Unpacking the Latest Options Trading Trends in Eli Lilly

Unpacking the Latest Options Trading Trends in Eli Lilly

Whales with a lot of money to spend have taken a noticeably bearish stance on Eli Lilly.

拥有大量资金的鲸鱼对Eli Lilly采取了明显看淡的立场。

Looking at options history for Eli Lilly (NYSE:LLY) we detected 30 trades.

通过查看Eli Lilly(纽交所:LLY)的期权历史,我们发现了30笔交易。

If we consider the specifics of each trade, it is accurate to state that 30% of the investors opened trades with bullish expectations and 43% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,30%的投资者持看涨期望,43%持看跌期望。

From the overall spotted trades, 4 are puts, for a total amount of $423,567 and 26, calls, for a total amount of $4,363,478.

从总体来看,有4个看跌期权交易,总金额为423,567美元,还有26个看涨期权交易,总金额为4,363,478美元。

Projected Price Targets

预计价格目标

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $700.0 to $1100.0 for Eli Lilly during the past quarter.

通过分析这些合约的成交量和持仓量,似乎大户在过去的一个季度里关注Eli Lilly的股价区间是700.0到1100.0美元之间。

Insights into Volume & Open Interest

成交量和持仓量分析

In terms of liquidity and interest, the mean open interest for Eli Lilly options trades today is 498.6 with a total volume of 1,460.00.

在流动性和关注度方面,今天Eli Lilly的期权交易平均持仓量为498.6,总成交量为1,460.00。

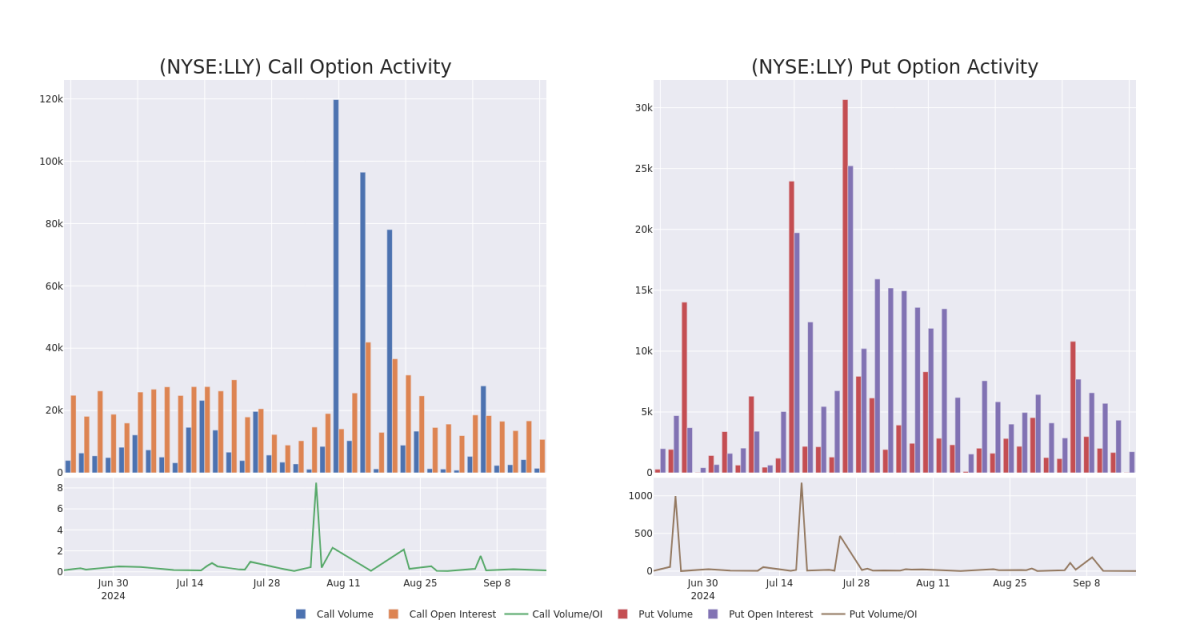

In the following chart, we are able to follow the development of volume and open interest of call and put options for Eli Lilly's big money trades within a strike price range of $700.0 to $1100.0 over the last 30 days.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Eli Lilly's big money trades within a strike price range of $700.0 to $1100.0 over the last 30 days.

