Wall Street's Most Accurate Analysts Spotlight On 3 Real Estate Stocks With Over 7% Dividend Yields

Wall Street's Most Accurate Analysts Spotlight On 3 Real Estate Stocks With Over 7% Dividend Yields

华尔街最准确的分析师关注的3只房地产股票,股息收益率超过7%

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

在市场动荡和不确定的时期,许多投资者会转向股息收益股,这些通常是具有较高的自由现金流并以高红利派息奖励股东的公司。

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Benzinga读者可以通过访问分析师股票评级页面来查看他们最喜欢的股票的最新分析师意见。交易员可以整理Benzinga的庞大分析师评级数据库,包括通过分析师准确度进行排序。

Below are the ratings of the most accurate analysts for three high-yielding stocks in the real estate sector.

以下是房地产板块中三个高股息股票最准确的分析师评级。

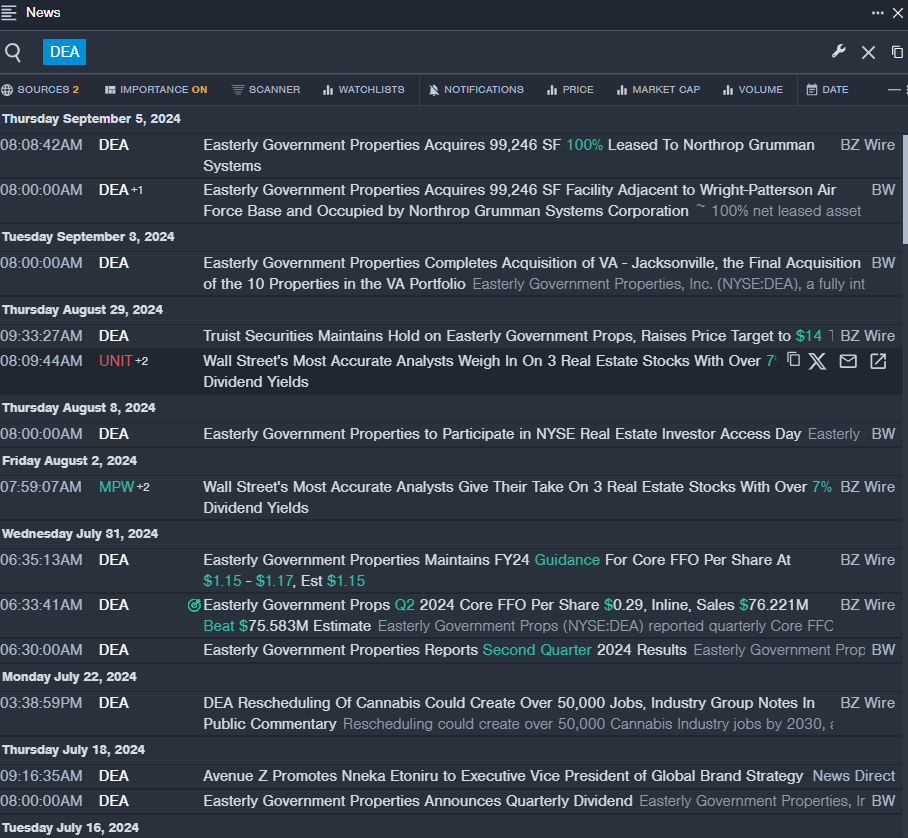

Easterly Government Properties, Inc. (NYSE:DEA)

Easterly Government Properties, Inc.(NYSE:DEA)

- Dividend Yield: 7.99%

- Truist Securities analyst Michael Lewis maintained a Hold rating and raised the price target from $13 to $14 on Aug. 29. This analyst has an accuracy rate of 70%.

- RBC Capital analyst Michael Carroll downgraded the stock from Sector Perform to Underperform and cut the price target from $15 to $13 on Aug. 16, 2023. This analyst has an accuracy rate of 64%.

- Recent News: On Sept. 5, Easterly Government Properties acquired 99,246 SF 100% leased to Northrop Grumman Systems.

- Benzinga Pro's real-time newsfeed alerted to latest DEA news.

- 股息收益率:7.99%

- Truist Securities分析师Michael Lewis于8月29日维持了持有(Hold)评级,并将目标价从13美元上调至14美元。该分析师的准确率为70%。

- RBC Capital分析师Michael Carroll于2023年8月16日将股票评级从板块表现降级至低于预期,并将目标价从15美元下调至13美元。该分析师的准确率为64%。

- 最新资讯:9月5日,Easterly Government Properties收购了99,246平方英尺的100%租给诺斯罗普格鲁曼系统的房地产。

- Benzinga Pro的实时新闻提醒了最新的DEA新闻。

Clipper Realty Inc. (NYSE:CLPR)

Clipper Realty Inc.(纽交所:CLPR)

- Dividend Yield: 7.44%

- Raymond James analyst Buck Horne downgraded the stock from Outperform to Underperform on April 15. This analyst has an accuracy rate of 74%.

