Seizing Value Stock ETF Opportunities in a Rate-Cut Cycle

Seizing Value Stock ETF Opportunities in a Rate-Cut Cycle

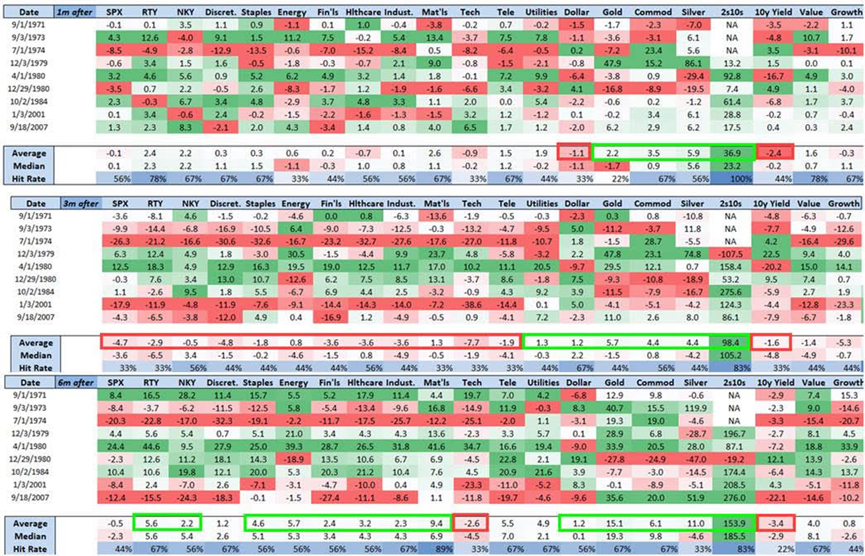

The Federal Reserve on Wednesday cut its benchmark interest rate by an unusually large half-point, marking the first easing of monetary policy since 2020. Nomura has looked at “all prior instances” of half-point cuts and found that three months after a 50bp cut, value stocks outperformed growth stocks.

美联储本周三异常大幅度降低了基准利率0.5个百分点,这是自2020年以来货币政策的首次宽松。野村已经研究了“所有此前的”0.5个百分点下调,并发现在50个基点降息后的三个月内,价值股的表现优于成长股。

Source: Nomura

来源:野村

Besides, exchange-traded funds focused on value stocks have raked in $6.9 billion so far in September, the cohort’s best month this year, according to data compiled by Bloomberg Intelligence. At the same time, growth-stock ETFs have shed about $13 million.

此外,根据彭博智能数据统计,重点关注价值股的交易所交易基金在今年9月迄今已经吸引了69亿美元的资金流入,这是该类基金今年最好的一个月。与此同时,成长股交易所交易基金约减少了1300万美元。

Source: Bloomberg Intelligence

来源:彭博智能

Note: Data is through the end of the month, except in September

注意:数据截至该月底,9月份除外

After the announcement of the rate cut, the large-cap value ETF sector reached an all-time high during trading sessions. Additionally, several value stock ETFs, including $Vanguard Value ETF (VTV.US)$, $EAFE Value Index MSCI Ishares (EFV.US)$, $Spdr Series Trust Spdr Portfolio S&P 500 Value Etf (SPYV.US)$, and $Ishares Russell Top 200 Value Etf (IWX.US)$, also hit new historical highs, according to moomoo.

在利率降低的公告之后,大型股价值型股票交易所交易基金板块在交易期间达到了历史最高水平。另外,包括 $价值股ETF-Vanguard (VTV.US)$, $EAFE价值股ETF-iShares (EFV.US)$, $SPDR Portfolio S&P 500 Value ETF (SPYV.US)$和$iShares Russell Top 200 Value ETF (IWX.US)$,也创下了历史新高点,根据moomoo。

The large-cap value stock ETF, Vanguard Value Index Fund ETF, with an AUM exceeding $183 billion, briefly reached an intraday all-time high of $174.349. Since the beginning of the year, it has risen by over 16%.

该大盘价值型股票etf,富国价值指数基金etf,资产规模超过1830亿美元,曾一度达到174.349美元的历史最高点。自年初以来,上涨超过16%。

It's worth noting that within the holdings of VTV, $Home Depot (HD.US)$ reached a new intraday all-time high yesterday, touching $392.67, and has risen over 12% in the second half of the year. Additionally, other holdings such as $Walmart (WMT.US)$, $Procter & Gamble (PG.US)$, $Berkshire Hathaway-B (BRK.B.US)$, $Johnson & Johnson (JNJ.US)$, and $UnitedHealth (UNH.US)$ have all reached their all-time highs this month.

值得注意的是,在VTV的持股中, $家得宝 (HD.US)$ 昨日创下历史新高,触及392.67美元,今年下半年上涨超过12%。此外,其他持股还包括 $沃尔玛 (WMT.US)$, $宝洁 (PG.US)$, $伯克希尔-B (BRK.B.US)$, $强生 (JNJ.US)$和$联合健康 (UNH.US)$ 这些股票已经在本月达到了历史最高点。

More than half of the September influx into value ETFs is coming from the iShares MSCI EAFE Value ETF, which has been a big beneficiary of BlackRock tweaking its model portfolios. The asset manager reduced its tilt to US equities and growth-oriented shares in favor of value stocks and fixed-income.

九月份价值型ETF的资金净流入超过一半,其中大部分来自iShares MSCI EAFE Value ETF,这是贝莱德调整其模型组合的重要受益者。该资产管理公司减少了对美国股票和成长型股票的偏好,转而青睐价值股和固定收益。

The SPDR Portfolio S&P 500 Value ETF, which has an AUM of $25 billion, saw its largest weekly inflow ever last week.

上周,拥有250亿美元资产净流入的SPDR Portfolio S&P 500 Value ETF创下了有史以来最大的周度资金流入。

The $3.2 billion iShares Russell Top 200 Value ETF has garnered more than $800 million so far in September.

这只规模为32亿美元的iShares Russell Top 200 Value ETF在9月份迄今已经吸引了超过8千万美元的资金流入。

“It’s where we’re seeing the best earnings potential,” Tushar Yadava, a strategist at BlackRock said. He added that while they’re still overweight growth stocks, they’re dialing some of that exposure back by adding value stocks to portfolios.

“这是我们看到的最佳盈利潜力的板块,”贝莱德(BlackRock)的战略家图沙尔·亚达瓦(Tushar Yadava)表示。他补充道,虽然他们仍然偏重增长股,但他们在组合中增加了一些价值股以减少这种偏重。

Source: Bloomberg, Financial Times

来源:彭博社,金融时报

Source: Bloomberg Intelligence

Source: Bloomberg Intelligence