Behind the Scenes of Costco Wholesale's Latest Options Trends

Behind the Scenes of Costco Wholesale's Latest Options Trends

Financial giants have made a conspicuous bullish move on Costco Wholesale. Our analysis of options history for Costco Wholesale (NASDAQ:COST) revealed 41 unusual trades.

金融巨头对Costco Wholesale采取了明显的看涨举动。我们对好市多批发(纳斯达克股票代码:COST)期权历史的分析显示了41笔不寻常的交易。

Delving into the details, we found 46% of traders were bullish, while 29% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $460,708, and 36 were calls, valued at $4,673,027.

深入研究细节,我们发现46%的交易者看涨,而29%的交易者表现出看跌倾向。在我们发现的所有交易中,有5笔是看跌期权,价值460,708美元,36笔是看涨期权,价值4,673,027美元。

Projected Price Targets

预计价格目标

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $255.0 and $1100.0 for Costco Wholesale, spanning the last three months.

在评估了交易量和未平仓合约之后,很明显,主要市场推动者将注意力集中在Costco Wholesale在过去三个月的255.0美元至1100.0美元之间的价格区间上。

Volume & Open Interest Development

交易量和未平仓合约的发展

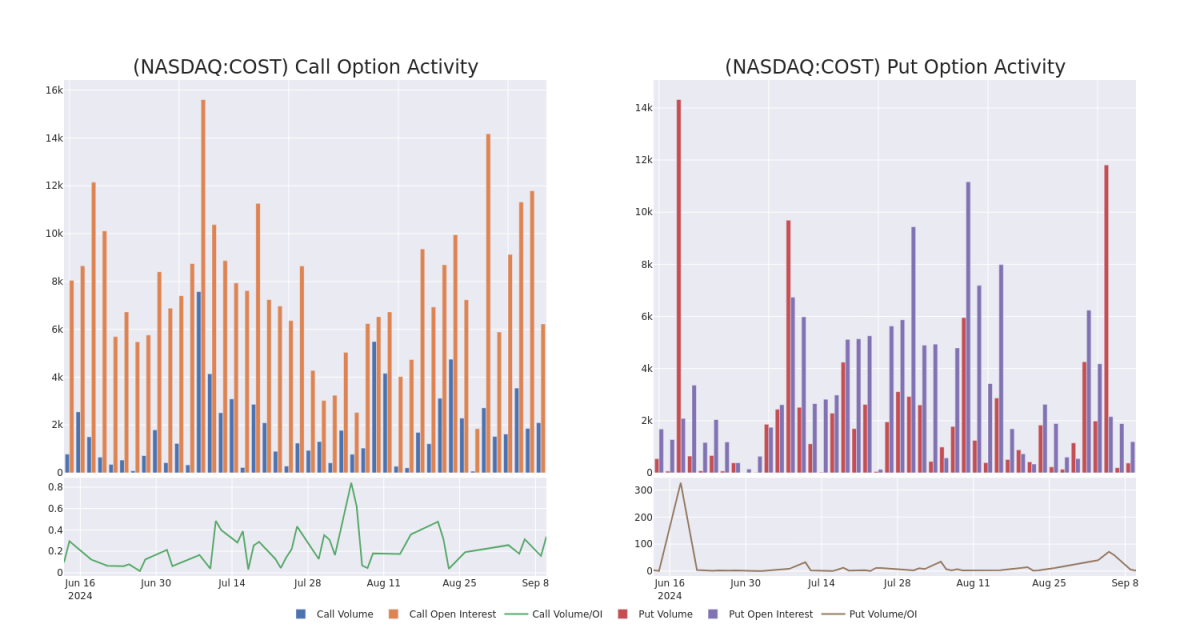

In terms of liquidity and interest, the mean open interest for Costco Wholesale options trades today is 224.82 with a total volume of 2,474.00.

就流动性和利息而言,今天好市多批发期权交易的平均未平仓合约为224.82,总交易量为2,474.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Costco Wholesale's big money trades within a strike price range of $255.0 to $1100.0 over the last 30 days.

在下图中,我们可以跟踪过去30天Costco Wholesale在255.0美元至1100.0美元行使价区间内的大额资金交易的看涨期权和未平仓合约的发展情况。

Costco Wholesale 30-Day Option Volume & Interest Snapshot

Costco 批发 30 天期权交易量和利息快照

Significant Options Trades Detected:

