S&P Global Unusual Options Activity

S&P Global Unusual Options Activity

High-rolling investors have positioned themselves bearish on S&P Global (NYSE:SPGI), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in SPGI often signals that someone has privileged information.

高风险投资者已看淡标普环球(S&P Global,纽交所:SPGI),对于散户交易者来说这一点很重要。 通过Benzinga对公开的期权数据进行跟踪,我们今天注意到了这一活动。这些投资者的身份尚不确定,但SPGI的这种重大变动通常意味着有人掌握特权信息。

Today, Benzinga's options scanner spotted 8 options trades for S&P Global. This is not a typical pattern.

今天,Benzinga的期权扫描器发现了8笔标普环球的期权交易。这不是一个典型的模式。

The sentiment among these major traders is split, with 12% bullish and 87% bearish. Among all the options we identified, there was one put, amounting to $77,000, and 7 calls, totaling $208,800.

这些重要交易参与者的情绪分为看涨12%和看淡87%。 在我们识别出的所有期权中,有一项看跌,金额为77,000美元,还有7项看涨,总额为208,800美元。

Expected Price Movements

预期价格波动

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $490.0 to $580.0 for S&P Global over the recent three months.

根据交易活动,看来这些重要投资者的目标价区间是标普环球在最近三个月内从490.0美元到580.0美元。

Insights into Volume & Open Interest

成交量和持仓量分析

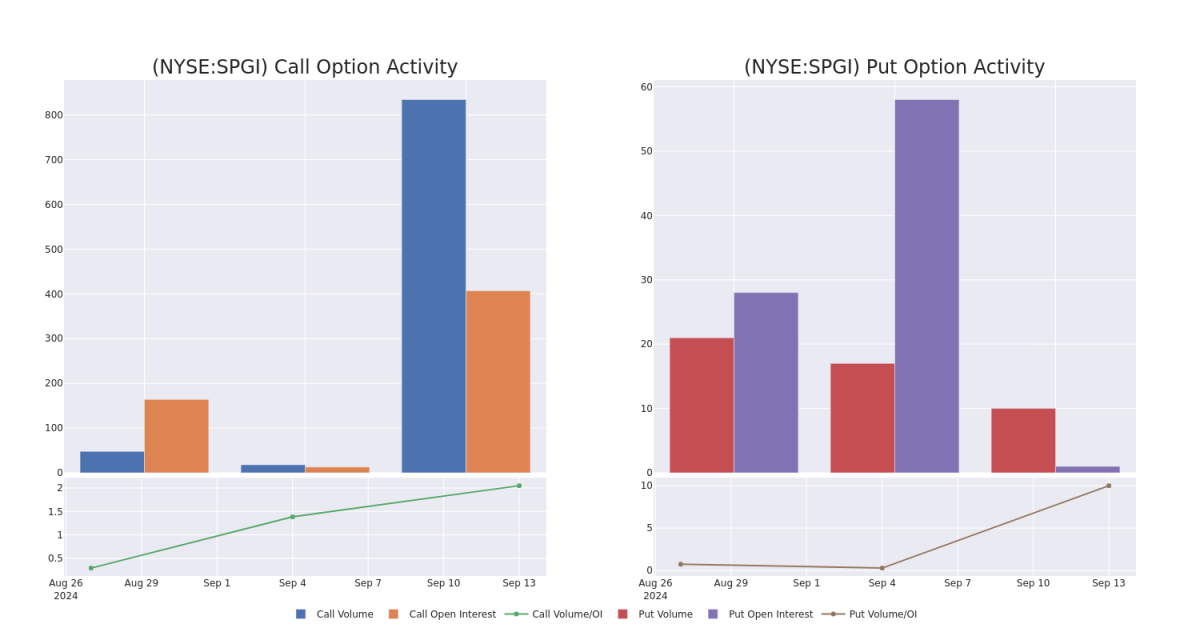

In terms of liquidity and interest, the mean open interest for S&P Global options trades today is 136.0 with a total volume of 844.00.

就流动性和兴趣而言,标普环球期权交易的平均持仓量是136.0,总成交量为844.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for S&P Global's big money trades within a strike price range of $490.0 to $580.0 over the last 30 days.

