RHBBANK Rises to RM6.24: A Promising Investment Amidst Market Volatility and Sustainable Growth Initiatives

RHBBANK Rises to RM6.24: A Promising Investment Amidst Market Volatility and Sustainable Growth Initiatives

$RHBBANK (1066.MY)$ Technical Analysis:

$RHBBANK (1066.MY)$ 技术面分析:

Support: RM6.280

Resistance: RM5.660

The current buy-sell ratio is -51.59%, indicating that selling pressure dominates the market, possibly due to profit-taking by investors. Given that most shareholders' cost basis is around RM5.6 and the current price is RM6.24, the majority of shareholders are in a profitable position and may choose to sell to lock in gains, thereby increasing selling pressure.

However, with the current price of RM6.240 above the support level of RM5.660, a Sharp decline in the short term is unlikely. If the price breaks through the resistance level of RM6.280, it is expected to rise further.

支撑位:RM6.280

压力位:RM5.660

当前的买卖比率为-51.59%,表明卖压主导市场,可能是由于投资者进行了获利了结。考虑到大多数股东的成本基础约为RM5.6,当前价格为RM6.24,大多数股东处于盈利地位,可能选择卖出以锁定收益,从而增加卖压。

然而,由于当前价格为RM6.240远高于RM5.660的支撑位,短期内的急剧下跌不太可能发生。如果价格突破RM6.280的阻力位,预计会进一步上涨。

Market News:

市场资讯:

1H FY2024 Financial Overview:

2024财年上半年财务概览:

On August 27, RHB Bank released its half-year financial report for the period ending June 30, 2024 ("1H FY2024"), showing a total revenue increase of over 10% to RM4.2 billion. The group attributed this significant growth to strong contributions from both net interest income and non-interest income.

RHb Bank于2024年6月30日(“2024 1H”)发布了截至该日的上半年财务报告,显示总营收增长超过10%,达到RM42亿。集团称这一显著增长归功于净利息收入和非利息收入的强劲贡献。

The group achieved a net profit of RM1.45 billion, slightly lower than the RM1.57 billion recorded in the first half of last year, with the return on equity ("ROE") rising to 9.6%. Additionally, RHB’s cost-to-income ratio improved to 46.3%, reflecting effective cost management.

集团实现了14.5亿令吉的净利润,略低于去年上半年的15.7亿令吉;ROE提高至9.6%。此外,RHb的成本收入比率改善至46.3%,反映了有效的成本管理。

Collaborative Progress:

协作进展:

On September 4, RHB Banking Group, in collaboration with BNP Paribas Malaysia Berhad, launched Malaysia’s first sustainable use-of-proceeds (UOP) cross-currency repurchase (repo) transaction. This cross-currency repo involving Australian dollars and Malaysian ringgit bonds aims to support SMEs transitioning to sustainability.

9月4日,RHb银行集团与法国巴黎银行马来西亚分行合作,推出了马来西亚首个可持续使用收益(UOP)的跨货币回购(repo)交易。这笔跨货币回购涉及澳大利亚元和马来西亚令吉债券,旨在支持中小企业过渡到可持续发展。

The banking group plans to achieve a RM50 billion sustainable finance goal by 2026. To date, RM31 billion has been mobilized, accounting for 62% of the 2026 target, demonstrating significant progress and reinforcing its commitment to supporting businesses in transitioning to low-carbon practices. RHB positions itself as a catalyst for sustainable business and a leader in advancing a low-carbon future.

该银行集团计划在2026年实现500亿令吉的可持续金融目标。截至目前,已动员310亿令吉,占2026年目标的62%,展示了显著的进展,并进一步证明了其支持企业转向低碳实践的承诺。RHb将自己定位为可持续业务的推动者和低碳未来的领导者。

