Palo Alto Networks Options Trading: A Deep Dive Into Market Sentiment

Palo Alto Networks Options Trading: A Deep Dive Into Market Sentiment

Financial giants have made a conspicuous bullish move on Palo Alto Networks. Our analysis of options history for Palo Alto Networks (NASDAQ:PANW) revealed 25 unusual trades.

Financial giants have made a conspicuous bullish move on Palo Alto Networks. Our analysis of options history for Palo Alto Networks (NASDAQ:PANW) revealed 25 unusual trades.

Delving into the details, we found 40% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 11 were puts, with a value of $572,389, and 14 were calls, valued at $645,040.

Delving into the details, we found 40% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 11 were puts, with a value of $572,389, and 14 were calls, valued at $645,040.

Predicted Price Range

预测价格区间

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $250.0 to $370.0 for Palo Alto Networks over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $250.0 to $370.0 for Palo Alto Networks over the recent three months.

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

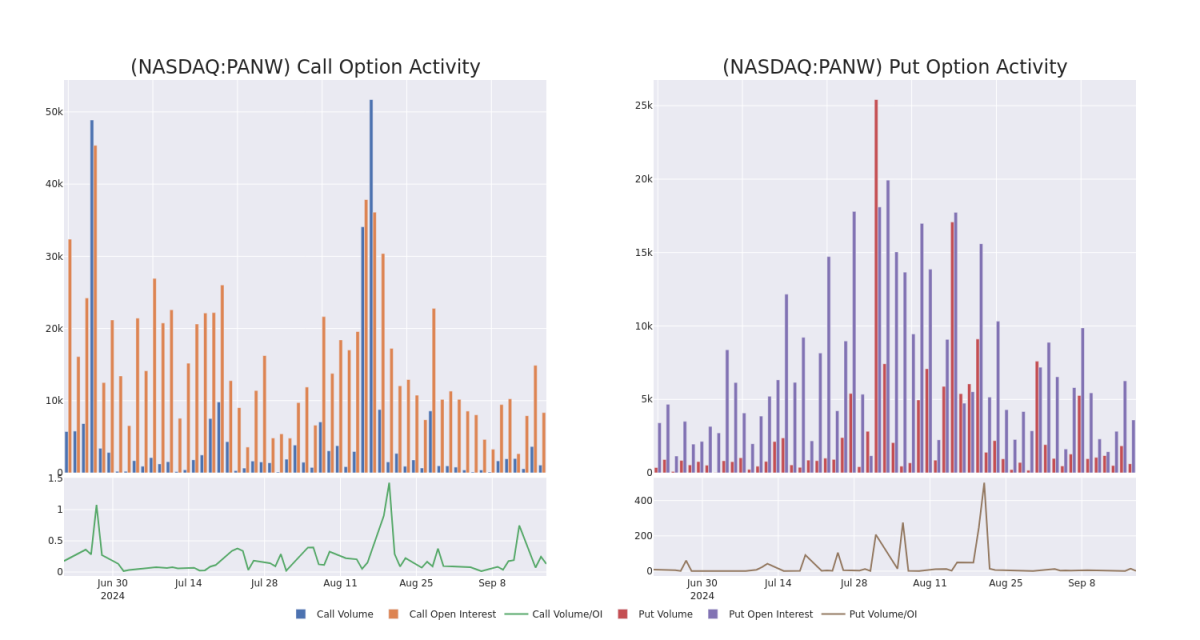

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Palo Alto Networks's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Palo Alto Networks's whale trades within a strike price range from $250.0 to $370.0 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Palo Alto Networks's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Palo Alto Networks's whale trades within a strike price range from $250.0 to $370.0 in the last 30 days.

Palo Alto Networks Call and Put Volume: 30-Day Overview

Palo Alto Networks的看涨和看跌成交量:30天概述

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PANW | PUT | SWEEP | BEARISH | 03/21/25 | $11.0 | $11.0 | $11.0 | $280.00 | $110.0K | 182 | 0 |

