Smart Money Is Betting Big In Micron Technology Options

Smart Money Is Betting Big In Micron Technology Options

Whales with a lot of money to spend have taken a noticeably bearish stance on Micron Technology.

有很多钱可以花的鲸鱼对美光科技采取了明显的看跌立场。

Looking at options history for Micron Technology (NASDAQ:MU) we detected 17 trades.

查看美光科技(纳斯达克股票代码:MU)的期权历史记录,我们发现了17笔交易。

If we consider the specifics of each trade, it is accurate to state that 41% of the investors opened trades with bullish expectations and 47% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,有41%的投资者以看涨的预期开盘,47%的投资者持看跌预期。

From the overall spotted trades, 3 are puts, for a total amount of $226,275 and 14, calls, for a total amount of $582,345.

在已发现的全部交易中,有3笔是看跌期权,总额为226,275美元,14笔是看涨期权,总额为582,345美元。

Predicted Price Range

预测的价格区间

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $85.0 to $100.0 for Micron Technology over the recent three months.

根据交易活动,看来重要投资者的目标是在最近三个月中将美光科技的价格范围从85.0美元扩大到100.0美元。

Volume & Open Interest Development

交易量和未平仓合约的发展

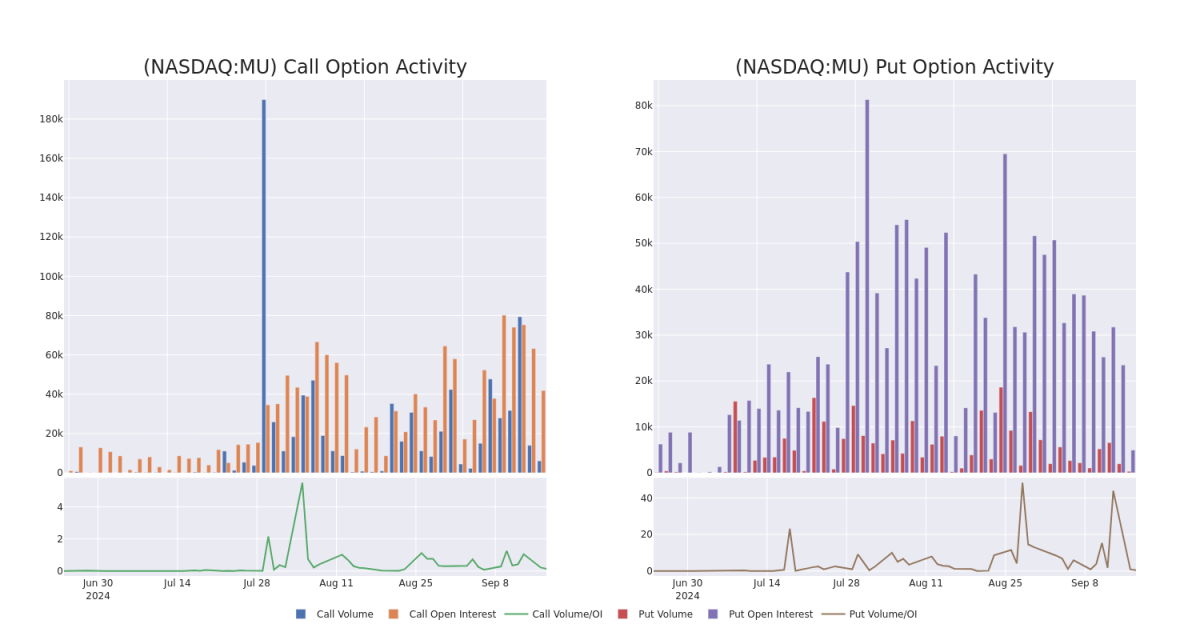

In terms of liquidity and interest, the mean open interest for Micron Technology options trades today is 3601.92 with a total volume of 6,396.00.

就流动性和利息而言,今天美光科技期权交易的平均未平仓合约为3601.92,总交易量为6,396.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Micron Technology's big money trades within a strike price range of $85.0 to $100.0 over the last 30 days.