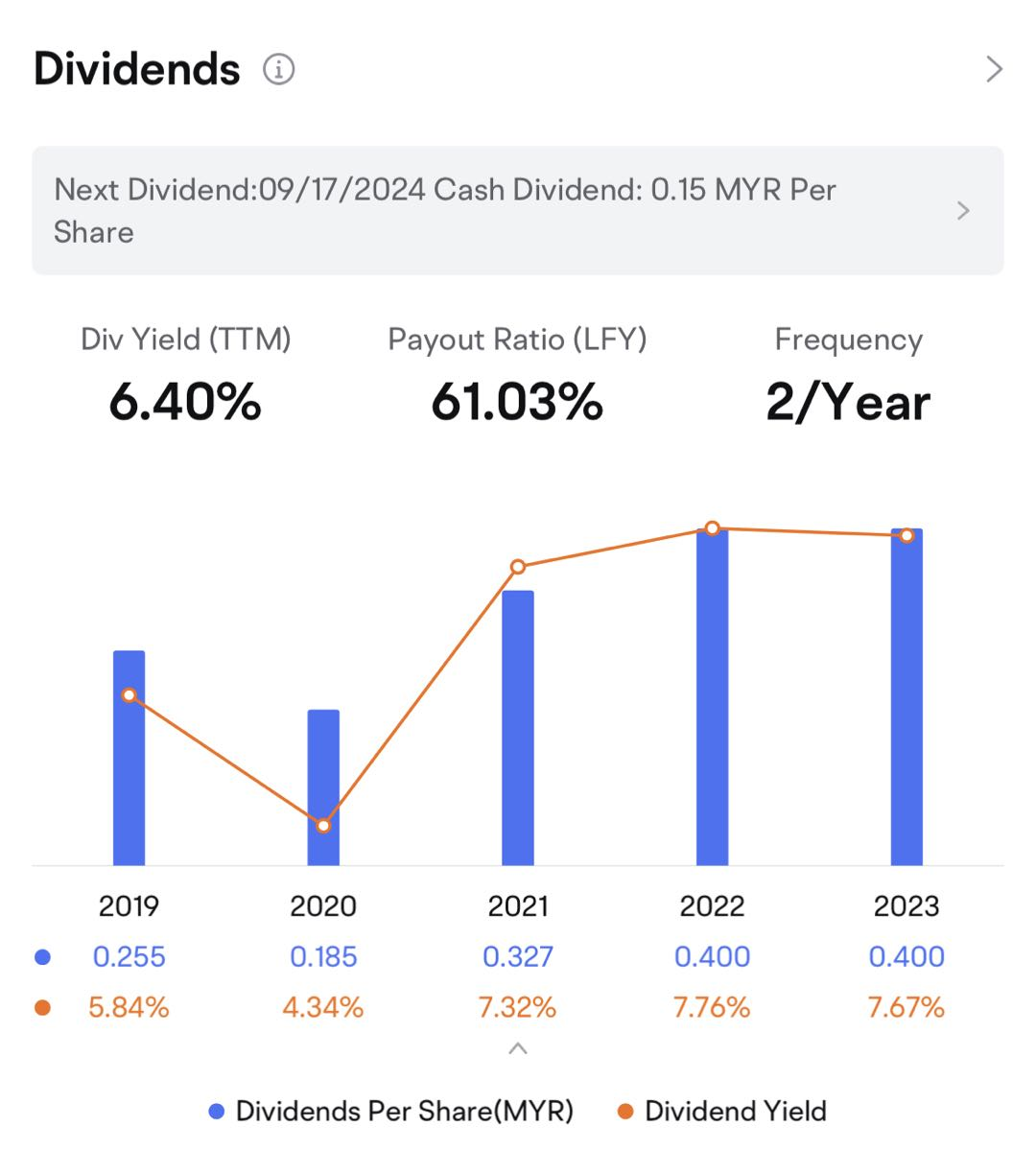

Dividend Payout:

股息支付:

RHBBANK is also favored for its high dividend yield of approximately 6.4%, providing stable returns amid capital market pressures. The next payout will be on September 17, 2024, with a dividend of RM0.15 per share.

RHBBANk还因其约6.4%的高股息收益而备受青睐,在资本市场压力下提供稳定的回报。下一次股息支付将在2024年9月17日进行,每股股息为0.15令吉。

Combined Analysis:

综合分析:

The current stock price is above the support level, indicating strong market support. Despite some selling pressure, if the stock price can break through the resistance level, it will offer further upside potential for investors.

目前股价高于支撑位,表明市场支撑差。尽管存在一些卖压,如果股价能突破阻力位,将为投资者提供进一步的上行潜力。

RHB Banking Group’s proactive engagement in sustainable finance, in collaboration with BNP Paribas, lays a solid foundation for its long-term growth. The upcoming dividend payout will further enhance its appeal to value investors.

RHb银行集团在可持续金融方面采取积极参与,在与巴黎银行的合作中为其长期增长打下了坚实基础。即将到来的股息派发将进一步增强其对价值投资者的吸引力。

In summary, RHB Banking Group’s stock shows positive signals both technically and fundamentally. While short-term market fluctuations may occur, its strategic positioning in sustainable finance and robust dividend policy make it a noteworthy investment prospect in the long term.

总之,RHb银行集团股票在技术面和基本面都显示出积极信号。虽然短期市场波动可能会发生,但其在可持续金融的战略定位和强劲的股息政策使其成为长期投资中值得关注的投资前景。

However, with the current price of RM6.240 above the support level of RM5.660, a Sharp decline in the short term is unlikely. If the price breaks through the resistance level of RM6.280, it is expected to rise further.

However, with the current price of RM6.240 above the support level of RM5.660, a Sharp decline in the short term is unlikely. If the price breaks through the resistance level of RM6.280, it is expected to rise further.