What the Options Market Tells Us About General Motors

What the Options Market Tells Us About General Motors

Whales with a lot of money to spend have taken a noticeably bearish stance on General Motors.

有很多资金可支配的鲸鱼已经明显看淡了通用汽车。

Looking at options history for General Motors (NYSE:GM) we detected 11 trades.

查看通用汽车(纽交所:GM)的期权历史,我们发现了11笔交易。

If we consider the specifics of each trade, it is accurate to state that 36% of the investors opened trades with bullish expectations and 45% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说投资者中有36%采取看好的预期和45%采取看淡的预期。

From the overall spotted trades, 5 are puts, for a total amount of $210,940 and 6, calls, for a total amount of $375,791.

从总体上看,我们发现了5笔看跌期权交易,总金额为$210,940,以及6笔看涨期权交易,总金额为$375,791。

Predicted Price Range

预测价格区间

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $35.0 and $55.0 for General Motors, spanning the last three months.

经过对成交量和持仓量的评估,显然市场主要关注通用汽车的股价在$35.0和$55.0之间的区间,遍及最近三个月。

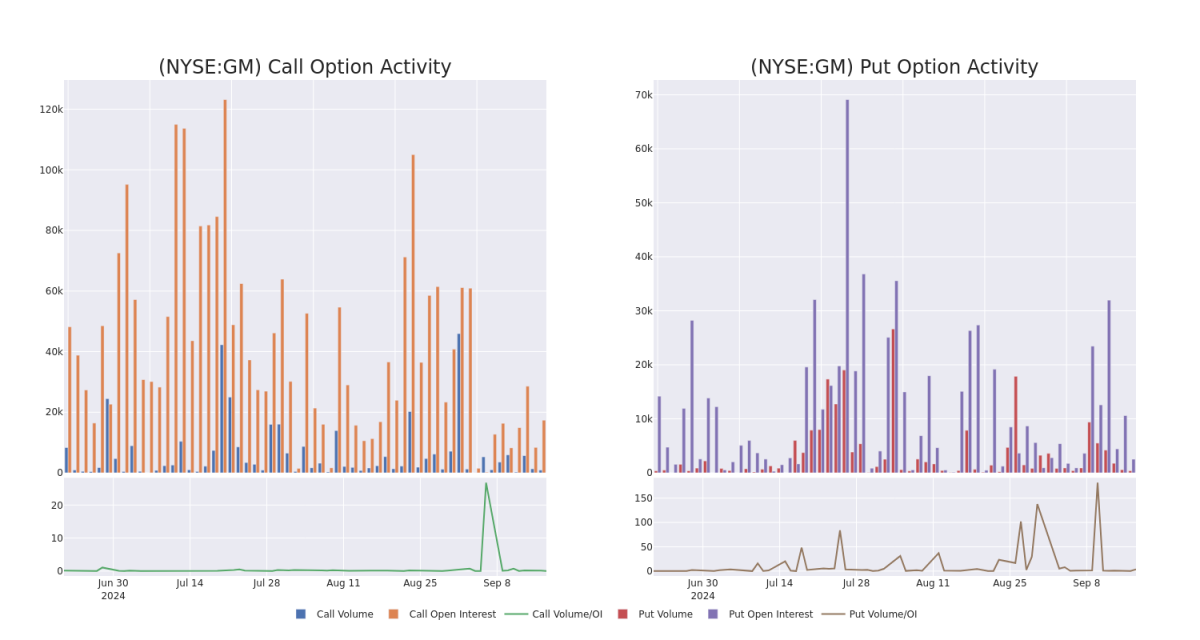

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

In terms of liquidity and interest, the mean open interest for General Motors options trades today is 2486.25 with a total volume of 1,284.00.

就流动性和兴趣而言,通用汽车期权交易的平均持仓量今天为2486.25,总成交量为1,284.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for General Motors's big money trades within a strike price range of $35.0 to $55.0 over the last 30 days.

In the following chart, we are able to follow the development of volume and open interest of call and put options for General Motors's big money trades within a strike price range of $35.0 to $55.0 over the last 30 days.