在下图中,我们可以跟踪过去30天美光科技在85.0美元至100.0美元行使价区间内的大额资金交易的看涨和看跌期权交易量和未平仓合约的变化。

Micron Technology Option Volume And Open Interest Over Last 30 Days

过去 30 天的美光科技期权交易量和未平仓合约

Biggest Options Spotted:

发现的最大选择:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MU | PUT | TRADE | BULLISH | 06/20/25 | $13.35 | $13.15 | $13.2 | $87.50 | $99.0K | 1.4K | 225 |

| MU | PUT | SWEEP | BEARISH | 03/21/25 | $15.75 | $15.65 | $15.75 | $95.00 | $96.0K | 3.3K | 62 |

| MU | CALL | SWEEP | BEARISH | 03/21/25 | $15.3 | $15.1 | $15.16 | $85.00 | $84.9K | 1.1K | 58 |

| MU | CALL | TRADE | BEARISH | 01/16/26 | $23.2 | $23.05 | $23.05 | $85.00 | $59.9K | 294 | 28 |

| MU | CALL | SWEEP | BULLISH | 09/20/24 | $2.79 | $2.45 | $2.8 | $87.00 | $56.0K | 1.9K | 209 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 亩 | 放 | 贸易 | 看涨 | 06/20/25 | 13.35 美元 | 13.15 美元 | 13.2 美元 | 87.50 美元 | 99.0K | 1.4K | 225 |

| 亩 | 放 | 扫 | 粗鲁的 | 03/21/25 | 15.75 美元 | 15.65 美元 | 15.75 美元 | 95.00 美元 | 96.0 万美元 | 3.3K | 62 |

| 亩 | 打电话 | 扫 | 粗鲁的 | 03/21/25 | 15.3 美元 | 15.1 美元 | 15.16 美元 | 85.00 美元 | 84.9 万美元 | 1.1K | 58 |

| 亩 | 打电话 | 贸易 | 粗鲁的 | 01/16/26 | 23.2 美元 | 23.05 美元 | 23.05 美元 | 85.00 美元 | 59.9 万美元 | 294 | 28 |

| 亩 | 打电话 | 扫 | 看涨 | 09/20/24 | 2.79 美元 | 2.45 美元 | 2.8 美元 | 87.00 美元 | 56.0 万美元 | 1.9K | 209 |

About Micron Technology

关于美光科技

Micron is one of the largest semiconductor companies in the world, specializing in memory and storage chips. Its primary revenue stream comes from dynamic random access memory, or DRAM, and it also has minority exposure to not-and or NAND, flash chips. Micron serves a global customer base, selling chips into data centers, mobile phones, consumer electronics, and industrial and automotive applications. The firm is vertically integrated.

美光是世界上最大的半导体公司之一,专门生产存储和存储芯片。它的主要收入来源来自动态随机存取存储器(DRAM),并且在非AND或NAND闪存芯片方面也占少数份额。美光为全球客户群提供服务,向数据中心、手机、消费电子产品以及工业和汽车应用销售芯片。该公司是垂直整合的。

Where Is Micron Technology Standing Right Now?

美光科技现在处于什么位置?

- Currently trading with a volume of 2,940,198, the MU's price is up by 0.98%, now at $88.03.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 8 days.

- MU目前的交易量为2940,198美元,价格上涨了0.98%,目前为88.03美元。

- RSI读数表明,该股目前在超买和超卖之间处于中立状态。

- 预计财报将在8天后发布。

Professional Analyst Ratings for Micron Technology

美光科技专业分析师评级

5 market experts have recently issued ratings for this stock, with a consensus target price of $121.4.

5位市场专家最近发布了该股的评级,共识目标价为121.4美元。

- An analyst from Needham persists with their Buy rating on Micron Technology, maintaining a target price of $140.

- An analyst from Raymond James persists with their Outperform rating on Micron Technology, maintaining a target price of $125.

- An analyst from Exane BNP Paribas has revised its rating downward to Underperform, adjusting the price target to $67.

- Maintaining their stance, an analyst from Susquehanna continues to hold a Positive rating for Micron Technology, targeting a price of $175.

- An analyst from Morgan Stanley has decided to maintain their Equal-Weight rating on Micron Technology, which currently sits at a price target of $100.

- 来自尼德姆的一位分析师坚持对美光科技的买入评级,维持140美元的目标价。

- 雷蒙德·詹姆斯的一位分析师坚持对美光科技的跑赢大盘评级,维持125美元的目标价。

- Exane BNP Paribas的一位分析师已将其评级下调至表现不佳,将目标股价调整为67美元。

- 萨斯奎哈纳的一位分析师保持立场,继续对美光科技持正面评级,目标价格为175美元。

- 摩根士丹利的一位分析师决定维持对美光科技的等权评级,目前的目标股价为100美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Micron Technology with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了获得更高利润的可能性。精明的交易者通过持续的教育、战略交易调整、利用各种指标以及随时关注市场动态来降低这些风险。通过 Benzinga Pro 了解美光科技的最新期权交易,实时提醒。

From the overall spotted trades, 3 are puts, for a total amount of $226,275 and 14, calls, for a total amount of $582,345.

From the overall spotted trades, 3 are puts, for a total amount of $226,275 and 14, calls, for a total amount of $582,345.