Smart Money Is Betting Big In ORCL Options

Smart Money Is Betting Big In ORCL Options

Financial giants have made a conspicuous bullish move on Oracle. Our analysis of options history for Oracle (NYSE:ORCL) revealed 39 unusual trades.

Financial giants have made a conspicuous bullish move on Oracle. Our analysis of options history for Oracle (NYSE:ORCL) revealed 39 unusual trades.

Delving into the details, we found 53% of traders were bullish, while 35% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $139,890, and 35 were calls, valued at $3,947,276.

Delving into the details, we found 53% of traders were bullish, while 35% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $139,890, and 35 were calls, valued at $3,947,276.

Expected Price Movements

预期价格波动

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $130.0 and $230.0 for Oracle, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $130.0 and $230.0 for Oracle, spanning the last three months.

Analyzing Volume & Open Interest

分析成交量和未平仓合约

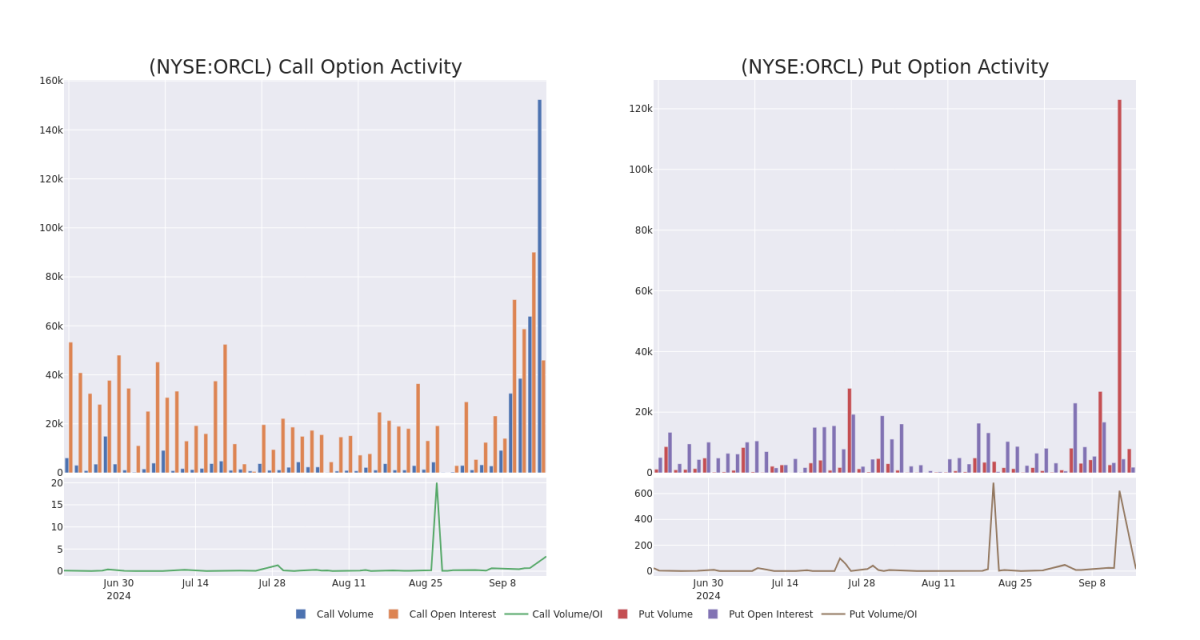

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Oracle's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Oracle's substantial trades, within a strike price spectrum from $130.0 to $230.0 over the preceding 30 days.

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Oracle's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Oracle's substantial trades, within a strike price spectrum from $130.0 to $230.0 over the preceding 30 days.

Oracle 30-Day Option Volume & Interest Snapshot

Oracle 30天期权成交量和利益快照

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | CALL | TRADE | BULLISH | 12/20/24 | $5.0 | $4.8 | $4.95 | $185.00 | $1.7M | 665 | 3.7K |

| ORCL | CALL | SWEEP | NEUTRAL | 11/15/24 | $5.3 | $5.2 | $5.29 | $175.00 | $264.7K | 1.3K | 869 |

| ORCL | CALL | SWEEP | BULLISH | 09/27/24 | $4.45 | $3.8 | $4.45 | $165.00 | $178.0K | 1.5K | 971 |

| ORCL | CALL | TRADE | BEARISH | 11/15/24 | $3.65 | $3.5 | $3.55 | $180.00 | $177.5K | 710 | 3.4K |

| ORCL | CALL | TRADE | BULLISH | 09/27/24 | $4.1 | $3.3 | $4.1 | $165.00 | $123.0K | 1.5K | 309 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | 看涨 | 交易 | 看好 | 12/20/24 | $5.0 | $4.8 | $4.95 | $185.00 | $1.7M | 665 | 3.7K |

| ORCL | 看涨 | SWEEP | 中立 | 11/15/24 | $5.3 | $5.2 | $5.29 | $175.00 | 264.7千美元 | 1.3K | 869 |

| ORCL | 看涨 | SWEEP | 看好 | 09/27/24 | $4.45 | $3.8 | $4.45 | 165.00美元 | $178.0K | 1.5K | 971 |

| ORCL | 看涨 | 交易 | 看淡 | 11/15/24 | $3.65 | $3.5 | $3.55 | 180.00美元 | $177.5K | 710 | 3.4千 |

| ORCL | 看涨 | 交易 | 看好 | 09/27/24 | $4.1 | $3.3 | $4.1 | 165.00美元 | $123.0K | 1.5K | 309 |

About Oracle

关于Oracle

Oracle provides database technology and enterprise resource planning, or ERP, software to enterprises around the world. Founded in 1977, Oracle pioneered the first commercial SQL-based relational database management system. Today, Oracle has 430,000 customers in 175 countries, supported by its base of 136,000 employees.

Oracle向全球企业提供数据库技术和企业资源规划(ERP)软件。Oracle成立于1977年,是第一个商用SQL数据库管理系统的创始人。如今,Oracle在175个国家拥有430,000个客户,由136,000名员工支持。

Following our analysis of the options activities associated with Oracle, we pivot to a closer look at the company's own performance.

在对Oracle的期权活动进行分析之后,我们将转向更密切关注公司的表现。

Current Position of Oracle

Oracle的当前位置

- With a trading volume of 8,897,618, the price of ORCL is up by 4.89%, reaching $169.96.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 84 days from now.

- 交易量为8,897,618,ORCL的价格上涨了4.89%,达到了169.96美元。

- 当前RSI值表明股票可能已经超买。

- 下一个财报将于84天后公布。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Oracle options trades with real-time alerts from Benzinga Pro.

期权交易存在更高的风险和回报潜力。精明的交易员通过不断学习、调整策略、监控多个指标并密切关注市场动向来管理这些风险。通过Benzinga Pro的实时提醒了解最新的Oracle期权交易情况。