What the Options Market Tells Us About ConocoPhillips

What the Options Market Tells Us About ConocoPhillips

Financial giants have made a conspicuous bullish move on ConocoPhillips. Our analysis of options history for ConocoPhillips (NYSE:COP) revealed 8 unusual trades.

金融巨头们对康菲石油采取了明显的看好行动。我们对康菲石油(NYSE:COP)的期权历史进行了分析,发现了8笔不寻常的交易。

Delving into the details, we found 37% of traders were bullish, while 37% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $281,534, and 3 were calls, valued at $104,866.

深入研究后,我们发现37%的交易者看好,而37%的交易者看淡。在我们发现的所有交易中,有5笔看跌期权,价值281,534美元,有3笔看涨期权,价值104,866美元。

Predicted Price Range

预测价格区间

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $89.0 to $120.0 for ConocoPhillips over the last 3 months.

考虑到这些合约的成交量和持仓量,过去3个月中,投资者一直将康菲石油的目标价区间定在89.0至120.0美元之间。

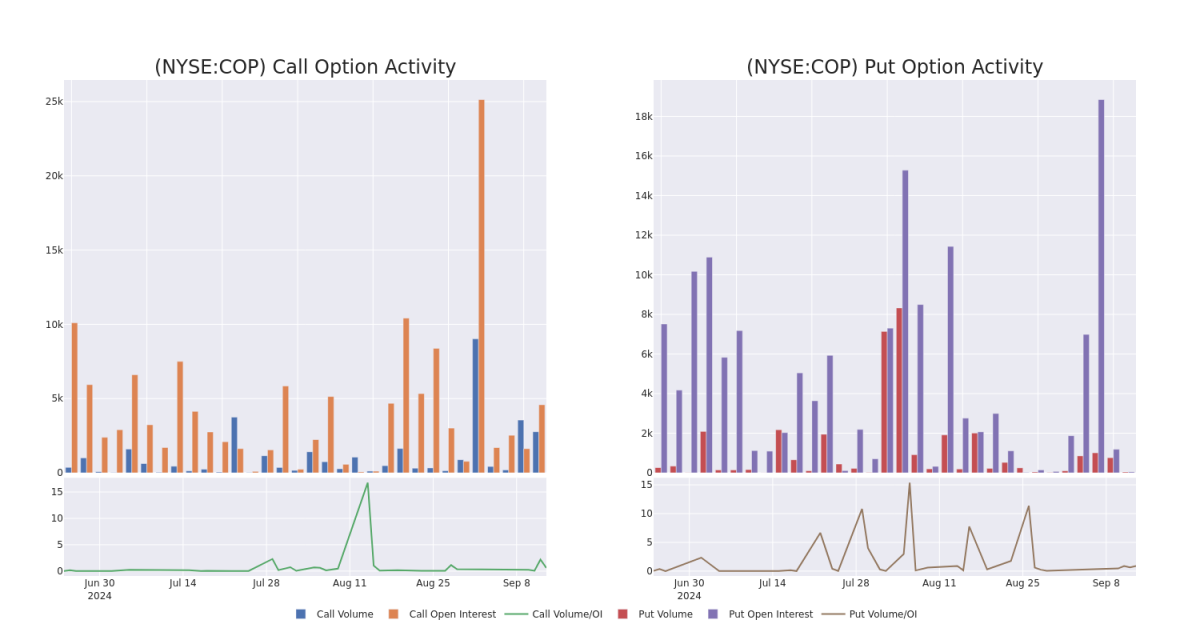

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

In terms of liquidity and interest, the mean open interest for ConocoPhillips options trades today is 1874.4 with a total volume of 599.00.

就流动性和利益而言,康菲石油期权今天的平均持仓量为1874.4,总成交量为599.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for ConocoPhillips's big money trades within a strike price range of $89.0 to $120.0 over the last 30 days.

