Markets Weekly Update (September 13) : FOMC Decision Hangs in the Balance, 25 Basis Points Increase Appears More Probable

Markets Weekly Update (September 13) : FOMC Decision Hangs in the Balance, 25 Basis Points Increase Appears More Probable

Macro Matters

宏观事项

FOMC Decision Hangs in the Balance, 25 Basis Points Cut Appears More Probable

FOMC决定悬而未决,25个基点的降息似乎更有可能

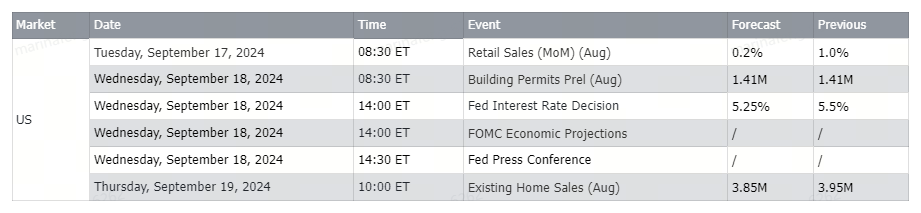

The Federal Reserve will make the decision on interest rates and release the latest quarterly economic forecast and interest rate dot ploton September 18.

美联储将于9月18日做出利率决定,并发布最新的季度经济预测和利率点阵图。

Traders are betting on a 55% chance that the Fed will cut rates by 25bp and a 45% chance of a 50bp cut.

