What the Options Market Tells Us About Philip Morris Intl

What the Options Market Tells Us About Philip Morris Intl

Whales with a lot of money to spend have taken a noticeably bullish stance on Philip Morris Intl.

资金雄厚的大鳄对菲利普莫里斯国际采取了明显看好的态度。

Looking at options history for Philip Morris Intl (NYSE:PM) we detected 16 trades.

观察菲利普莫里斯国际(纽交所:PM)的期权历史记录,我们发现了16笔交易。

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 31% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,50%的投资者持看好观望态度,31%的投资者持看淡观望态度。

From the overall spotted trades, 2 are puts, for a total amount of $66,002 and 14, calls, for a total amount of $682,665.

从总体看,我们发现了2笔看跌期权交易,总金额为66,002美元,以及14笔看涨期权交易,总金额为682,665美元。

What's The Price Target?

目标价是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $50.0 to $140.0 for Philip Morris Intl during the past quarter.

分析这些合约中的成交量和未平仓合约,我们发现大型投资者在过去季度中一直关注菲利普莫里斯国际的股价窗口在50.0至140.0美元之间。

Insights into Volume & Open Interest

成交量和持仓量分析

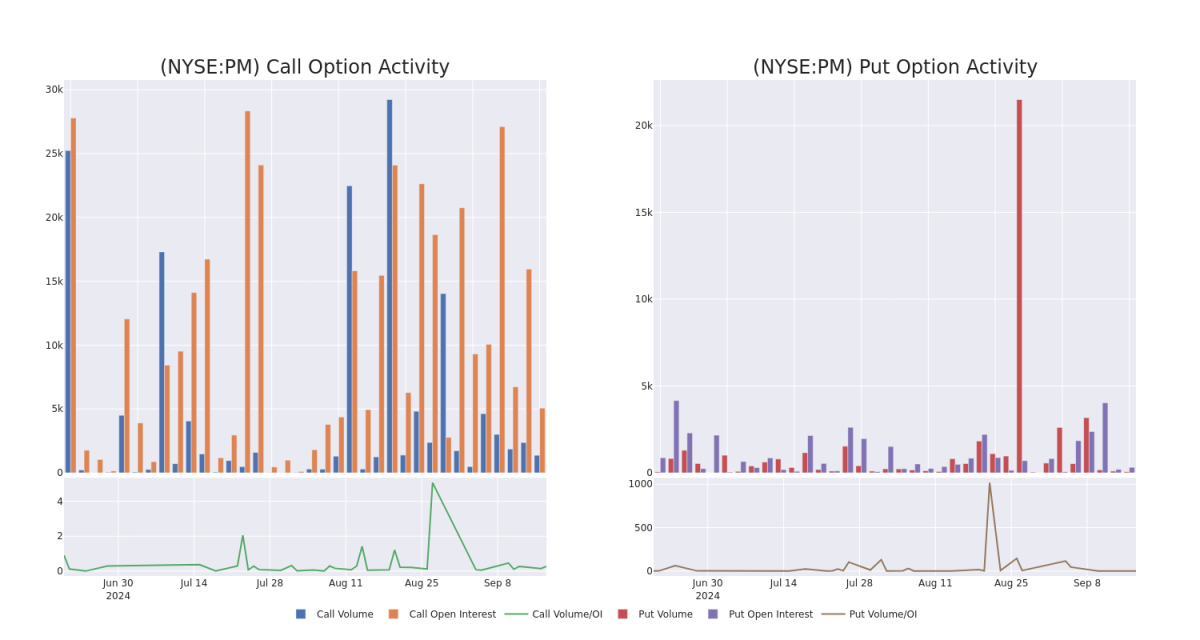

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Philip Morris Intl's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Philip Morris Intl's significant trades, within a strike price range of $50.0 to $140.0, over the past month.

