PayPal Holdings Unusual Options Activity For September 17

PayPal Holdings Unusual Options Activity For September 17

High-rolling investors have positioned themselves bullish on PayPal Holdings (NASDAQ:PYPL), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in PYPL often signals that someone has privileged information.

一些高手投资者持看涨态度,对于零售交易者来说要注意。通过贝宁扎跟踪公开期权数据,我们今天注意到了这种活动。这些投资者的身份尚不确定,但PYPL的这种重大变动通常意味着某人获得了内幕消息。

Today, Benzinga's options scanner spotted 8 options trades for PayPal Holdings. This is not a typical pattern.

今天,Benzinga的期权交易扫描器发现了8笔paypal的期权交易。这不是一个典型的模式。

The sentiment among these major traders is split, with 75% bullish and 25% bearish. Among all the options we identified, there was one put, amounting to $31,250, and 7 calls, totaling $424,280.

这些主要交易商之间的情绪分为75%看好和25%看淡。在我们标识出的所有期权中,有一项看跌,总额为31250美元,和7项看涨,总额为424280美元。

Projected Price Targets

预计价格目标

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $55.0 to $80.0 for PayPal Holdings over the last 3 months.

考虑到这些合同的成交量和未平仓合约量,过去3个月中,鲸鱼们一直在将paypal的目标价区间定在55.0至80.0美元之间。

Insights into Volume & Open Interest

成交量和持仓量分析

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for PayPal Holdings's options for a given strike price.

这些数据可以帮助您跟踪PayPal Holdings不同行权价格的期权的流动性和兴趣。

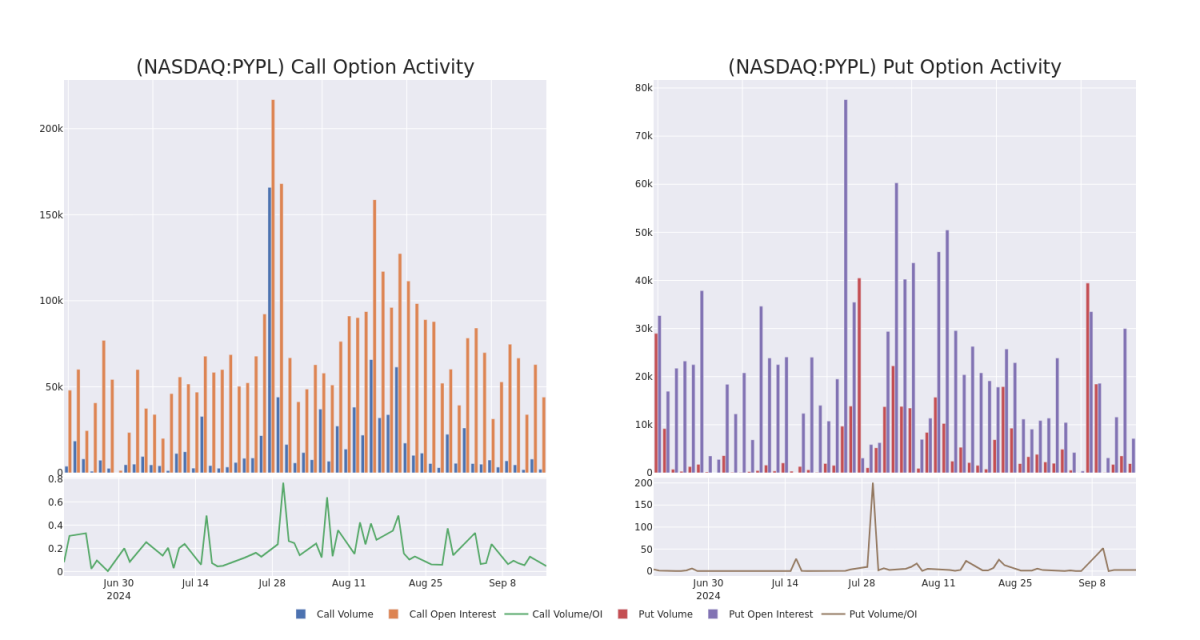

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of PayPal Holdings's whale activity within a strike price range from $55.0 to $80.0 in the last 30 days.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of PayPal Holdings's whale activity within a strike price range from $55.0 to $80.0 in the last 30 days.