交易员押注联邦储备委员会降息25个基点的几率为55%,降息50个基点的几率为45%。

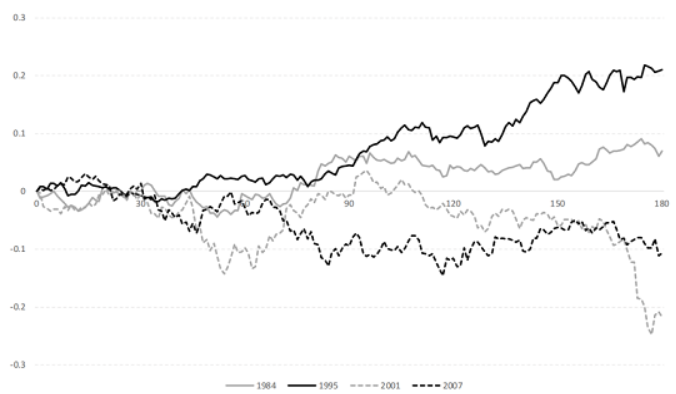

Chart: Dow Jones Index Performance After Rate Cuts

图表:道琼斯指数在降息后的表现

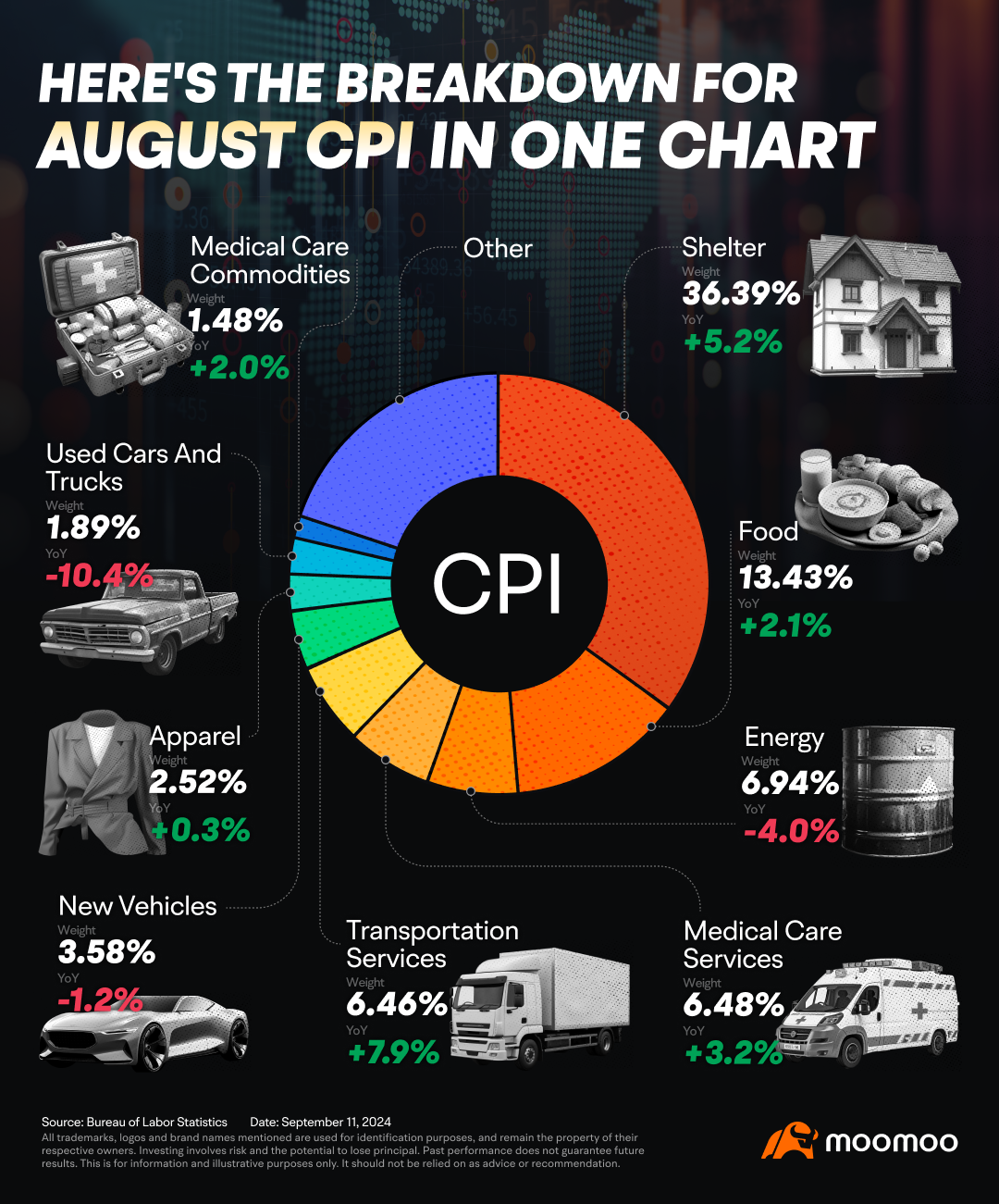

Annual CPI Hits Lowest Since Early 2021

年度消费者价格指数自2021年初以来最低

The US annual inflation rate decreased for the fifth straight month to 2.5% in August 2024, marking the lowest level since February 2021, down from 2.9% in July and falling below the anticipated 2.6%. Month-over-month, the Consumer Price Index (CPI) increased by 0.2%, consistent with July's figures.

美国年度通胀率在2024年8月连续第五个月下降至2.5%,创下自2021年2月以来的最低水平,低于7月的2.9%,并跌破预期的2.6%。按月计,消费者价格指数(CPI)增长了0.2%,与7月的数据保持一致。