General Motors 30-Day Option Volume & Interest Snapshot

通用汽车30天期权成交量与持仓量快照

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GM | CALL | TRADE | NEUTRAL | 06/20/25 | $14.85 | $14.55 | $14.7 | $35.00 | $147.0K | 4.1K | 100 |

| GM | CALL | TRADE | BEARISH | 10/18/24 | $3.5 | $3.45 | $3.45 | $45.00 | $69.0K | 3.2K | 200 |

| GM | PUT | SWEEP | BEARISH | 12/18/26 | $11.6 | $10.2 | $11.6 | $55.00 | $59.1K | 109 | 82 |

| GM | CALL | SWEEP | BULLISH | 12/20/24 | $7.45 | $7.35 | $7.45 | $42.00 | $55.1K | 2.0K | 130 |

| GM | PUT | SWEEP | BEARISH | 12/18/26 | $11.6 | $10.2 | $11.6 | $55.00 | $44.0K | 109 | 169 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 通用汽车公司 | 看涨 | 交易 | 中立 | 06/20/25 | $14.85 | $14.55 | $14.7 | 35.00美元 | $147.0K | 4.1K | 100 |

| 通用汽车公司 | 看涨 | 交易 | 看淡 | 10/18/24 | $3.5 | $3.45 | $3.45 | $45.00 | $69.0K | 3.2K | 200 |

| 通用汽车公司 | 看跌 | SWEEP | 看淡 | 12/18/26 | $11.6 | $10.2 | $11.6 | $55.00 | $59.1K | 109 | 82 |

| 通用汽车公司 | 看涨 | SWEEP | 看好 | 12/20/24 | $7.45 | $7.35 | $7.45 | 根据TipRanks.com数据,Gruber是一位5星分析师,平均回报率为14.5%,成功率为60.5%。Gruber主要研究北美板块的股票,重点关注Solaris Oilfield Infrastructure、Oceaneering International和Atlas Energy Solutions等股票。 | $55.1K | 2.0K | Dated: September 3, 2024 |

| 通用汽车公司 | 看跌 | SWEEP | 看淡 | 12/18/26 | $11.6 | $10.2 | $11.6 | $55.00 | $44.0K | 109 | 169 |

About General Motors

通用汽车概况

General Motors Co. emerged from the bankruptcy of General Motors Corp. (old GM) in July 2009. GM has eight brands and operates under four segments: GM North America, GM International, Cruise, and GM Financial. The United States now has four brands instead of eight under old GM. The company regained its us market share leader crown in 2022, after losing it to Toyota due to the chip shortage in 2021. 2023's share was 16.5%. GM's Cruise autonomous vehicle arm has previously done driverless geofenced AV robotaxi services in San Francisco and other cities but stopped in late 2023 after an accident. It restarted service in 2024 but not in California. GM owns over 80% of Cruise. GM Financial became the company's captive finance arm in October 2010 via the purchase of AmeriCredit.

通用汽车公司于2009年7月从通用汽车公司(旧GM)的破产中脱颖而出。GM拥有八个品牌,分为四个部门:GM北美、GM国际、Cruise和GM金融。现在,美国有四个品牌,而旧的通用汽车公司则有八个。该公司在2022年重夺了美国市场份额领先者的宝座,这是由于2021年芯片短缺导致该公司输给了丰田。2023年的市场份额为16.5%。GM的Cruise自动驾驶车辆部门先前曾在旧金山和其他城市进行过无人驾驶的地理围栏AV机器人出租车服务,但在2023年底发生事故后停止了服务。它在2024年重新启动了服务,但并未在加利福尼亚州提供服务。GM拥有超过80%的Cruise股份。GM金融于2010年10月通过收购美国信贷公司成为该公司的专属金融部门。

Having examined the options trading patterns of General Motors, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了通用汽车的期权交易模式后,我们现在将直接关注该公司。这个转变使我们能深入探讨其目前的市场位置和业绩

Present Market Standing of General Motors

通用汽车的当前市场地位

- With a volume of 2,529,475, the price of GM is up 2.15% at $47.88.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 35 days.

- 通用汽车的成交量为2,529,475,股价上涨2.15%,报47.88美元。

- RSI指标暗示该股票可能要超买了。

- 下次盈利预计将在35天后发布。

What Analysts Are Saying About General Motors

分析师对通用汽车的评价

2 market experts have recently issued ratings for this stock, with a consensus target price of $43.0.

2位市场专家最近对这支股票发表了评级意见,一致目标价为43.0美元。

- An analyst from Wells Fargo has decided to maintain their Underweight rating on General Motors, which currently sits at a price target of $33.

- An analyst from Deutsche Bank downgraded its action to Hold with a price target of $53.

- 富国银行的分析师决定保持通用汽车的股票为低评级,目标价目前为33美元。

- 德意志银行的分析师下调了通用汽车的评级至持有,并将目标价设定为53美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for General Motors with Benzinga Pro for real-time alerts.

交易期权涉及更大风险,但也有更高利润的潜力。精明的交易者通过持续教育、战略交易调整、利用各种因子以及对市场动态保持敏感来减轻这些风险。通过Benzinga Pro实时警报及时了解通用汽车的最新期权交易。

From the overall spotted trades, 5 are puts, for a total amount of $210,940 and 6, calls, for a total amount of $375,791.

From the overall spotted trades, 5 are puts, for a total amount of $210,940 and 6, calls, for a total amount of $375,791.