检查成交量和未平仓合约对股票研究至关重要。这些信息是评估菲利普莫里斯国际在某个行权价的期权的流动性和兴趣水平的关键。以下是过去一个月菲利普莫里斯国际在50.0至140.0美元行权价范围内的大宗交易中看涨和看跌合约成交量和未平仓合约趋势的快照。

Philip Morris Intl Call and Put Volume: 30-Day Overview

菲利普莫里斯国际的看涨和看跌期权成交量: 30天概览

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PM | CALL | TRADE | BULLISH | 01/16/26 | $18.1 | $15.6 | $17.38 | $110.00 | $173.8K | 688 | 130 |

| PM | CALL | SWEEP | BULLISH | 09/27/24 | $1.3 | $1.2 | $1.3 | $123.00 | $99.9K | 222 | 892 |

| PM | CALL | TRADE | NEUTRAL | 01/16/26 | $20.1 | $19.4 | $19.69 | $110.00 | $49.2K | 688 | 25 |

| PM | CALL | SWEEP | BULLISH | 09/19/25 | $9.8 | $9.5 | $9.8 | $125.00 | $49.0K | 4 | 47 |

| PM | PUT | SWEEP | BEARISH | 06/20/25 | $19.4 | $18.8 | $19.4 | $140.00 | $38.8K | 25 | 20 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 菲利普莫里斯 | 看涨 | 交易 | 看好 | 01/16/26 | $18.1 | $15.6 | $17.38 | $110.00 | 173,800美元 | 688 | Dated: September 3, 2024 |

| 菲利普莫里斯 | 看涨 | SWEEP | 看好 | 09/27/24 | $1.3 | $1.2 | $1.3 | $123.00 | $99.9K | 222 | 892 |

| 菲利普莫里斯 | 看涨 | 交易 | 中立 | 01/16/26 | $20.1 | $19.4 | 19.69美元 | $110.00 | $49.2千 | 688 | 25 |

| 菲利普莫里斯 | 看涨 | SWEEP | 看好 | 09/19/25 | $9.8 | $9.5 | $9.8 | $125.00 | $49.0千 | 4 | 47 |

| 菲利普莫里斯 | 看跌 | SWEEP | 看淡 | 06/20/25 | $19.4 | $18.8 | $19.4 | $140.00 | $38.8K | 25 | 20 |

About Philip Morris Intl

关于菲利普莫里斯国际

Created from the international operations of Altria in 2008, Philip Morris International sells cigarettes and reduced-risk products, including heatsticks, vapes, and oral nicotine offerings primarily outside of the US. With the 2022 acquisition of Swedish Match, a leading manufacturer of traditional oral tobacco products and nicotine pouches primarily in the US and Scandinavia, PMI has not only diversified away from smokeable products but also gained a toehold into the US to sell its iQOS heatsticks.

菲利普莫里斯国际是奥驰亚在2008年创立的国际运营部门,销售卷烟和降危风险产品,包括加热棒、电子烟和口服尼古丁产品,主要在美国以外地区销售。凭借对瑞典瑞士Match的收购,后者是美国和斯堪的纳维亚地区传统口腔烟草产品和尼古丁袋的主要生产商,PMI不仅摆脱了可吸烟的产品,而且进入了美国市场以销售其iQOS加热棒。

Present Market Standing of Philip Morris Intl

菲利普莫里斯国际的现状

- With a trading volume of 4,202,134, the price of PM is down by -2.3%, reaching $123.07.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 30 days from now.

- 交易量达到4,202,134股,PM的价格下跌了-2.3%,达到123.07美元。

- 当前RSI值表明该股票可能接近超买状态。

- 下一个财报发布日期为30天后。

Professional Analyst Ratings for Philip Morris Intl

菲利普莫里斯国际的专业分析师评级

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $131.75.

过去一个月,有4位行业分析师分享了他们对这支股票的见解,提议平均目标价为131.75美元。

- Maintaining their stance, an analyst from UBS continues to hold a Sell rating for Philip Morris Intl, targeting a price of $105.

- An analyst from B of A Securities has decided to maintain their Buy rating on Philip Morris Intl, which currently sits at a price target of $139.

- An analyst from Barclays has decided to maintain their Overweight rating on Philip Morris Intl, which currently sits at a price target of $145.

- An analyst from Stifel persists with their Buy rating on Philip Morris Intl, maintaining a target price of $138.

- UBS的分析师继续保持立场,继续对菲利普莫里斯国际公司持有卖出评级,目标价为105美元。

- B of A证券的一位分析师决定维持对菲利普莫里斯国际公司的买入评级,目前的价格目标为$139。

- 巴克莱银行的一位分析师决定维持对菲利普莫里斯国际的超配评级,目前的目标价为145美元。

- 斯蒂夫尔的一位分析师坚持对菲利普莫里斯国际公司的买入评级,维持目标价为$138。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

From the overall spotted trades, 2 are puts, for a total amount of $66,002 and 14, calls, for a total amount of $682,665.

From the overall spotted trades, 2 are puts, for a total amount of $66,002 and 14, calls, for a total amount of $682,665.