PayPal Holdings Option Volume And Open Interest Over Last 30 Days

过去30天内PayPal Holdings期权成交量和持仓量

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PYPL | CALL | TRADE | BULLISH | 11/15/24 | $17.7 | $17.55 | $17.7 | $55.00 | $88.5K | 141 | 50 |

| PYPL | CALL | SWEEP | BULLISH | 01/17/25 | $3.4 | $3.35 | $3.4 | $80.00 | $85.0K | 21.0K | 516 |

| PYPL | CALL | SWEEP | BULLISH | 01/17/25 | $3.4 | $3.25 | $3.4 | $80.00 | $85.0K | 21.0K | 253 |

| PYPL | CALL | TRADE | BULLISH | 12/18/26 | $19.5 | $18.6 | $19.5 | $70.00 | $58.5K | 673 | 0 |

| PYPL | CALL | TRADE | BEARISH | 12/18/26 | $22.95 | $21.6 | $21.95 | $65.00 | $52.6K | 19.4K | 0 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PYPL | 看涨 | 交易 | 看好 | 11/15/24 | $17.7 | $17.55 | $17.7 | $55.00 | $88.5K | 141 | 50 |

| PYPL | 看涨 | SWEEP | 看好 | 01/17/25 | $3.4 | $3.35 | $3.4 | $80.00 | $85.0K | 21.0千 | 516 |

| PYPL | 看涨 | SWEEP | 看好 | 01/17/25 | $3.4 | $3.25 | $3.4 | $80.00 | $85.0K | 21.0千 | 177 |

| PYPL | 看涨 | 交易 | 看好 | 12/18/26 | $19.5。 | 18.6美元 | $19.5。 | 70.00美元 | $58.5K | 673 | 0 |

| PYPL | 看涨 | 交易 | 看淡 | 12/18/26 | $22.95 | $21.6 | $21.95 | $65.00 | $52.6K | 19.4K | 0 |

About PayPal Holdings

关于paypal控股

PayPal was spun off from eBay in 2015 and provides electronic payment solutions to merchants and consumers, with a focus on online transactions. The company had 426 million active accounts at the end of 2023. The company also owns Venmo, a person-to-person payment platform.

paypal控股于2015年从ebay分拆出来,为商家和消费者提供电子支付解决方案,重点放在在线交易方面。该公司在2023年末拥有4.26亿活跃账户。该公司还拥有Venmo,这是一个人对人的支付平台。

Having examined the options trading patterns of PayPal Holdings, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在审查paypal控股的期权交易模式之后,我们现在将直接关注该公司。这种转变使我们能够深入研究其现在的市场位置和表现。

PayPal Holdings's Current Market Status

paypal控股公司的当前市场状况

- With a volume of 302,661, the price of PYPL is up 0.79% at $71.63.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 43 days.

- 成交量为302,661,PYPL的价格上涨0.79%,为71.63美元。

- RSI指标暗示该股票可能要超买了。

- 预计将在43天内发布下一份收益报告。

Professional Analyst Ratings for PayPal Holdings

PayPal Holdings的专业分析师评级

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $85.0.

在过去的一个月里,有2位行业分析师分享了他们对这只股票的见解,提出了平均目标价为85.0美元。

- Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on PayPal Holdings with a target price of $80.

- An analyst from Mizuho has decided to maintain their Outperform rating on PayPal Holdings, which currently sits at a price target of $90.

- 根据JP Morgan的分析师评价,PayPal Holdings保持着超配评级,目标价为80美元。

- Mizuho的一位分析师决定维持他们对PayPal Holdings股票的超越市场的评级,目前的目标价为90美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for PayPal Holdings with Benzinga Pro for real-time alerts.

交易期权涉及更高的风险,但也提供了更高的利润潜力。精明的交易者通过持续进修、策略性交易调整、利用各种因子,以及关注市场动态来减轻这些风险。使用Benzinga Pro随时关注PayPal Holdings的最新期权交易以获取实时警报。