MAYBANK Rises to RM10.8: Upward Surge Driven by Strong Technicals and Strategic Moves

MAYBANK Rises to RM10.8: Upward Surge Driven by Strong Technicals and Strategic Moves

MAYBANK Technical Analysis Chart:

马来亚银行技术面分析图表:

Technical Analysis:

技术面分析:

Support: RM9.800

Resistance: RM10.800

With a trading volume of 6.5M and a turnover of 69.76M, the market shows active trading and high participation.

MAYBANK’s stock price has been on an upward trend recently, with the current dense trading range around RM9.800. Investors should closely monitor whether the stock price can sustain above the support level. Further, attention should be given to whether the stock price can continue to break through the resistance level. If it does, the stock price is likely to continue rising.

压力位: RM9.800

支撑位: RM10.800

市场交投活跃,参与度高,成交量为650万,成交额为6976万。

马来亚银行股票最近呈上涨趋势,目前密集交易区域在RM9.800附近。投资者应密切关注股票价格是否能够保持在支撑位以上。此外,也要关注股票价格是否能够继续突破压力位。如果能够突破,股票价格有可能会继续上涨。

Market News:

市场资讯:

Impressive Financial Results: Since the release of the FY2024 financial report on August 28, the stock price has been on the rise. The company’s net operating income reached RM7.58 billion, a year-on-year increase of 19.2%, primarily driven by a substantial increase in non-interest income to RM2.7 billion, an impressive year-on-year growth of 79.2%. The surge in financial markets business earnings and the turnaround in insurance business profitability drove the revenue spike.

Strategic Investment: On September 11, MAYBANK announced a strategic investment in Funding Societies | Modalku (Funding Societies), Southeast Asia’s largest unified digital financial platform for micro, small, and medium enterprises (MSMEs). This investment aims to explore synergies with Funding Societies to promote inclusivity and bridge the funding gap within its served communities.

