What the Options Market Tells Us About UnitedHealth Group

What the Options Market Tells Us About UnitedHealth Group

Financial giants have made a conspicuous bearish move on UnitedHealth Group. Our analysis of options history for UnitedHealth Group (NYSE:UNH) revealed 44 unusual trades.

金融巨头对联合健康集团采取了明显的看跌举动。我们对联合健康集团(纽约证券交易所代码:UNH)期权历史的分析显示,有44笔不寻常的交易。

Delving into the details, we found 40% of traders were bullish, while 43% showed bearish tendencies. Out of all the trades we spotted, 27 were puts, with a value of $3,065,429, and 17 were calls, valued at $1,024,188.

深入研究细节,我们发现40%的交易者看涨,而43%的交易者表现出看跌倾向。在我们发现的所有交易中,有27笔是看跌期权,价值为3,065,429美元,17笔是看涨期权,价值1,024,188美元。

Predicted Price Range

预测的价格区间

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $440.0 and $700.0 for UnitedHealth Group, spanning the last three months.

在评估了交易量和未平仓合约之后,很明显,主要市场走势者将注意力集中在UnitedHealth Group在过去三个月的440.0美元至700.0美元之间的价格区间上。

Insights into Volume & Open Interest

对交易量和未平仓合约的见解

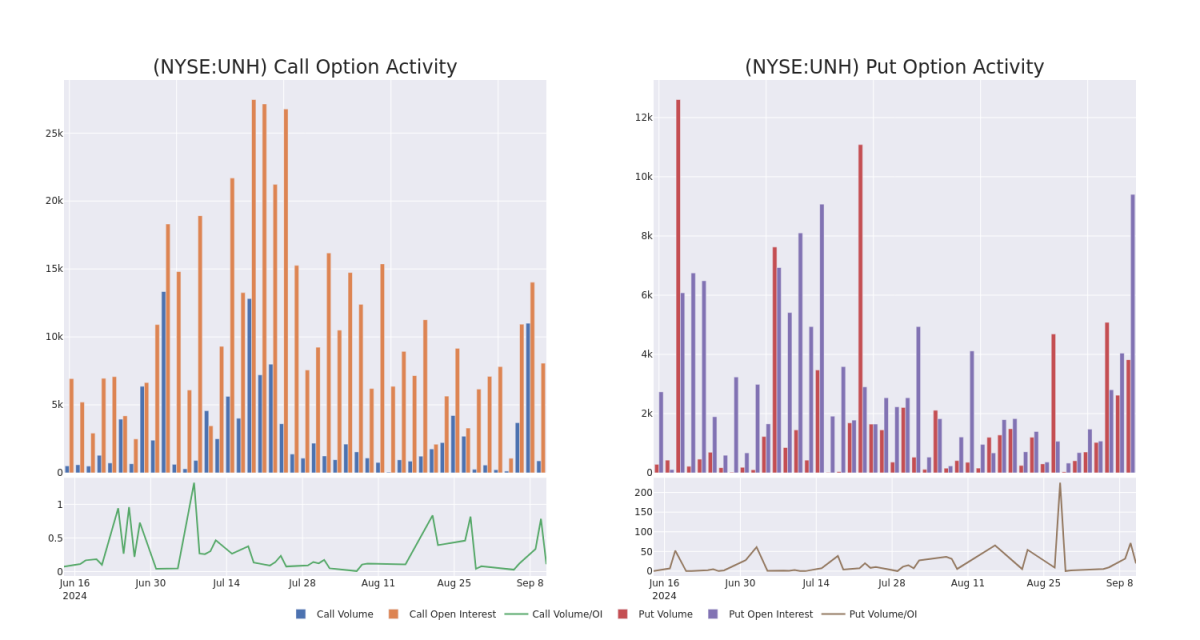

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

查看交易量和未平仓合约是一种对股票进行尽职调查的有见地的方法。

This data can help you track the liquidity and interest for UnitedHealth Group's options for a given strike price.

这些数据可以帮助您跟踪给定行使价下UnitedHealth Group期权的流动性和利息。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of UnitedHealth Group's whale activity within a strike price range from $440.0 to $700.0 in the last 30 days.

