Behind the Scenes of Affirm Holdings's Latest Options Trends

Behind the Scenes of Affirm Holdings's Latest Options Trends

Deep-pocketed investors have adopted a bearish approach towards Affirm Holdings (NASDAQ:AFRM), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in AFRM usually suggests something big is about to happen.

财力雄厚的投资者对Affirm Holdings(纳斯达克股票代码:AFRM)采取了看跌态度,这是市场参与者不容忽视的。我们对本辛加公开期权记录的追踪今天揭示了这一重大举措。这些投资者的身份仍然未知,但是AfRM的如此重大变动通常表明即将发生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 24 extraordinary options activities for Affirm Holdings. This level of activity is out of the ordinary.

我们今天从观察中收集了这些信息,当时Benzinga的期权扫描仪重点介绍了Affirm Holdings的24项非同寻常的期权活动。这种活动水平与众不同。

The general mood among these heavyweight investors is divided, with 29% leaning bullish and 54% bearish. Among these notable options, 12 are puts, totaling $792,968, and 12 are calls, amounting to $700,397.

这些重量级投资者的总体情绪存在分歧,29%的人倾向于看涨,54%的人倾向于看跌。在这些值得注意的期权中,有12个是看跌期权,总额为792,968美元,12个是看涨期权,总额为700,397美元。

Predicted Price Range

预测的价格区间

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $20.0 and $60.0 for Affirm Holdings, spanning the last three months.

在评估了交易量和未平仓合约之后,很明显,主要市场走势者将注意力集中在Affirm Holdings在过去三个月中20.0美元至60.0美元之间的价格区间上。

Insights into Volume & Open Interest

对交易量和未平仓合约的见解

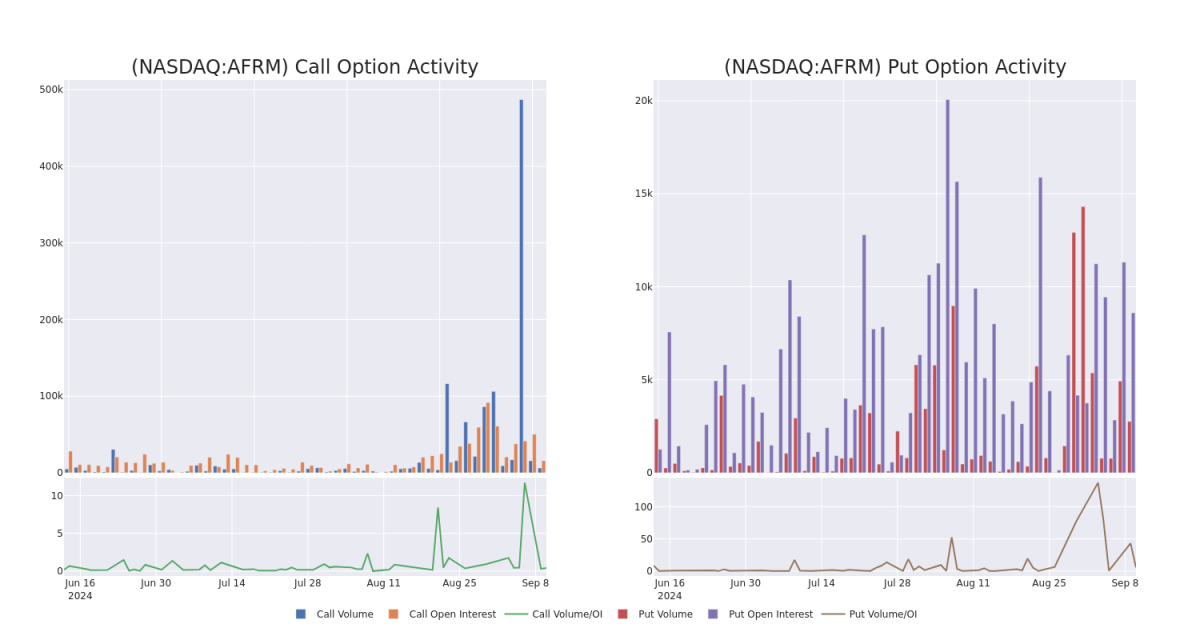

In terms of liquidity and interest, the mean open interest for Affirm Holdings options trades today is 1161.29 with a total volume of 9,000.00.

