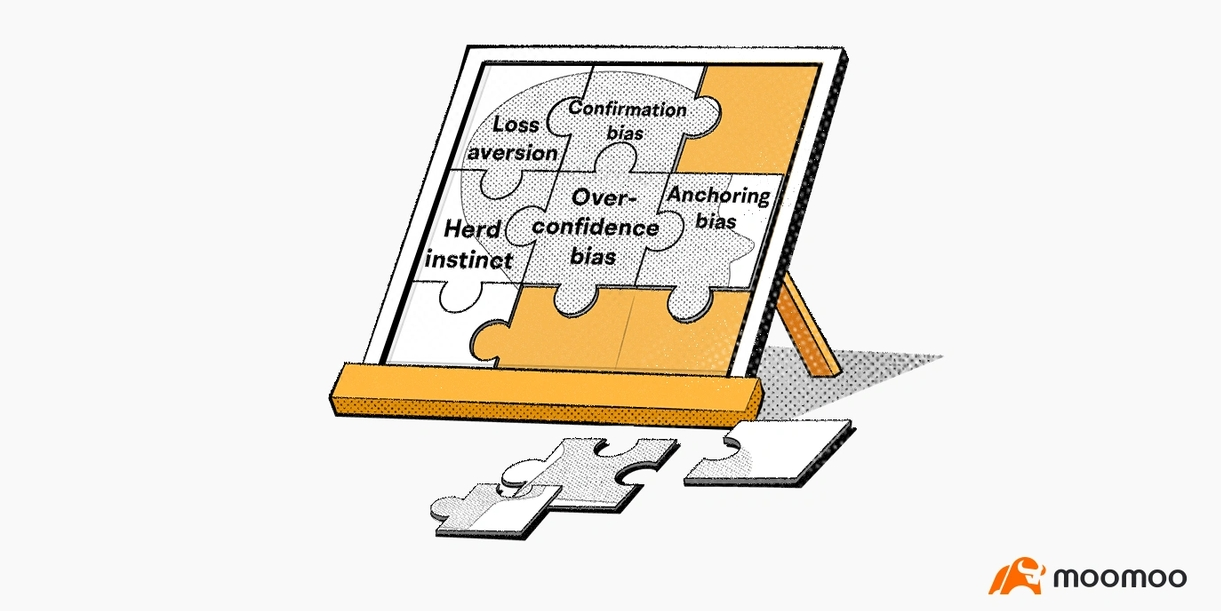

In the world of investing, emotions and cognitive biases often influence our decisions. Understanding these psychological factors can significantly enhance your investment strategy. Behavioral finance sheds light on how to identify and overcome these biases, helping you make smarter investment choices. Here are 5 common behavioral biases and how to overcome them.

在投资世界中,情绪和认知偏见常常影响我们的决策。了解这些心理因素可以显著增强您的投资策略。行为金融揭示了如何识别和克服这些偏见,帮助您做出更明智的投资选择。以下是5种常见的行为偏见以及如何克服它们。

1. Loss Aversion

1. 损失厌恶

What it is: Loss aversion occurs when the pain of losing money is stronger than the pleasure of gaining it. Investors often prefer avoiding losses over acquiring equivalent gains.

How to overcome it: Focus on a long-term investment strategy to mitigate the emotional impact of short-term losses. Diversify your portfolio to spread risk and reduce the urge to constantly monitor your investments. By checking your portfolio only once or twice a year, you can avoid emotional reactions that may lead to poor decisions.

什么是:损失厌恶是指失去金钱的痛苦比获得金钱的快乐更强烈。投资者通常更喜欢避免损失而不是获得等值收益。

如何克服:专注于长期投资策略,以减轻短期损失的情绪影响。分散您的投资组合,以减少风险并减少不断监控投资的冲动。每年只检查一两次您的投资组合,可以避免可能导致糟糕决策的情绪反应。

2. Home Bias

2. 地域偏好

What it is: Home bias is the tendency to favor investments from one's own country over those from foreign markets. This can lead to an overly concentrated portfolio.

How to overcome it: Aim for a globally diversified portfolio to spread risk and capture opportunities from different markets. Research international stocks, bonds, and other assets to ensure a balanced investment approach. Consider using global index funds or exchange-traded funds (ETFs) to easily diversify internationally.

什么是:地域偏好是指倾向于偏爱自己国家的投资,而不是外国市场的投资。这可能导致投资组合过度集中。

如何克服:致力于全球多元化的投资组合,以分散风险并抓住不同市场的机会。研究国际股票、债券和其他资产,确保平衡的投资方式。考虑使用全球指数基金或交易所交易基金(ETF),轻松实现国际多元化。

3. Herd Instinct

3. 从众心理

What it is: Herd instinct is the tendency to follow the actions of a larger group, often leading to buying or selling stocks based on what others are doing, rather than conducting your own analysis.

How to overcome it: Conduct independent research and rely on your own analysis. Trust your judgment and avoid making impulsive decisions based on market trends or rumors. Remember that following the crowd can often lead to buying overvalued stocks or selling undervalued ones, which can negatively impact your investment returns.

什么是:群体效应是指趋向于跟随一个较大群体的行动,通常会导致根据他人的行为而买入或卖出股票,而不是依据自己的分析。

如何克服:进行独立研究,依靠自己的分析。相信自己的判断,避免基于市场趋势或传言做出冲动的决策。记住,跟随群众往往会导致购买高估的股票或卖出低估的股票,这可能对您的投资回报产生负面影响。

4. Overconfidence Bias

4. 过度自信偏见

What it is: Overconfidence bias is the tendency to overestimate one’s knowledge and abilities, leading to excessive risk-taking. This can result in poor investment choices and significant losses.

How to overcome it: Stay humble and recognize the limits of your knowledge. Diversify your portfolio to mitigate risk and consider seeking advice from financial professionals. Regularly review and adjust your investment strategy based on objective data and market conditions.

什么是:过度自信偏见是指过高估计自己的知识和能力,从而导致过度冒险。这可能导致糟糕的投资选择和重大亏损。

如何克服:保持谦虚,认识到自己的知识的局限性。分散投资组合以减轻风险,并考虑寻求金融专业人士的建议。根据客观数据和市场状况定期审查和调整您的投资策略。

5. Confirmation Bias

5. 确认偏见

What it is: Confirmation bias is the tendency to favor information that supports your existing beliefs and ignore information that contradicts them. This can lead to a skewed perception of reality and poor investment decisions.

How to overcome it: Actively seek out diverse perspectives and consider information that challenges your views. Evaluate your investments objectively and be open to changing your strategy based on new information. By considering different viewpoints, you can make more informed and balanced investment decisions.

什么是:确认偏见是指倾向于支持您现有信念的信息,并忽视与之相矛盾的信息。这可能导致对现实的扭曲认知和糟糕的投资决策。

如何克服:积极寻求不同的观点,并考虑挑战您的观点的信息。客观评估您的投资,并愿意根据新的信息调整您的策略。通过考虑不同的观点,您可以做出更明智和平衡的投资决策。

Recognizing and understanding these common behavioral biases is the first step towards making more rational and informed investment decisions. By being aware of these psychological traps, you can develop strategies to minimize their impact and improve your long-term financial outcomes.

认识和理解这些常见的行为偏见是朝着更理性和明智的投资决策迈出的第一步。通过意识到这些心理陷阱,您可以制定策略,减少它们的影响,改善您的长期财务结果。