Market Whales and Their Recent Bets on BNTX Options

Market Whales and Their Recent Bets on BNTX Options

Investors with a lot of money to spend have taken a bearish stance on BioNTech (NASDAQ:BNTX).

拥有大量资金的投资者对BioNTech (纳斯达克:BNTX) 采取了看淡的态度。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我们在这里追踪的公开期权历史记录上看到交易时发现了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with BNTX, it often means somebody knows something is about to happen.

无论是机构还是富裕的个人,我们都不知道。但当BNTX发生这么大的事情时,通常意味着有人知道即将发生什么事情。

So how do we know what these investors just did?

那么我们如何知道这些投资者刚刚做了什么呢?

Today, Benzinga's options scanner spotted 19 uncommon options trades for BioNTech.

今天,Benzinga的期权扫描器发现了19次BioNTech的非常规期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 31% bullish and 63%, bearish.

这些大笔资金交易者的整体情绪分为31%看好和63%看淡。

Out of all of the special options we uncovered, 4 are puts, for a total amount of $127,500, and 15 are calls, for a total amount of $910,265.

在我们发现的所有特殊期权中,有4个看跌期权,总金额为127,500美元,有15个看涨期权,总金额为910,265美元。

What's The Price Target?

目标价是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $95.0 to $200.0 for BioNTech over the last 3 months.

考虑到这些合约的成交量和持仓量,看起来鲸鱼们在过去3个月里一直瞄准着BioNTech的股价区间在95.0美元到200.0美元之间。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

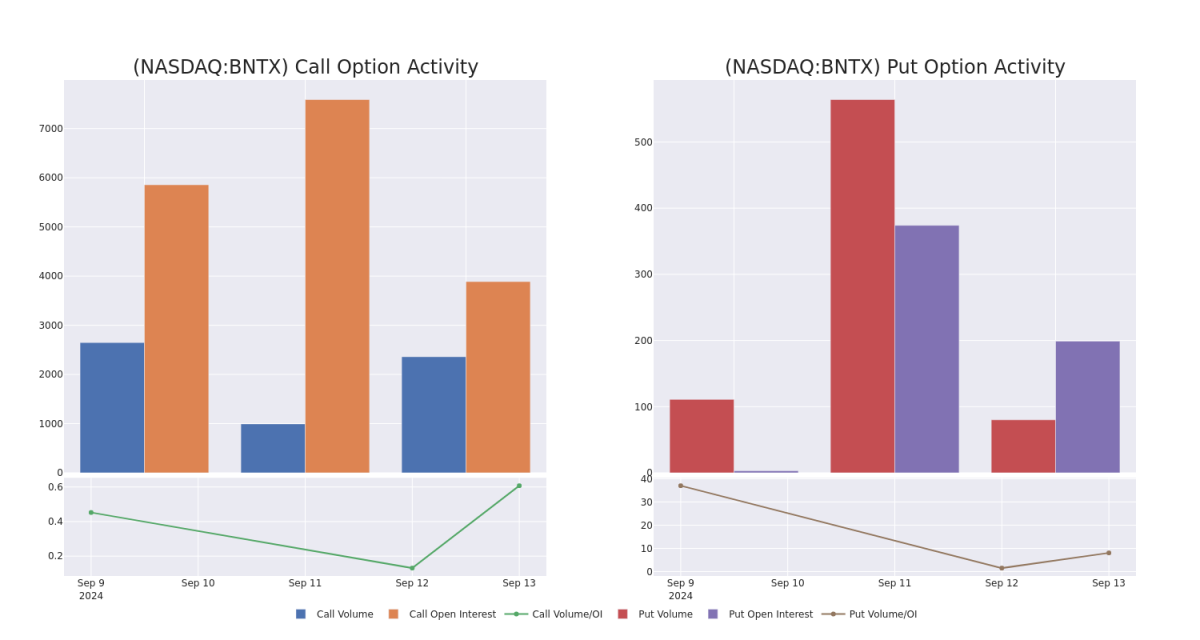

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for BioNTech's options for a given strike price.

这些数据可以帮助您跟踪BioNTech某个行权价的期权的流动性和利息。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of BioNTech's whale activity within a strike price range from $95.0 to $200.0 in the last 30 days.