Smart Money Flow

智能资金流

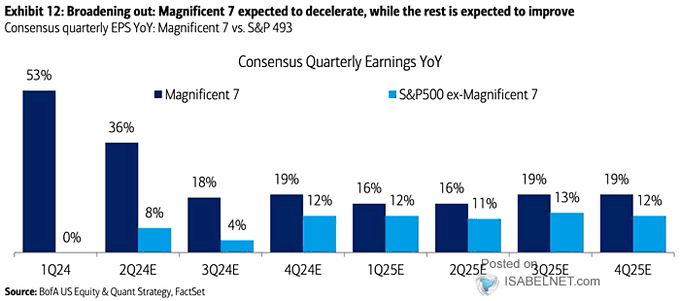

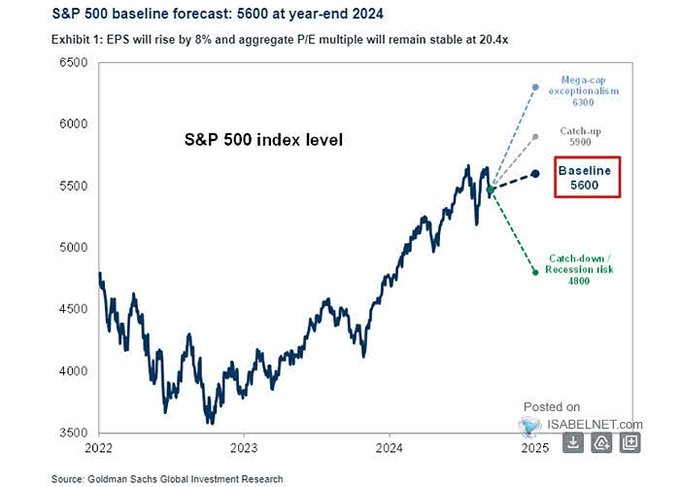

While the Magnificent Seven have been the main drivers of S&P 500 earnings growth, the remaining 493 stocks are expected to catch up.

科技七巨头是S&P 500盈利增长的主要推动因素,预计其余493只股票将会迎头赶上。

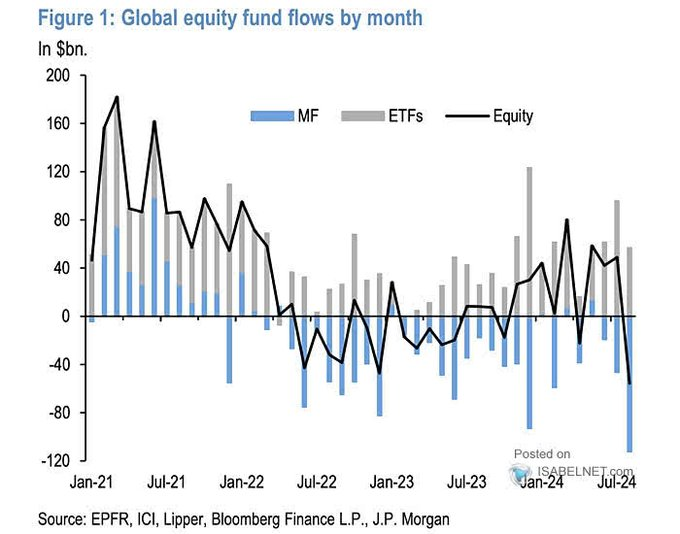

In August, global equity funds saw significant outflows, the largest since 2022, reflecting a cautious sentiment among investors.

八月份,全球股票型基金出现了大幅流出,这是自2022年以来最大的流出规模,反映出投资者对市场的谨慎情绪。

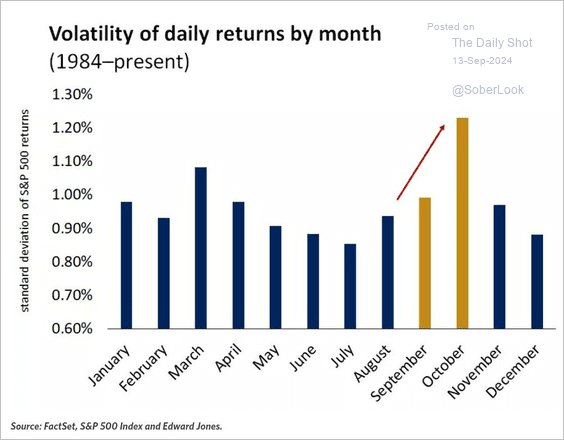

September and October tend to have the highest #volatility of daily #stock price returns. Much of that is due to the second half of September and 1st half of October which tend to be seasonally weak.

