Unpacking the Latest Options Trading Trends in Johnson & Johnson

Unpacking the Latest Options Trading Trends in Johnson & Johnson

Whales with a lot of money to spend have taken a noticeably bullish stance on Johnson & Johnson.

有大量资金可以花的鲸鱼对强生公司采取了明显的看涨立场。

Looking at options history for Johnson & Johnson (NYSE:JNJ) we detected 10 trades.

查看强生(纽约证券交易所代码:JNJ)的期权历史记录,我们发现了10笔交易。

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 30% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,50%的投资者以看涨的预期开启交易,30%的投资者持看跌预期。

From the overall spotted trades, 5 are puts, for a total amount of $552,410 and 5, calls, for a total amount of $522,817.

在所有已发现的交易中,有5笔是看跌期权,总额为552,410美元,5笔是看涨期权,总额为522,817美元。

Projected Price Targets

预计价格目标

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $155.0 to $170.0 for Johnson & Johnson over the last 3 months.

考虑到这些合约的交易量和未平仓合约,在过去的3个月中,鲸鱼的目标价格似乎在155.0美元至170.0美元之间。

Insights into Volume & Open Interest

对交易量和未平仓合约的见解

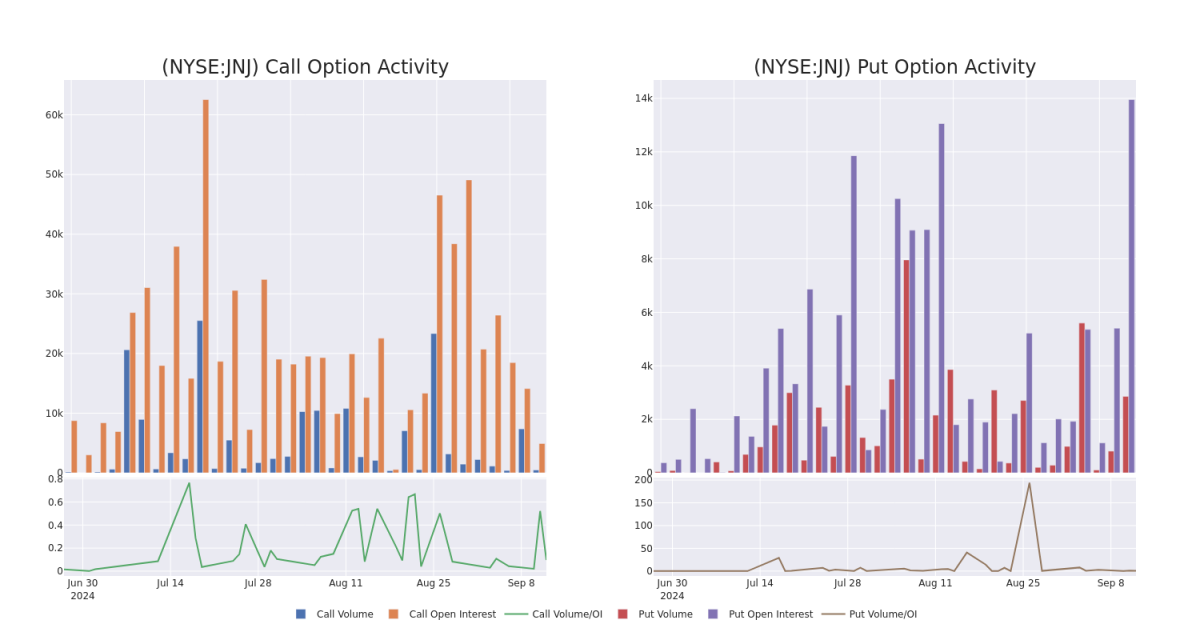

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

查看交易量和未平仓合约是一种对股票进行尽职调查的有见地的方法。

This data can help you track the liquidity and interest for Johnson & Johnson's options for a given strike price.

这些数据可以帮助您跟踪给定行使价下强生期权的流动性和利息。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Johnson & Johnson's whale activity within a strike price range from $155.0 to $170.0 in the last 30 days.