在下图中,我们可以追踪康菲石油的大额期权交易的成交量和持仓量的发展,该交易涵盖了89.0至120.0美元的执行价区间,时间跨度为30天。

ConocoPhillips 30-Day Option Volume & Interest Snapshot

康菲石油30天期权成交量和利益快照

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| COP | PUT | SWEEP | NEUTRAL | 11/15/24 | $8.4 | $6.8 | $8.4 | $110.00 | $75.8K | 3.7K | 88 |

| COP | PUT | SWEEP | NEUTRAL | 06/20/25 | $7.7 | $6.05 | $7.7 | $100.00 | $68.8K | 753 | 88 |

| COP | PUT | SWEEP | BULLISH | 11/15/24 | $8.4 | $6.8 | $6.75 | $110.00 | $53.5K | 3.7K | 87 |

| COP | PUT | SWEEP | BULLISH | 06/20/25 | $7.7 | $6.05 | $6.05 | $100.00 | $48.4K | 753 | 87 |

| COP | CALL | SWEEP | BEARISH | 09/20/24 | $2.17 | $2.07 | $2.08 | $104.00 | $41.7K | 2.3K | 141 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| COP | 看跌 | SWEEP | 中立 | 11/15/24 | $8.4 | $6.8 | $8.4 | $110.00 | $75.8K | 3.7K | 88 |

| COP | 看跌 | SWEEP | 中立 | 06/20/25 | $7.7 | $6.05 | $7.7 | $100.00。 | $68.8K | 753 | 88 |

| COP | 看跌 | SWEEP | 看好 | 11/15/24 | $8.4 | $6.8 | 其股票的收盘价格昨天为$5.75。 | $110.00 | $53.5K | 3.7K | 87 |

| COP | 看跌 | SWEEP | 看好 | 06/20/25 | $7.7 | $6.05 | $6.05 | $100.00。 | $48.4K | 753 | 87 |

| COP | 看涨 | SWEEP | 看淡 | 09/20/24 | $2.17 | $2.07 | $2.08 | 104.00美元 | $41.7K | 2.3K | 141 |

About ConocoPhillips

关于康菲石油

ConocoPhillips is a US-based independent exploration and production firm. In 2023, it produced 1.2 million barrels per day of oil and natural gas liquids and 3.1 billion cubic feet per day of natural gas, primarily from Alaska and the Lower 48 in the United States and Norway in Europe and several countries in Asia-Pacific and the Middle East. Proven reserves at year-end 2023 were 6.8 billion barrels of oil equivalent.

康菲石油是一家总部位于美国的独立勘探和生产公司。2023年,它从阿拉斯加和美国48个州以及欧洲挪威和亚太和中东的若干国家主要生产了每天120万桶的原油和天然气液体和每天31亿立方英尺的天然气。年末,已探明的储量为68亿桶石油当量。

Where Is ConocoPhillips Standing Right Now?

康菲石油目前的状况如何?

- With a volume of 1,159,934, the price of COP is up 1.3% at $104.85.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 45 days.

- COP的成交量为1,159,934,价格上涨1.3%,达到104.85美元。

- RSI指标暗示该标的股票目前处于超买和超卖的中立区间。

- 下次收益预计在45天内发布。

What Analysts Are Saying About ConocoPhillips

分析师对康菲石油的评价

In the last month, 4 experts released ratings on this stock with an average target price of $142.25.

过去一个月,4位专家发布了对这支股票的评级,平均目标价为142.25美元。

- Maintaining their stance, an analyst from Susquehanna continues to hold a Positive rating for ConocoPhillips, targeting a price of $147.

- An analyst from UBS persists with their Buy rating on ConocoPhillips, maintaining a target price of $153.

- An analyst from RBC Capital has revised its rating downward to Outperform, adjusting the price target to $140.

- An analyst from Mizuho persists with their Neutral rating on ConocoPhillips, maintaining a target price of $129.

- Susquehanna的分析师坚持维持对康菲石油的积极评级,并将目标价定为147美元。

- 瑞银的分析师坚持给康菲石油买入评级,保持目标价在153美元。

- RBC Capital的分析师将评级调降至表现优异,将价格目标调整至140美元。

- 瑞穗的分析师坚持对康菲石油的中立评级,并保持目标价在129美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for ConocoPhillips with Benzinga Pro for real-time alerts.

交易期权涉及更高的风险,但也提供了更高的利润潜力。聪明的交易者通过持续的教育、策略性的交易调整、利用各种因子和保持对市场动态的敏感来缓解这些风险。通过Benzinga Pro获得康菲石油的最新期权交易,进行实时提醒。

In terms of liquidity and interest, the mean open interest for ConocoPhillips options trades today is 1874.4 with a total volume of 599.00.

In terms of liquidity and interest, the mean open interest for ConocoPhillips options trades today is 1874.4 with a total volume of 599.00.