下面,我们可以观察该股最近30天内所有看涨和看跌期权的成交量和持仓量的变化,范围是从95.0美元到200.0美元。

BioNTech 30-Day Option Volume & Interest Snapshot

BioNTech 30天期权成交量及利息快照

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BNTX | CALL | TRADE | BEARISH | 09/20/24 | $22.6 | $20.4 | $21.1 | $95.00 | $116.0K | 2.5K | 396 |

| BNTX | CALL | SWEEP | BULLISH | 09/20/24 | $19.0 | $18.1 | $19.0 | $95.00 | $115.9K | 2.5K | 167 |

| BNTX | CALL | TRADE | BEARISH | 09/20/24 | $21.1 | $18.4 | $19.0 | $95.00 | $102.6K | 2.5K | 53 |

| BNTX | CALL | TRADE | BULLISH | 09/20/24 | $19.0 | $18.2 | $19.0 | $95.00 | $83.6K | 2.5K | 228 |

| BNTX | CALL | TRADE | BEARISH | 09/20/24 | $22.4 | $20.5 | $21.1 | $95.00 | $73.8K | 2.5K | 396 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BNTX | 看涨 | 交易 | 看淡 | 09/20/24 | $22.6 | $20.4 | $21.1 | $ 95.00 | $116.0K | 2.5千 | 396 |

| BNTX | 看涨 | SWEEP | 看好 | 09/20/24 | $19.0 | $18.1 | $19.0 | $ 95.00 | 115.9K美元 | 2.5千 | 167 |

| BNTX | 看涨 | 交易 | 看淡 | 09/20/24 | $21.1 | $18.4 | $19.0 | $ 95.00 | $102.6K | 2.5千 | 53 |

| BNTX | 看涨 | 交易 | 看好 | 09/20/24 | $19.0 | $18.2 | $19.0 | $ 95.00 | $83.6K | 2.5千 | 228 |

| BNTX | 看涨 | 交易 | 看淡 | 09/20/24 | $22.4 | $20.5 | $21.1 | $ 95.00 | $73.8K | 2.5千 | 396 |

About BioNTech

生物制药新技术是一家开创癌症和其他严重疾病新疗法的下一代免疫治疗公司。该公司利用广泛的计算发现和治疗药物平台,快速开发新型生物制药。其广泛的肿瘤学产品候选品组合包括个性化和即用型基于 mRNA 的疗法、创新的嵌合抗原受体 T 细胞、双特异性免疫检查点调节剂、有针对性的癌症抗体和小分子化合物。基于其在 mRNA 疫苗开发和内部

BioNTech is a Germany-based biotechnology company that focuses on developing cancer therapeutics, including individualized immunotherapy, as well as vaccines for infectious diseases, including covid. The company's oncology pipeline contains several classes of drugs, including mRNA-based drugs to encode antigens, neoantigens, cytokines, and antibodies; cell therapies; bispecific antibodies; and antibody-drug conjugates. BioNTech is partnered with several large pharmaceutical companies, including Roche, Eli Lilly, Pfizer, Sanofi, and Genmab. Covid vaccine Comirnaty is its first commercialized product.

biontech是一家总部位于德国的生物技术公司,专注于开发癌症治疗药物,包括个体化免疫疗法以及包括covid在内的传染性疾病疫苗。该公司的肿瘤学流水线包含几类药物,包括mRNA药物来编码抗原、新抗原、细胞因子和抗体、细胞疗法、双特异性抗体和抗体药物偶联物。biontech与几家大型制药公司合作,包括罗氏、礼来、辉瑞、赛诺菲安万特和genmab。covid疫苗Comirnaty是该公司的第一个商业化产品。

Present Market Standing of BioNTech

生物-疫苗的现行市场地位

- With a volume of 492,652, the price of BNTX is up 6.46% at $111.78.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 52 days.

- 成交量为492,652,BNTX的价格上涨6.46%,为$111.78。

- RSI因子暗示底层股票可能被超买。

- 下一轮收益预计在52天内发布。

What Analysts Are Saying About BioNTech

关于biontech,分析师的看法

3 market experts have recently issued ratings for this stock, with a consensus target price of $105.66666666666667.

最近有3位市场专家对这只股票进行了评级,一致认为目标价为105.66666666666667美元。

- An analyst from JP Morgan has decided to maintain their Underweight rating on BioNTech, which currently sits at a price target of $91.

- In a cautious move, an analyst from HC Wainwright & Co. downgraded its rating to Buy, setting a price target of $113.

- An analyst from HC Wainwright & Co. has revised its rating downward to Buy, adjusting the price target to $113.

- JP摩根的一位分析师决定维持他们对biontech的低配评级,目前的价格目标为91美元。

- HC Wainwright & Co.的一位分析师采取谨慎的行动,将其评级下调为买入,并设定目标价为113美元。

- HC Wainwright&Co.的一位分析师将其评级下调为买入,并将目标价调整为113美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest BioNTech options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在回报。精明的交易者通过不断学习,调整策略,监控多个因子,并密切关注市场动态来管理这些风险。通过Benzinga Pro的实时警报及时了解最新的biontech期权交易信息。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with BNTX, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with BNTX, it often means somebody knows something is about to happen.