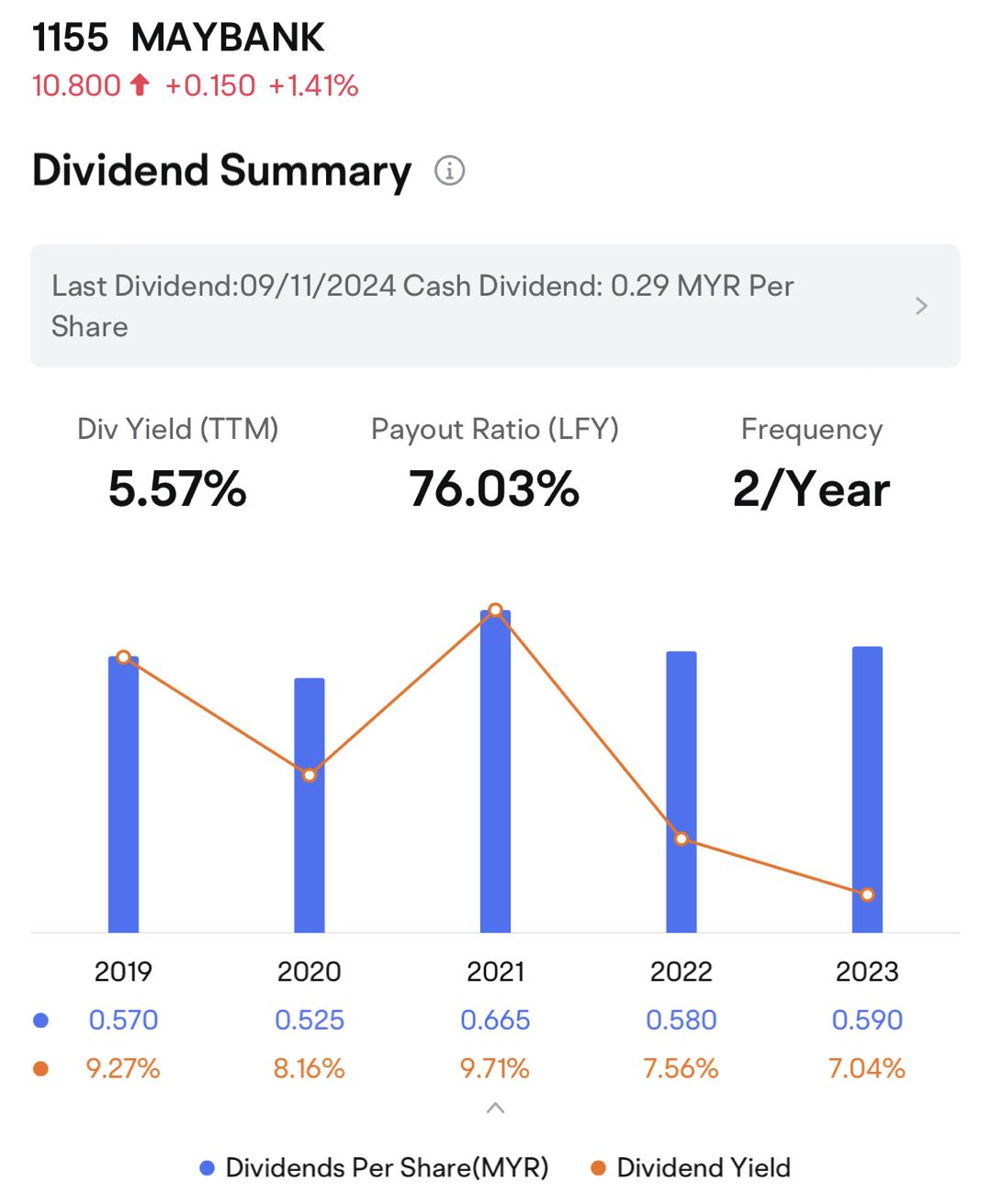

Dividend Payout: Currently, the company’s dividend yield stands at 5.57%, with semi-annual distributions. Historically, the company has consistently maintained stable dividend payments, demonstrating a commitment to returning value to shareholders. The latest announcement indicates that MAYBANK will go ex-dividend on September 11, 2024, with a dividend of RM0.29 per share. Stable shareholder returns can also boost investor sentiment, further driving the stock price upward.

令人印象深刻的财务成果:自8月28日发布2024财务报告以来,股价一直在上涨。公司的净营业收入达到75.8亿令吉,同比增长19.2%,主要由非利息收入大幅增加至27亿令吉,同比增长79.2%,金融市场业务收益的激增和保险业务盈利的扭亏为营收的激增提供了动力。

战略投资:5月11日,马来亚银行宣布对Funding Societies | Modalku(Funding Societies)进行战略投资,这是东南亚最大的统一数字金融平台,服务于中小企业(MSMEs)。这项投资旨在与Funding Societies探索协同效应,促进包容性,并弥合其服务社区内的资金缺口。

股息支付:目前,公司的股息率为5.57%,为半年度分配。历史上,公司一直维持稳定的股息支付,表明了对股东回报价值的承诺。最新公告表明,马来亚银行将在2024年9月11日除息,每股股息为0.29令吉。稳定的股东回报也能提振投资者情绪,进一步推动股价上涨。

Combined Analysis:

综合分析:

From a technical analysis perspective, MAYBANK’s stock exhibits a strong upward trend with high market participation. The current resistance level is at RM10.800. If the stock price can sustain above the support level and break through the resistance level, it is likely to continue rising.From the market news perspective, MAYBANK’s strategic investment in Funding Societies aims to leverage its banking expertise along with Funding Societies’ innovative digital platform to foster a robust MSME ecosystem. This move may create synergies and strengthen the company’s market position.Additionally, the company’s stable dividend announcement of RM0.29 per share enhances investor confidence. Solid fundamentals are likely to propel the stock price higher.

从技术分析的角度来看,马来亚银行的股票呈现出强劲的上涨趋势,市场参与度高。目前的阻力位于10.800马来西亚令吉。如果股价能够保持在支撑位上方并突破阻力位,可能会继续上涨。从市场资讯的角度来看,马来亚银行对Funding Societies的战略投资旨在利用其银行专业知识以及Funding Societies的创新数字平台,培育强大的MSME生态系统。此举可能会创造协同效应并加强公司的市场地位。此外,每股0.29马来西亚令吉的稳定股利公告增强了投资者信心。坚实的基本面可能会推动股价上涨。

With a trading volume of 6.5M and a turnover of 69.76M, the market shows active trading and high participation.

With a trading volume of 6.5M and a turnover of 69.76M, the market shows active trading and high participation.