检测到的重要期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| COST | CALL | TRADE | BULLISH | 03/21/25 | $93.6 | $91.7 | $92.9 | $870.00 | $1.3M | 50 | 150 |

| COST | CALL | TRADE | BEARISH | 01/16/26 | $642.85 | $638.0 | $638.0 | $265.00 | $446.6K | 37 | 10 |

| COST | CALL | TRADE | BULLISH | 01/16/26 | $626.0 | $623.05 | $626.0 | $275.00 | $438.2K | 113 | 10 |

| COST | CALL | TRADE | BEARISH | 06/20/25 | $49.95 | $49.0 | $49.0 | $1000.00 | $367.5K | 167 | 77 |

| COST | CALL | SWEEP | BULLISH | 01/17/25 | $501.0 | $501.0 | $501.0 | $395.00 | $350.7K | 38 | 7 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 成本 | 打电话 | 贸易 | 看涨 | 03/21/25 | 93.6 美元 | 91.7 美元 | 92.9 美元 | 870.00 美元 | 130 万美元 | 50 | 150 |

| 成本 | 打电话 | 贸易 | 粗鲁的 | 01/16/26 | 642.85 美元 | 638.0 美元 | 638.0 美元 | 265.00 美元 | 446.6 万美元 | 37 | 10 |

| 成本 | 打电话 | 贸易 | 看涨 | 01/16/26 | 626.0 美元 | 623.05 美元 | 626.0 美元 | 275.00 美元 | 438.2 万美元 | 113 | 10 |

| 成本 | 打电话 | 贸易 | 粗鲁的 | 06/20/25 | 49.95 美元 | 49.0 美元 | 49.0 美元 | 1000.00 美元 | 367.5 万美元 | 167 | 77 |

| 成本 | 打电话 | 扫 | 看涨 | 01/17/25 | 501.0 美元 | 501.0 美元 | 501.0 美元 | 395.00 美元 | 350.7 万美元 | 38 | 7 |

About Costco Wholesale

关于 Costco 批发

Costco operates a membership-based, no-frills retail model, predicated on offering a select product assortment in bulk quantities at bargain prices. The firm avoids maintaining costly product displays by keeping inventory on pallets and limits distribution expenses by storing its inventory at point of sale in the warehouse. Given Costco's frugal cost structure, the firm is able to price its merchandise below competing retailers, driving high sales volume per warehouse and allowing the retailer to generate strong profits on thin margins. Costco operates over 600 warehouses in the United States and enjoys over 60% market share in the domestic warehouse club industry. Internationally, Costco operates another 270 warehouses, primarily in markets such as Canada, Mexico, Japan, and the UK.

Costco采用会员制、简洁的零售模式,其前提是以低廉的价格批量提供精选产品。该公司通过将库存保存在托盘上来避免维护昂贵的产品陈列柜,并通过在销售点将库存存储在仓库中来限制配送费用。鉴于好市多的节俭成本结构,该公司能够将其商品定价低于竞争零售商,从而推动每个仓库的高销售量,并使零售商能够以微薄的利润创造丰厚的利润。Costco在美国经营600多个仓库,在国内仓库俱乐部行业中占有60%以上的市场份额。在国际上,Costco还经营着另外270个仓库,主要位于加拿大、墨西哥、日本和英国等市场。

Where Is Costco Wholesale Standing Right Now?

Costco Wolesale 现在在哪里?

- Trading volume stands at 1,308,047, with COST's price down by -0.25%, positioned at $894.29.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 16 days.

- 交易量为1,308,047美元,COST的价格下跌了-0.25%,为894.29美元。

- RSI指标显示该股可能接近超买。

- 预计将在16天后公布财报。

Professional Analyst Ratings for Costco Wholesale

Costco 批发专业分析师评级

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $936.0.

在过去的一个月中,5位行业分析师分享了他们对该股的见解,提出平均目标价为936.0美元。

- An analyst from Loop Capital persists with their Buy rating on Costco Wholesale, maintaining a target price of $975.

- Reflecting concerns, an analyst from Redburn Atlantic lowers its rating to Neutral with a new price target of $890.

- An analyst from Stifel has decided to maintain their Buy rating on Costco Wholesale, which currently sits at a price target of $915.

- Maintaining their stance, an analyst from BMO Capital continues to hold a Outperform rating for Costco Wholesale, targeting a price of $950.

- Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Costco Wholesale, targeting a price of $950.

- Loop Capital的一位分析师坚持对好市多批发的买入评级,维持975美元的目标价格。

- 雷德本大西洋的一位分析师将其评级下调至中性,新的目标股价为890美元,这反映了人们的担忧。

- Stifel的一位分析师已决定维持对Costco Wholesale的买入评级,该评级目前的目标股价为915美元。

- BMO Capital的一位分析师保持立场,继续维持好市多批发的跑赢大盘评级,目标价格为950美元。

- 摩根士丹利的一位分析师保持立场,继续维持好市多批发的增持评级,目标价格为950美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。

In terms of liquidity and interest, the mean open interest for Costco Wholesale options trades today is 224.82 with a total volume of 2,474.00.

In terms of liquidity and interest, the mean open interest for Costco Wholesale options trades today is 224.82 with a total volume of 2,474.00.