| PANW | CALL | TRADE | NEUTRAL | 12/18/26 | $79.35 | $65.3 | $73.3 | $370.00 | $102.6K | 49 | 14 |

| PANW | CALL | TRADE | BULLISH | 01/17/25 | $17.15 | $16.85 | $17.15 | $370.00 | $85.7K | 1.3K | 50 |

| PANW | PUT | TRADE | NEUTRAL | 10/18/24 | $15.45 | $15.1 | $15.25 | $340.00 | $82.3K | 952 | 66 |

| PANW | PUT | SWEEP | BEARISH | 10/18/24 | $14.75 | $14.65 | $14.75 | $340.00 | $72.2K | 952 | 122 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PANW | 看跌 | SWEEP | 看淡 | 03/21/25 | $11.0 | $11.0 | $11.0 | $280.00 | $110.0K | 182 | 0 |

| PANW | 看涨 | 交易 | 中立 | 12/18/26 | 79.35美元 | $65.3 | 73.3美元 | $370.00 | $102.6K | 49 | 14 |

| PANW | 看涨 | 交易 | 看好 | 01/17/25 | $17.15 | $16.85 | $17.15 | $370.00 | 85.7K美元 | 1.3K | 50 |

| PANW | 看跌 | 交易 | 中立 | 10/18/24 | $15.45 | $15.1 | $15.25 | $340.00 | $82.3K | 952 | 66 |

| PANW | 看跌 | SWEEP | 看淡 | 10/18/24 | $14.75 | $14.65 | $14.75 | $340.00 | $72.2K | 952 | 122 |

About Palo Alto Networks

关于Palo Alto Networks

Palo Alto Networks is a platform-based cybersecurity vendor with product offerings covering network security, cloud security, and security operations. The California-based firm has more than 80,000 enterprise customers across the world, including more than three fourths of the Global 2000.

Palo Alto Networks是一个基于平台的网络安全供应商,其产品涵盖网络安全、云安全和安全运营。这家总部位于加利福尼亚的公司在全球拥有超过80,000家企业客户,其中包括全球2000强的四分之三以上。

Having examined the options trading patterns of Palo Alto Networks, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在审查了 Palo Alto Networks 的期权交易模式后,我们的关注现在直接转向这家公司。这个转变让我们可以深入挖掘其目前的市场地位和表现。

Where Is Palo Alto Networks Standing Right Now?

Palo Alto Networks现在的情况如何?

- Currently trading with a volume of 740,487, the PANW's price is down by -2.02%, now at $331.1.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 56 days.

- 当前交易量为740,487,PANW的价格下跌了-2.02%,现在为331.1美元。

- RSI读数表明该股票目前可能接近超卖状态。

- 预计的盈利发布还有56天。

Expert Opinions on Palo Alto Networks

关于Palo Alto Networks的专家意见

In the last month, 5 experts released ratings on this stock with an average target price of $386.8.

在过去的一个月里,有5名专家发布了对该股票的评级,平均目标价为386.8美元。

- An analyst from BMO Capital has decided to maintain their Outperform rating on Palo Alto Networks, which currently sits at a price target of $390.

- An analyst from Cantor Fitzgerald has decided to maintain their Overweight rating on Palo Alto Networks, which currently sits at a price target of $400.

- An analyst from Deutsche Bank has decided to maintain their Buy rating on Palo Alto Networks, which currently sits at a price target of $395.

- An analyst from Northland Capital Markets has decided to maintain their Market Perform rating on Palo Alto Networks, which currently sits at a price target of $350.

- An analyst from Bernstein has decided to maintain their Outperform rating on Palo Alto Networks, which currently sits at a price target of $399.

- BMO Capital的一位分析师决定维持对Palo Alto Networks的强劲评级,目前的目标价为390美元。

- Cantor Fitzgerald的一位分析师决定维持对Palo Alto Networks的超重评级,目前的目标价为400美元。

- 德意志银行的一位分析师决定维持对Palo Alto Networks的买入评级,目前的目标价为395美元。

- Northland Capital Markets的一位分析师决定维持对Palo Alto Networks的市场表现评级,目前的目标价为350美元。

- Bernstein的一位分析师决定维持对Palo Alto Networks的强劲评级,目前的目标价为399美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Palo Alto Networks with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也有可能获得更高的利润。精明的交易员通过不断学习、战略性交易调整、利用各种指标以及保持对市场动态的敏感来减轻这些风险。使用Benzinga Pro及时获取Palo Alto Networks的最新期权交易提示。

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Palo Alto Networks's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Palo Alto Networks's whale trades within a strike price range from $250.0 to $370.0 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Palo Alto Networks's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Palo Alto Networks's whale trades within a strike price range from $250.0 to $370.0 in the last 30 days.