Eli Lilly Call and Put Volume: 30-Day Overview

Eli Lilly Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LLY | CALL | SWEEP | BEARISH | 11/15/24 | $223.4 | $217.55 | $220.0 | $700.00 | $2.2M | 836 | 300 |

| LLY | CALL | SWEEP | NEUTRAL | 01/17/25 | $81.9 | $80.95 | $81.9 | $900.00 | $311.3K | 1.8K | 46 |

| LLY | PUT | SWEEP | BULLISH | 10/18/24 | $28.3 | $25.0 | $25.0 | $900.00 | $300.4K | 883 | 2 |

| LLY | CALL | SWEEP | NEUTRAL | 01/17/25 | $119.15 | $115.4 | $119.15 | $840.00 | $273.9K | 459 | 7 |

| LLY | CALL | TRADE | BEARISH | 11/15/24 | $51.65 | $48.8 | $48.8 | $930.00 | $239.1K | 535 | 100 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LLY | 看涨 | SWEEP | 看淡 | 11/15/24 | $223.4 | $217.55 | $220.0 | $700.00 | $2.2M | 836 | 300 |

| LLY | 看涨 | SWEEP | 中立 | 01/17/25 | $81.9 | 80.95美元 | $81.9 | $900.00 | 311.3K美元 | 1.8K | 46 |

| LLY | 看跌 | SWEEP | 看好 | 10/18/24 | $28.3 | $25.0 | $25.0 | $900.00 | 300.4千美元 | 883 | 2 |

| LLY | 看涨 | SWEEP | 中立 | 01/17/25 | $119.15 | $115.4 | $119.15 | $840.00 | $273.9K | 459 | 7 |

| LLY | 看涨 | 交易 | 看淡 | 11/15/24 | $51.65 | 48.8美元 | 48.8美元 | $930.00 | 成交量为239.1K | 535 | 100 |

About Eli Lilly

关于Eli Lilly

Eli Lilly is a drug firm with a focus on neuroscience, cardiometabolic, cancer, and immunology. Lilly's key products include Verzenio for cancer; Mounjaro, Zepbound, Jardiance, Trulicity, Humalog, and Humulin for cardiometabolic; and Taltz and Olumiant for immunology.

Eli Lilly是一家专注于神经科学,心脏代谢,癌症和免疫学的药物公司。Lilly的主要产品包括用于治疗癌症的Verzenio;用于心脏代谢的Mounjaro,Zepbound,Jardiance,Trulicity,Humalog和Humulin;以及用于免疫学的Taltz和Olumiant。

Following our analysis of the options activities associated with Eli Lilly, we pivot to a closer look at the company's own performance.

在对Eli Lilly的期权活动进行分析后,我们转向更仔细地观察该公司的业绩。

Present Market Standing of Eli Lilly

Eli Lilly目前的市场地位

- Currently trading with a volume of 365,615, the LLY's price is down by -1.32%, now at $911.36.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 44 days.

- 目前交易量为365,615,LLY的价格下跌-1.32%,现在为$911.36。

- RSI读数表明该股票目前可能接近超卖状态。

- 预期四十四天后公布收益。

Professional Analyst Ratings for Eli Lilly

Eli Lilly的专业分析师评级

5 market experts have recently issued ratings for this stock, with a consensus target price of $1007.2.

有5位市场专家最近对这只股票发表了评级意见,达成共识目标价为$1007.2。

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $885.

- Reflecting concerns, an analyst from Citigroup lowers its rating to Buy with a new price target of $1060.

- Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on Eli Lilly with a target price of $1100.

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $885.

- An analyst from Morgan Stanley has revised its rating downward to Overweight, adjusting the price target to $1106.

- 为了谨慎起见,Cantor Fitzgerald的分析师将其评级下调为超重,设定了885美元的价格目标。

- 反映担忧,花旗集团的一位分析师将其评级下调为买入,目标价为$1060。

- JP摩根的分析师在对Eli Lilly的评估一致性上保持超额评级,目标价为$1100。

- 为了谨慎起见,Cantor Fitzgerald的分析师将其评级下调为超重,设定了885美元的价格目标。

- 摩根士丹利的一位分析师将其评级下调为增持,并将目标价调至1106美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Eli Lilly with Benzinga Pro for real-time alerts.

交易期权具有更高的风险,但也提供了更高的利润潜力。睿智的交易者通过不断的教育、策略性交易调整、利用各种因子并对市场动态保持敏感来减轻这些风险。通过使用Benzinga Pro,及时关注Eli Lilly的最新期权交易并获得实时提醒。

From the overall spotted trades, 4 are puts, for a total amount of $423,567 and 26, calls, for a total amount of $4,363,478.

From the overall spotted trades, 4 are puts, for a total amount of $423,567 and 26, calls, for a total amount of $4,363,478.