九月和十月往往是每日股票价格波动最大的时段。其中,九月的下半月和十月的上半月往往是季节性弱势时段。

In its base case scenario, #GoldmanSachs projects a year-end 2024 price target of 5,600 for the S&P 500 index, supported by robust earnings growth and a stable price-to-earnings ratio.

高盛的基准情景下,预计标普500指数的年底2024年标价目标为5600,这一目标得到了强劲的盈利增长和稳定的市盈率所支持。

Top Corporate News

头条公司新闻

Oracle Sees $104 Billion Sales in Fiscal 2029 on Cloud Boom

Oracle预计在2029财年的云业务繁荣中实现1040亿美元销售额

Oracle Corp. announced that its annual revenue is projected to reach at least $104 billion by fiscal 2029, highlighting strong growth prospects for its cloud infrastructure business. At an annual financial analysts briefing, Executive Vice President Doug Kehring also raised the company's fiscal 2026 sales outlook to at least $66 billion, surpassing analysts' average estimate of $64.5 billion. In response, Oracle's shares surged up to 7.8% on Friday, hitting a record high of $173.94, marking the stock's best weekly performance since 2002 and a 53% year-to-date rally.

Oracle公司宣布预计其年度营收将至少达到1040亿美元,预示着其云基础建设业务的强劲增长前景。在其年度财务分析师简报中,执行副总裁Doug Kehring还将公司2026财年的销售预期上调至至少660亿美元,超过分析师预估的645亿美元的平均值。作为回应,Oracle的股价在周五上涨了7.8%,达到173.94美元的创纪录高点,标志着该股票自2002年以来的最佳周表现和全年累计涨幅达53%。

Adobe Falls Most in Six Months on Disappointing Sales Outlook

由于销售业绩不及预期,Adobe股价下跌6个月以来最多。

Adobe Inc. shares experienced their steepest decline in six months after the company's fiscal fourth-quarter sales guidance fell short of Wall Street expectations, raising concerns among investors eager to see new artificial intelligence tools generate revenue. Despite integrating its AI technology, Firefly, into popular products like Photoshop and Illustrator, Adobe's projected digital media net new annual recurring revenue of $550 million for the period ending in November missed analysts' average estimate of $561.1 million. Additionally, the company's total revenue forecast of up to $5.55 billion also fell below the anticipated $5.6 billion, heightening investor apprehension as small startup rivals challenge traditional software giants like Adobe, Salesforce Inc., and Workday Inc.

Adobe公司股价在六个月以来首次出现大跌,原因是该公司财年第四季度的销售指导不及华尔街的预期,引发投资者担忧,他们渴望看到新的人工智能工具带来收入。尽管将其AI技术Firefly整合到了诸如Photoshop和Illustrator等热门产品中,但Adobe对截至11月份的数字媒体净新增年度重复收入的预期为55000万美元,略低于分析师平均估计的56110万美元。此外,该公司的总收入预测高达55.5亿美元,也低于预期的56亿美元,这加剧了投资者的担忧,因为小型初创企业正在挑战Adobe、Salesforce和Workday等传统软件巨头。

Uber and Waymo Expand Partnership to Bring Autonomous Ride-Hailing to Austin and Atlanta

Uber和Waymo扩大合作伙伴关系,将自动驾驶叫车服务引入奥斯汀和亚特兰大

Uber Technologies and Waymo LLC have announced an expansion of their partnership to offer autonomous ride-hailing services in Austin and Atlanta starting in early 2025. This collaboration will see Uber managing and dispatching a fleet of Waymo's fully autonomous, all-electric Jaguar I-PACE vehicles exclusively through the Uber app. Riders requesting UberX, Uber Green, Uber Comfort, or Uber Comfort Electric may be matched with a Waymo vehicle for qualifying trips. Uber CEO Dara Khosrowshahi expressed enthusiasm, highlighting the success of their fully autonomous trips in Phoenix and looking forward to bringing the same innovative mobility experience to riders in the new cities.