下面,我们可以观察过去30天内UnitedHealth Group所有鲸鱼活动的看涨和看跌期权交易量和未平仓合约的变化,其行使价在440.0美元至700.0美元之间。

UnitedHealth Group Call and Put Volume: 30-Day Overview

UnitedHealth 集团看涨和看跌交易量:30 天概览

Significant Options Trades Detected:

检测到的重要期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UNH | PUT | TRADE | BEARISH | 11/15/24 | $27.0 | $26.55 | $27.15 | $580.00 | $950.2K | 256 | 7 |

| UNH | PUT | SWEEP | BULLISH | 10/18/24 | $11.65 | $10.6 | $10.6 | $560.00 | $371.0K | 489 | 394 |

| UNH | PUT | TRADE | BEARISH | 09/13/24 | $8.1 | $7.4 | $8.1 | $590.00 | $261.6K | 465 | 379 |

| UNH | PUT | SWEEP | BEARISH | 09/20/24 | $8.25 | $7.55 | $8.25 | $575.00 | $206.2K | 170 | 39 |

| UNH | PUT | SWEEP | NEUTRAL | 12/20/24 | $8.8 | $8.7 | $8.77 | $510.00 | $148.0K | 229 | 424 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UNH | 放 | 贸易 | 粗鲁的 | 11/15/24 | 27.0 美元 | 26.55 美元 | 27.15 美元 | 580.00 美元 | 950.2K 美元 | 256 | 7 |

| UNH | 放 | 扫 | 看涨 | 10/18/24 | 11.65 美元 | 10.6 美元 | 10.6 美元 | 560.00 美元 | 371.0 万美元 | 489 | 394 |

| UNH | 放 | 贸易 | 粗鲁的 | 09/13/24 | 8.1 美元 | 7.4 美元 | 8.1 美元 | 590.00 美元 | 261.6 万美元 | 465 | 379 |

| UNH | 放 | 扫 | 粗鲁的 | 09/20/24 | 8.25 美元 | 7.55 美元 | 8.25 美元 | 575.00 美元 | 206.2 万美元 | 170 | 39 |

| UNH | 放 | 扫 | 中立 | 12/20/24 | 8.8 美元 | 8.7 美元 | 8.77 美元 | 510.00 美元 | 148.0 万美元 | 229 | 424 |

About UnitedHealth Group

关于联合健康集团

UnitedHealth Group is one of the largest private health insurers, providing medical benefits to about 50 million members globally, including 1 million outside the us as June 2024. As a leader in employer-sponsored, self-directed, and government-backed insurance plans, UnitedHealth has obtained massive scale in managed care. Along with its insurance assets, UnitedHealth's continued investments in its Optum franchises have created a healthcare services colossus that spans everything from medical and pharmaceutical benefits to providing outpatient care and analytics to both affiliated and third-party customers.

UnitedHealth Group是最大的私人健康保险公司之一,为全球约5000万名会员提供医疗福利,其中包括截至2024年6月美国以外的100万名会员。作为雇主赞助、自管和政府支持的保险计划的领导者,UnitedHealth在管理式医疗领域取得了巨大的规模。除了其保险资产外,UnitedHealth对其Optum特许经营权的持续投资还造就了医疗保健服务巨头,涵盖了从医疗和药品福利到为附属和第三方客户提供门诊护理和分析的方方面面。

In light of the recent options history for UnitedHealth Group, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鉴于UnitedHealth Group最近的期权历史,现在应该将重点放在公司本身上。我们的目标是探索其目前的表现。

Present Market Standing of UnitedHealth Group

联合健康集团目前的市场地位

- With a trading volume of 1,373,638, the price of UNH is down by -1.72%, reaching $588.72.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 30 days from now.

- UNH的交易量为1,373,638美元,价格下跌了-1.72%,至588.72美元。

- 当前的RSI值表明该股可能已接近超买。

- 下一份收益报告定于30天后发布。

Expert Opinions on UnitedHealth Group

关于联合健康集团的专家意见

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $591.0.

在过去的30天中,共有2位专业分析师对该股发表了看法,将平均目标股价定为591.0美元。

- An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $591.

- Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $591.

- 坎托·菲茨杰拉德的一位分析师将其评级下调至增持,目标股价为591美元。

- 坎托·菲茨杰拉德的一位分析师将其评级下调至增持,新的目标股价为591美元,这反映了人们的担忧。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。