This Is What Whales Are Betting On FedEx

This Is What Whales Are Betting On FedEx

Whales with a lot of money to spend have taken a noticeably bearish stance on FedEx.

有大量资金可支配的鲸鱼们采取了明显看淡联邦快递的立场。

Looking at options history for FedEx (NYSE:FDX) we detected 28 trades.

查看联邦快递(纽交所: FDX)的期权历史,我们发现了28笔交易。

If we consider the specifics of each trade, it is accurate to state that 25% of the investors opened trades with bullish expectations and 57% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,25%的投资者持有看好期权,57%持有看淡期权。

From the overall spotted trades, 12 are puts, for a total amount of $613,166 and 16, calls, for a total amount of $1,167,212.

从总体发现的交易中,有12笔看跌期权,总金额为613,166美元,16笔看涨期权,总金额为1,167,212美元。

Projected Price Targets

预计价格目标

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $240.0 to $330.0 for FedEx over the last 3 months.

考虑到这些合约的成交量和持仓量,看上去大户们在过去3个月一直将联邦快递的目标价区间定在240.0至330.0美元之间。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

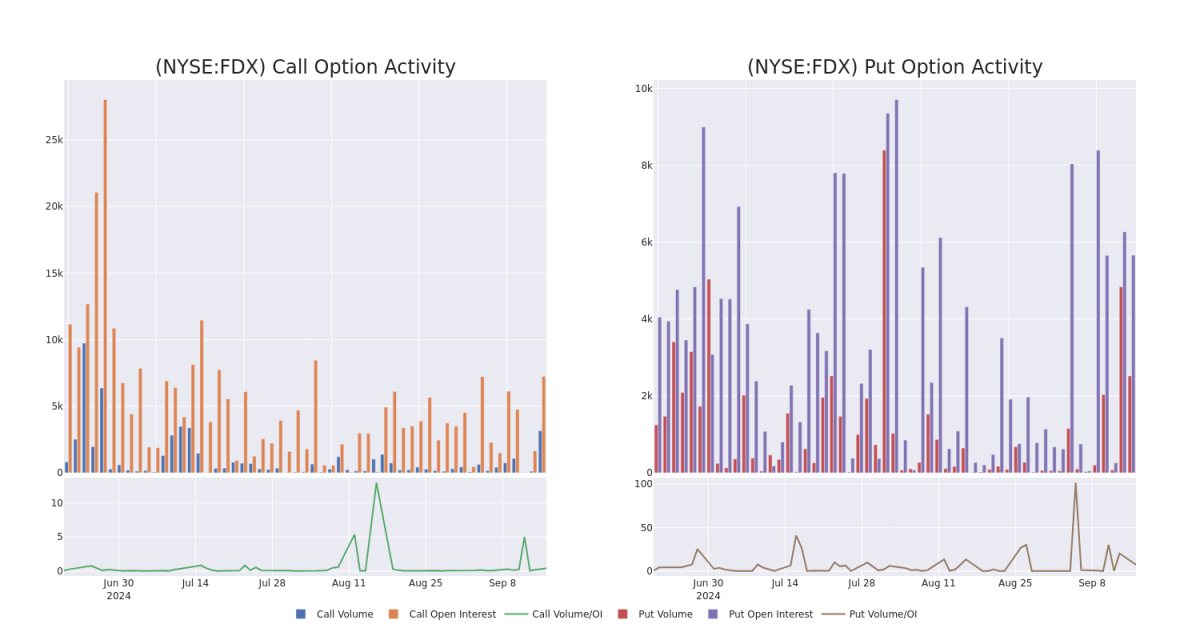

In today's trading context, the average open interest for options of FedEx stands at 614.86, with a total volume reaching 5,651.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in FedEx, situated within the strike price corridor from $240.0 to $330.0, throughout the last 30 days.