Uber Technologies和Waymo LLC宣布扩大他们的合作伙伴关系,从2025年初开始在奥斯汀和亚特兰大提供自动驾驶载客服务。这次合作将使Uber通过Uber应用程序独家管理和调度一批Waymo的全自动、全电动Jaguar I-PACE车辆。乘客请求UberX、Uber Green、Uber Comfort或Uber Comfort Electric可能会与Waymo车辆匹配,以符合规定的行程。Uber首席执行官Dara Khosrowshahi表示热情,强调了他们在菲尼克斯进行的全自动行程的成功,并期待将同样创新的出行体验带给新城市的乘客。

Qualcomm Explores Acquiring Pieces of Intel Chip-Design Business

高通正在考虑收购英特尔芯片设计业务的一些部分

Qualcomm is exploring the possibility of acquiring various segments of Intel's design business to enhance its product portfolio, according to sources familiar with the matter. With Intel facing financial challenges and seeking to divest certain business units and assets, Qualcomm has shown particular interest in Intel's client PC design business, though it is considering other design units as well.

高通正在探索收购英特尔的设计业务的各个部分,以增强其产品组合,据知情人士透露。由于英特尔面临财务挑战并寻求剥离某些业务部门和资产,高通对英特尔的客户PC设计业务表现出特别的兴趣,但也在考虑其他设计部门。

Verizon to Buy Frontier in $20 Bln Deal to Boost Fiber Network in U.S.

Verizon宣布周四同意收购光纤网络供应商Frontier Communications的全部股权,以20亿美元的现金交易完成,以扩大其用户群。此次收购为每股38.50美元,较Frontier 9月3日收盘股价溢价37.3%,使Verizon能更好地与AT&t和t-Mobile竞争,他们正在加强对无限计划和捆绑选项的关注。

Verizon announced on Thursday its agreement to acquire fiber-optic internet provider Frontier Communications in an all-cash deal valued at $20 billion, aiming to expand its subscriber base. The acquisition, offering $38.50 per share and representing a 37.3% premium over Frontier's closing stock price on September 3, positions Verizon to better compete with AT&T and T-Mobile, who are intensifying their focus on unlimited plans and bundling options.

Verizon周四宣布同意以全现金交易的方式收购光纤接入互联网服务提供商Frontier Communications,交易总价值为200亿美元,旨在扩大其订阅者基础。此次收购以每股38.50美元的价格进行,较Frontier 9月3日收盘股价溢价37.3%,使Verizon能更好地与AT&t和T-Mobile竞争,后者正在加强其对无限套餐和捆绑选择的关注。

Upcoming Economic Data

免责声明:本演示仅供信息和教育目的;不是任何特定投资或投资策略的建议或认可。在此提供的投资信息具有一般性质,仅供说明目的,并可能不适合所有投资者。它是在没有考虑个人投资者的财务知识水平、财务状况、投资目标、投资时间范围或风险承受能力的情况下提供的。在做出任何投资决策之前,您应考虑此信息是否适合您的相关个人情况。过去的投资业绩并不表明或保证未来的成功。收益将有所不同,所有投资都存在风险,包括本金损失。

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

moomoo 是由 Moomoo Technologies Inc 提供的一款金融信息和交易应用程序,在美国,Moomoo Financial Inc 为投资者提供投资产品和服务,为 FINRA/SIPC 的成员。

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

Moomoo是由Moomoo Technologies Inc.提供的金融信息和交易应用程序。在美国,Moomoo的投资产品和服务由Moomoo Financial Inc.提供,成为FINRA/SIPC成员。

Chart: Dow Jones Index Performance After Rate Cuts

Chart: Dow Jones Index Performance After Rate Cuts