在下图中,我们可以追踪标普环球的看涨和看跌期权在490.0美元到580.0美元的行权价格区间内过去30天的成交量和持仓量的变化。

S&P Global Call and Put Volume: 30-Day Overview

S&P Global Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SPGI | PUT | TRADE | BEARISH | 12/18/26 | $79.0 | $70.4 | $77.0 | $550.00 | $77.0K | 1 | 10 |

| SPGI | CALL | TRADE | BULLISH | 09/20/24 | $33.1 | $27.1 | $30.9 | $490.00 | $37.0K | 322 | 12 |

| SPGI | CALL | SWEEP | BEARISH | 01/17/25 | $10.0 | $7.5 | $7.5 | $580.00 | $30.0K | 85 | 112 |

| SPGI | CALL | SWEEP | BEARISH | 01/17/25 | $8.9 | $7.5 | $7.5 | $580.00 | $29.2K | 85 | 296 |

| SPGI | CALL | SWEEP | BEARISH | 01/17/25 | $10.0 | $7.5 | $7.5 | $580.00 | $29.2K | 85 | 152 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SPGI | 看跌 | 交易 | 看淡 | 12/18/26 | $79.0 | $70.4 | $77.0 | $550.00 | $77.0K | 1 | 10 |

| SPGI | 看涨 | 交易 | 看好 | 09/20/24 | $33.1 | $27.1 | $30.9 | $490.00 | $37.0K | 322 | 12 |

| SPGI | 看涨 | SWEEP | 看淡 | 01/17/25 | $10.0 | $7.5 | $7.5 | $30.0K | 85 | 112 | |

| SPGI | 看涨 | SWEEP | 看淡 | 01/17/25 | $8.9 | $7.5 | $7.5 | $29.2K | 85 | 296 | |

| SPGI | 看涨 | SWEEP | 看淡 | 01/17/25 | $10.0 | $7.5 | $7.5 | $29.2K | 85 | 152 |

About S&P Global

关于S&P Global

S&P Global provides data and benchmarks to capital and commodity market participants. Its ratings business is the largest credit rating agency in the world and S&P's largest segment by profitability. S&P's largest segment by revenue is market intelligence, which provides desktop, data and advisory solutions, enterprise solutions, and credit/risk solutions mostly in the financial-services industry. S&P's other segments include commodity insights (Platts and other data), mobility (Carfax), and indexes.

标普全球为资本和商品市场参与者提供数据和基准。其评级业务是世界上最大的信用评级机构,也是标普利润最大的板块。标普利润最大的板块是市场情报,该板块主要为金融服务行业提供桌面、数据和咨询解决方案、企业解决方案以及信用/风险解决方案。标普的其他板块包括商品信息(普氏和其他数据)、移动(Carfax)和指数。

After a thorough review of the options trading surrounding S&P Global, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

经过对标的交易的彻底审查,我们转而更详细地审视这家公司。这包括对其当前市场地位和业绩的评估。

Where Is S&P Global Standing Right Now?

S&P Global目前处于什么位置?

- With a volume of 556,875, the price of SPGI is down -0.16% at $519.16.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 48 days.

- 成交量为556,875,SPGI的价格下跌了-0.16%,为519.16美元。

- RSI因子暗示底层股票可能被超买。

- 下一个季度收益预计48天后公布。

Professional Analyst Ratings for S&P Global

标普全球的专业分析师评级

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $587.0.

过去30天内共有2位专业分析师对这支股票发表了看法,设定了目标价为587.0美元。

- Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for S&P Global, targeting a price of $564.

- Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on S&P Global with a target price of $610.

- 摩根士丹利的分析师继续维持对标普全球的超配评级,并设定目标价为564美元。

- 巴克莱银行的分析师一直保持对标普全球的超配评级,并设定目标价为610美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest S&P Global options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在回报。精明的交易员通过不断学习,调整策略,监控多个因子并密切关注市场走势来管理这些风险。通过Benzinga Pro的实时提醒及时了解最新的标普全球期权交易。