在今天的交易背景下,联邦快递期权的平均持仓量为614.86,总成交量达到5,651.00。附带的图表描述了联邦快递高价值交易的看涨和看跌期权成交量以及持仓量的发展情况,在过去30天内这些交易都位于240.0至330.0美元的行权价格区间内。

FedEx Call and Put Volume: 30-Day Overview

联邦快递看涨和看跌期权成交量:30天概述

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FDX | CALL | TRADE | BEARISH | 10/18/24 | $6.65 | $6.4 | $6.4 | $310.00 | $163.2K | 725 | 270 |

| FDX | CALL | SWEEP | BEARISH | 10/18/24 | $15.05 | $14.85 | $14.85 | $290.00 | $118.8K | 610 | 85 |

| FDX | CALL | SWEEP | BULLISH | 12/20/24 | $13.4 | $12.2 | $13.27 | $310.00 | $107.0K | 368 | 85 |

| FDX | PUT | SWEEP | BULLISH | 09/20/24 | $10.2 | $10.0 | $10.0 | $290.00 | $100.0K | 3.4K | 125 |

| FDX | CALL | SWEEP | BEARISH | 09/20/24 | $3.95 | $3.8 | $3.8 | $310.00 | $94.3K | 1.5K | 353 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 联邦快递 | 看涨 | 交易 | 看淡 | 10/18/24 | $6.65 | 6.4美元 | 6.4美元 | $ 310.00 | 163.2千美元 | 725 | 270 |

| 联邦快递 | 看涨 | SWEEP | 看淡 | 10/18/24 | $15.05 | $14.85 | $14.85 | $290.00 | $118.8K | 610 | 85 |

| 联邦快递 | 看涨 | SWEEP | 看好 | 12/20/24 | $13.4 | $12.2 | $13.27 | $ 310.00 | $107.0K | 368 | 85 |

| 联邦快递 | 看跌 | SWEEP | 看好 | 09/20/24 | $10.2 | $10.0 | $10.0 | $290.00 | $100.0K | 3.4千 | 125 |

| 联邦快递 | 看涨 | SWEEP | 看淡 | 09/20/24 | $3.95 | $3.8 | $3.8 | $ 310.00 | $94.3K | 1.5K | 353 |

About FedEx

关于联邦快递

FedEx pioneered overnight delivery in 1973 and remains the world's largest express package provider. In its fiscal 2024, which ended May 2024, FedEx derived 47% of revenue from its express division, 37% from ground, and 10% from freight, its asset-based less-than-truckload shipping segment. The remainder comes from other services, including FedEx Office, which provides document production/shipping, and FedEx Logistics, which provides global forwarding. FedEx acquired Dutch parcel delivery firm TNT Express in 2016, boosting the firm's presence across Europe. TNT was previously the fourth-largest global parcel delivery provider.

联邦快递于1973年率先推出隔夜快递服务,至今仍是全球规模最大的快递包裹提供商。在其截至2024年5月的财年中,联邦快递的47%营业收入来自其快递业务,37%来自地面运输,10%来自基于资产的零担运输业务。其余收入来自其他服务,包括提供文件制作/运输的联邦快递办公室和提供全球货运的联邦快递物流。2016年,联邦快递收购了荷兰包裹快递公司TNT快递,提高了该公司在欧洲的影响力。TNT曾是全球第四大包裹快递服务提供商。

After a thorough review of the options trading surrounding FedEx, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

对于联邦快递周围的期权交易进行仔细审查之后,我们转而更详细地研究该公司。这包括对其当前市场地位和业绩的评估。

Present Market Standing of FedEx

联邦快递的当前市场地位

- Currently trading with a volume of 567,279, the FDX's price is up by 2.14%, now at $292.52.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 3 days.

- 目前交易量为567,279,FDX的价格上涨了2.14%,现在为$292.52。

- RSI读数表明该股目前可能接近超买水平。

- 预期盈利将在3天内公布。

Expert Opinions on FedEx

关于联邦快递的专家意见

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $336.3333333333333.

过去一个月来,有3位行业分析师分享了他们对该股票的见解,提出了一个平均目标价格为336.3333333333333美元。

- An analyst from TD Cowen downgraded its action to Buy with a price target of $334.

- An analyst from Baird persists with their Outperform rating on FedEx, maintaining a target price of $340.

- Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for FedEx, targeting a price of $335.

- TD Cowen的一位分析师将其行动降级为买入,目标价格为334美元。

- Baird的一位分析师坚持维持对联邦快递的超越评级,目标价格为340美元。

- Evercore ISI Group的分析师继续持有联邦快递的超越评级,目标价格为335美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest FedEx options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在回报。精明的交易者通过不断学习、调整策略、监控多个因子、密切关注市场走势来控制这些风险。通过Benzinga Pro的实时提醒及时了解最新的联邦快递期权交易。

From the overall spotted trades, 12 are puts, for a total amount of $613,166 and 16, calls, for a total amount of $1,167,212.

From the overall spotted trades, 12 are puts, for a total amount of $613,166 and 16, calls, for a total amount of $1,167,212.