下面,我们可以分别观察过去30天在155.0美元至170.0美元行使价范围内强生所有鲸鱼活动的看涨和看跌期权交易量和未平仓合约的变化。

Johnson & Johnson 30-Day Option Volume & Interest Snapshot

强生30天期权交易量和利息快照

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JNJ | PUT | TRADE | BULLISH | 01/17/25 | $4.65 | $4.55 | $4.56 | $160.00 | $410.4K | 4.8K | 1.2K |

| JNJ | CALL | TRADE | BULLISH | 04/17/25 | $15.7 | $15.15 | $15.59 | $155.00 | $144.9K | 7 | 93 |

| JNJ | CALL | SWEEP | BEARISH | 01/17/25 | $13.5 | $13.45 | $13.45 | $155.00 | $121.0K | 3.3K | 114 |

| JNJ | CALL | TRADE | BULLISH | 06/20/25 | $13.7 | $12.75 | $13.7 | $160.00 | $119.1K | 1.4K | 87 |

| JNJ | CALL | SWEEP | NEUTRAL | 09/19/25 | $10.65 | $9.4 | $9.6 | $170.00 | $80.6K | 8 | 95 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JNJ | 放 | 贸易 | 看涨 | 01/17/25 | 4.65 美元 | 4.55 美元 | 4.56 美元 | 160.00 美元 | 410.4 万美元 | 4.8K | 1.2K |

| JNJ | 打电话 | 贸易 | 看涨 | 04/17/25 | 15.7 美元 | 15.15 美元 | 15.59 美元 | 155.00 美元 | 144.9 万美元 | 7 | 93 |

| JNJ | 打电话 | 扫 | 粗鲁的 | 01/17/25 | 13.5 美元 | 13.45 美元 | 13.45 美元 | 155.00 美元 | 121.0K | 3.3K | 114 |

| JNJ | 打电话 | 贸易 | 看涨 | 06/20/25 | 13.7 美元 | 12.75 美元 | 13.7 美元 | 160.00 美元 | 119.1 万美元 | 1.4K | 87 |

| JNJ | 打电话 | 扫 | 中立 | 09/19/25 | 10.65 美元 | 9.4 美元 | 9.6 美元 | 170.00 美元 | 80.6 万美元 | 8 | 95 |

About Johnson & Johnson

关于强生公司

Johnson & Johnson is the world's largest and most diverse healthcare firm. It has two divisions: pharmaceutical and medical devices. These now represent all of the company's sales following the divestment of the consumer business, Kenvue, in 2023. The drug division focuses on the following therapeutic areas: immunology, oncology, neurology, pulmonary, cardiology, and metabolic diseases. Geographically, just over half of total revenue is generated in the United States.

强生是世界上最大、最多元化的医疗保健公司。它有两个部门:制药和医疗器械。这些现在代表了该公司在2023年撤资消费业务Kenvue之后的所有销售额。该药物部门专注于以下治疗领域:免疫学、肿瘤学、神经病学、肺部、心脏病学和代谢性疾病。从地理位置上看,总收入的略超过一半来自美国。

After a thorough review of the options trading surrounding Johnson & Johnson, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对强生公司的期权交易进行了全面审查之后,我们将对该公司进行更详细的审查。这包括评估其当前的市场状况和表现。

Johnson & Johnson's Current Market Status

强生公司当前的市场状况

- With a trading volume of 4,494,400, the price of JNJ is down by -0.11%, reaching $164.64.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 33 days from now.

- JNJ的交易量为4,494,400美元,下跌了-0.11%,至164.64美元。

- 当前的RSI值表明该股可能已接近超买。

- 下一份收益报告定于现在起33天后发布。

Professional Analyst Ratings for Johnson & Johnson

强生公司的专业分析师评级

2 market experts have recently issued ratings for this stock, with a consensus target price of $215.0.

2位市场专家最近发布了该股的评级,共识目标价为215.0美元。

- An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $215.

- Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $215.

- 坎托·菲茨杰拉德的一位分析师将其行动评级下调至增持,目标股价为215美元。

- 坎托·菲茨杰拉德的一位分析师将其评级下调至增持,新的目标股价为215美元,这反映了担忧。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Johnson & Johnson with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高利润的潜力。精明的交易者通过持续的教育、战略贸易调整、利用各种指标以及随时关注市场动态来降低这些风险。使用Benzinga Pro了解强生公司的最新期权交易,以获取实时警报。

From the overall spotted trades, 5 are puts, for a total amount of $552,410 and 5, calls, for a total amount of $522,817.

From the overall spotted trades, 5 are puts, for a total amount of $552,410 and 5, calls, for a total amount of $522,817.