就流动性和利息而言,今天Affirm Holdings期权交易的平均未平仓合约为1161.29,总交易量为9,000.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Affirm Holdings's big money trades within a strike price range of $20.0 to $60.0 over the last 30 days.

在下图中,我们可以跟踪过去30天Affirm Holdings在20.0美元至60.0美元行使价区间内的大额资金交易的看涨和看跌期权交易量和未平仓合约的变化。

Affirm Holdings 30-Day Option Volume & Interest Snapshot

Affirm Holdings 30 天期权交易量和利息快照

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AFRM | CALL | SWEEP | BULLISH | 09/20/24 | $2.5 | $2.42 | $2.5 | $35.00 | $289.7K | 5.7K | 14 |

| AFRM | PUT | SWEEP | BULLISH | 03/21/25 | $4.95 | $4.85 | $4.85 | $32.50 | $127.5K | 813 | 37 |

| AFRM | PUT | SWEEP | BEARISH | 01/16/26 | $2.93 | $2.91 | $2.93 | $20.00 | $111.6K | 2.0K | 1.5K |

| AFRM | PUT | SWEEP | BEARISH | 02/21/25 | $3.45 | $3.35 | $3.45 | $30.00 | $111.4K | 317 | 484 |

| AFRM | PUT | SWEEP | BEARISH | 02/21/25 | $7.35 | $7.25 | $7.3 | $37.50 | $90.5K | 392 | 124 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 农场 | 打电话 | 扫 | 看涨 | 09/20/24 | 2.5 美元 | 2.42 美元 | 2.5 美元 | 35.00 美元 | 289.7 万美元 | 5.7K | 14 |

| 农场 | 放 | 扫 | 看涨 | 03/21/25 | 4.95 美元 | 4.85 美元 | 4.85 美元 | 32.50 美元 | 12.75 万美元 | 813 | 37 |

| 农场 | 放 | 扫 | 粗鲁的 | 01/16/26 | 2.93 美元 | 2.91 美元 | 2.93 美元 | 20.00 美元 | 111.6 万美元 | 2.0K | 1.5K |

| 农场 | 放 | 扫 | 粗鲁的 | 02/21/25 | 3.45 美元 | 3.35 美元 | 3.45 美元 | 30.00 美元 | 111.4 万美元 | 317 | 484 |

| 农场 | 放 | 扫 | 粗鲁的 | 02/21/25 | 7.35 美元 | 7.25 美元 | 7.3 美元 | 37.50 | 90.5 万美元 | 392 | 124 |

About Affirm Holdings

关于 Affirm 控股公司

Affirm Holdings Inc offers a platform for digital and mobile-first commerce. It comprises a point-of-sale payment solution for consumers, merchant commerce solutions, and a consumer-focused app. The firm generates its revenue from merchant networks, and through virtual card networks among others. Geographically, it generates a majority share of its revenue from the United States.

Affirm Holdings Inc为数字和移动优先商务提供了一个平台。它包括面向消费者的销售点支付解决方案、商户商务解决方案和以消费者为中心的应用程序。该公司的收入来自商户网络以及虚拟卡网络等。从地理上讲,它的大部分收入来自美国。

Having examined the options trading patterns of Affirm Holdings, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了Affirm Holdings的期权交易模式之后,我们的注意力现在直接转向了该公司。这种转变使我们能够深入研究其目前的市场地位和表现

Present Market Standing of Affirm Holdings

Affirm Holdings目前的市场状况

- Currently trading with a volume of 3,382,389, the AFRM's price is down by -4.06%, now at $36.62.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 57 days.

- AFRM目前的交易量为3,382,389美元,价格下跌了-4.06%,目前为36.62美元。

- RSI读数表明,该股目前可能接近超买。

- 预计财报将在57天后发布。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Affirm Holdings with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高利润的潜力。精明的交易者通过持续的教育、战略贸易调整、利用各种指标以及随时关注市场动态来降低这些风险。使用Benzinga Pro了解Affirm Holdings的最新期权交易,以获取实时提醒。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $20.0 and $60.0 for Affirm Holdings, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $20.0 and $60.0 for Affirm Holdings, spanning the last three months.