- JMP Securities analyst Aaron Hecht downgraded the stock from Market Outperform to Market Perform on April 11. This analyst has an accuracy rate of 63%.

- Recent News: On Aug. 1, Clipper Realty reported better-than-expected second-quarter revenue and FFO results.

- Benzinga Pro's charting tool helped identify the trend in CLPR stock.

- 股息收益率:7.44%

- Raymond James的分析师Buck Horne于4月15日将该股评级从跑赢市场降级为表现不佳。这位分析师的准确率为74%。

- JMP Securities的分析师Aaron Hecht于4月11日将该股评级从市场跑赢降级为市场表现。这位分析师的准确率为63%。

- 最新资讯:Clipper Realty 在 8 月 1 日报告了超出预期的第二季度营业收入和FFO结果。

- Benzinga Pro的图表工具帮助识别了CLPR股票的趋势。

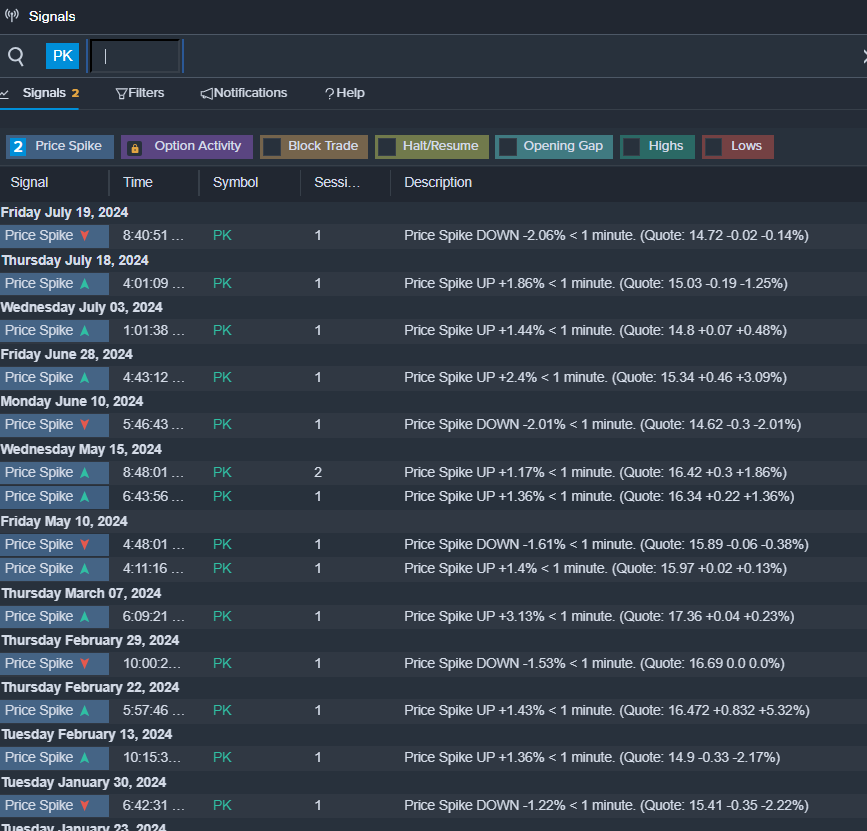

Park Hotels & Resorts Inc. (NYSE:PK)

Park Hotels & Resorts Inc.(纽交所:PK)

- Dividend Yield: 7.32%

- Truist Securities analyst Patrick Scholes maintained a Buy rating and cut the price target from $20 to $18 on Sept. 4. This analyst has an accuracy rate of 70%.

- UBS analyst Robin Farley maintained a Neutral rating and cut the price target from $18 to $14 on Aug. 16. This analyst has an accuracy rate of 84%.

- Recent News: On July 31, Park Hotels & Resorts posted weak quarterly sales.

- Benzinga Pro's signals feature notified of a potential breakout in PK shares.

- 股息收益率:7.32%

- Truist Securities的分析师Patrick Scholes维持买入评级,并于9月4日将目标价格从20万亿美元下调至18美元。该分析师准确率为70%。

- UBS的分析师Robin Farley维持中立评级,并于8月16日将目标价格从18美元下调至14美元。该分析师准确率为84%。

- 最新资讯:7月31日,帕客酒店及度假村公布了低迷的季度销售额。

- Benzinga Pro的信号特征指示Pk股票有潜力突破。

Read More:

阅读更多:

- Jim Cramer: 'Not The Time To Own Oil,' When Asked About Exxon Mobil; Says IBM Is 'Performing Well'

- 吉姆·克拉默:当被问及埃克森美孚时,他表示现在不是拥有石油的时候;他称IBM表现良好。